Region:Asia

Author(s):Shubham

Product Code:KRAB1080

Pages:83

Published On:October 2025

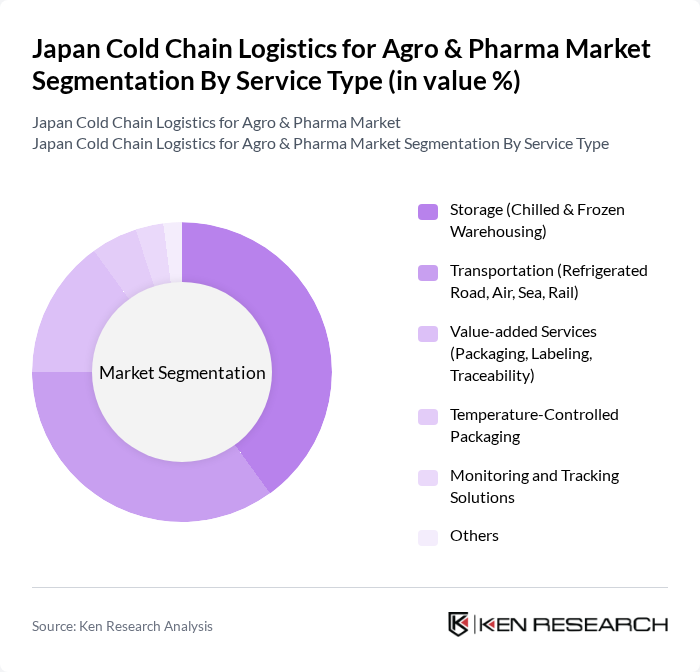

By Service Type:The service type segmentation includes various aspects of cold chain logistics, such as storage, transportation, and value-added services. Among these, storage (chilled and frozen warehousing) is a significant sub-segment, driven by the increasing need for safe and efficient storage solutions for perishable goods. The demand for transportation services, particularly refrigerated road and air transport, is also growing due to the rise in e-commerce and online grocery delivery services. Value-added services like packaging and labeling are gaining traction as companies seek to enhance product traceability and compliance with regulations.

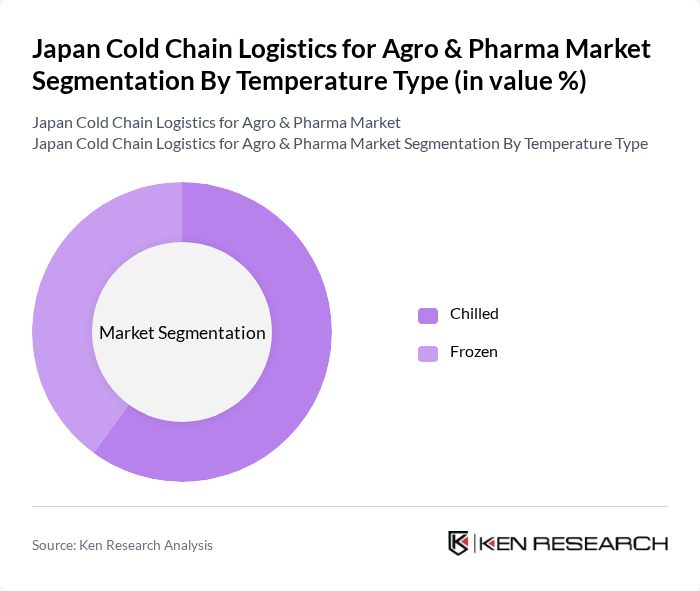

By Temperature Type:The temperature type segmentation is divided into chilled and frozen categories. The chilled segment dominates the market due to the high demand for fresh produce and dairy products, which require specific temperature controls to maintain quality. The frozen segment is also significant, driven by the increasing consumption of frozen foods and the need for long-term storage solutions for various perishable items, particularly with the growth of the pharmaceutical and life sciences sector requiring temperature-sensitive medications.

The Japan Cold Chain Logistics for Agro & Pharma Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express Co., Ltd., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Kintetsu World Express, Inc., Seino Holdings Co., Ltd., Marubeni Corporation, Mitsui-Soko Holdings Co., Ltd., Hitachi Transport System, Ltd., K Line Logistics, Ltd., DHL Japan, Inc., DB Schenker Japan, DSV Air & Sea Co., Ltd., CEVA Logistics Japan, XPO Logistics Japan, Geodis Japan K.K., Agility Logistics Japan, Lineage Logistics, Nichirei Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of cold chain logistics in Japan is poised for transformation, driven by technological innovations and evolving consumer preferences. As e-commerce continues to expand, logistics providers are expected to adopt smart solutions that enhance efficiency and transparency. Additionally, the increasing focus on sustainability will likely lead to the adoption of eco-friendly practices, such as using renewable energy sources and reducing waste. These trends will shape the industry's landscape, fostering growth and resilience in the face of challenges.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Storage (Chilled & Frozen Warehousing) Transportation (Refrigerated Road, Air, Sea, Rail) Value-added Services (Packaging, Labeling, Traceability) Temperature-Controlled Packaging Monitoring and Tracking Solutions Others |

| By Temperature Type | Chilled Frozen |

| By End-User | Food and Beverage Pharmaceuticals Biotechnology Healthcare Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics E-commerce Platforms Others |

| By Application | Fresh Produce Frozen Foods Pharmaceuticals Biologics Others |

| By Sales Channel | Online Sales Offline Retail Wholesale Distribution Others |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Agricultural Cold Chain Logistics | 60 | Supply Chain Managers, Logistics Coordinators |

| Pharmaceutical Cold Chain Management | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Temperature-Controlled Transportation | 40 | Fleet Managers, Operations Directors |

| Cold Storage Facility Operations | 45 | Facility Managers, Inventory Control Specialists |

| Logistics Technology Solutions | 55 | IT Managers, Technology Implementation Leads |

The Japan Cold Chain Logistics for Agro & Pharma Market is valued at approximately USD 21 billion, driven by the increasing demand for temperature-sensitive products in the food and pharmaceutical sectors, along with advancements in logistics technology and infrastructure.