Region:Asia

Author(s):Dev

Product Code:KRAB3673

Pages:98

Published On:October 2025

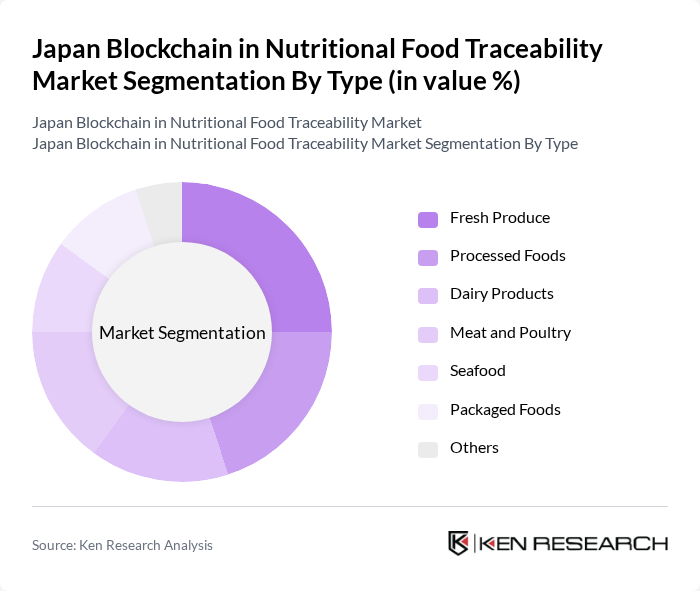

By Type:The market is segmented into various types, including Fresh Produce, Processed Foods, Dairy Products, Meat and Poultry, Seafood, Packaged Foods, and Others. Each of these segments plays a crucial role in the overall market dynamics, driven by consumer preferences and industry requirements.

The Fresh Produce segment is currently dominating the market due to the increasing consumer focus on organic and locally sourced products. This trend is driven by health-conscious consumers who prefer fresh, unprocessed foods. Additionally, the demand for transparency in the supply chain has led retailers and producers to adopt blockchain technology to ensure traceability and quality assurance. The growing awareness of food safety issues further propels the need for effective tracking solutions in this segment.

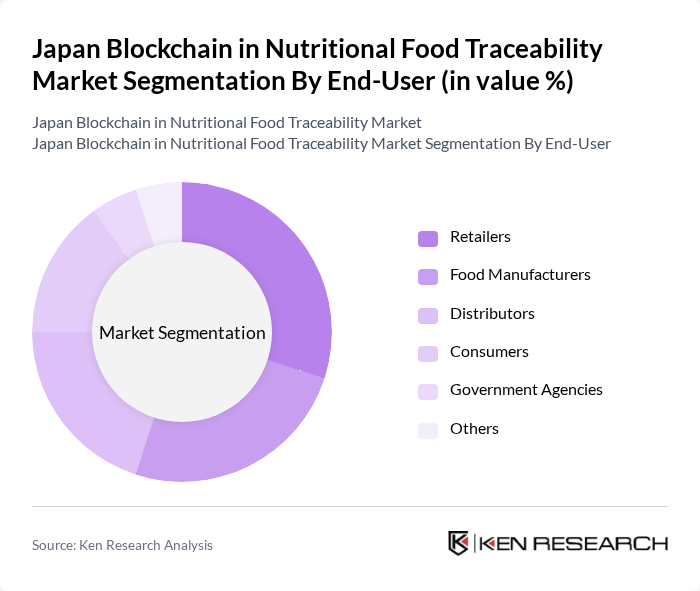

By End-User:The market is segmented by end-users, including Retailers, Food Manufacturers, Distributors, Consumers, Government Agencies, and Others. Each segment has unique requirements and influences the adoption of blockchain technology in food traceability.

Retailers are the leading end-user segment, driven by the need for enhanced transparency and consumer trust. As consumers increasingly demand information about the origins of their food, retailers are adopting blockchain solutions to provide traceability and ensure compliance with food safety regulations. This trend is further supported by the competitive landscape, where retailers seek to differentiate themselves through transparency and quality assurance in their offerings.

The Japan Blockchain in Nutritional Food Traceability Market is characterized by a dynamic mix of regional and international players. Leading participants such as IBM Corporation, Fujitsu Limited, NEC Corporation, NTT Data Corporation, Accenture PLC, SAP SE, Oracle Corporation, ChainPoint, VeChain, Provenance, FoodLogiQ, Ripe.io, TE-FOOD, Ambrosus, Blockfood contribute to innovation, geographic expansion, and service delivery in this space.

The future of blockchain in Japan's nutritional food traceability market appears promising, driven by technological advancements and increasing consumer expectations. As companies invest in integrating artificial intelligence with blockchain, operational efficiencies are expected to improve significantly. Additionally, the rise of decentralized food networks will facilitate greater collaboration among stakeholders, enhancing transparency and trust. These trends indicate a robust growth trajectory, positioning Japan as a leader in food traceability innovation in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fresh Produce Processed Foods Dairy Products Meat and Poultry Seafood Packaged Foods Others |

| By End-User | Retailers Food Manufacturers Distributors Consumers Government Agencies Others |

| By Application | Supply Chain Management Quality Assurance Regulatory Compliance Consumer Engagement Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales B2B Sales Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Others |

| By Price Range | Low Price Mid Price High Price Premium Price Others |

| By Packaging Type | Bulk Packaging Retail Packaging Eco-Friendly Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nutritional Food Manufacturers | 100 | Production Managers, Quality Assurance Officers |

| Retailers of Nutritional Products | 80 | Supply Chain Managers, Category Buyers |

| Blockchain Technology Providers | 60 | Product Development Leads, Sales Executives |

| Consumers of Nutritional Foods | 150 | Health-Conscious Shoppers, Eco-Friendly Consumers |

| Regulatory Bodies and Food Safety Experts | 50 | Policy Makers, Food Safety Inspectors |

The Japan Blockchain in Nutritional Food Traceability Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by consumer demand for transparency in food sourcing and the adoption of blockchain technology in supply chain management.