Region:Asia

Author(s):Geetanshi

Product Code:KRAA1326

Pages:90

Published On:August 2025

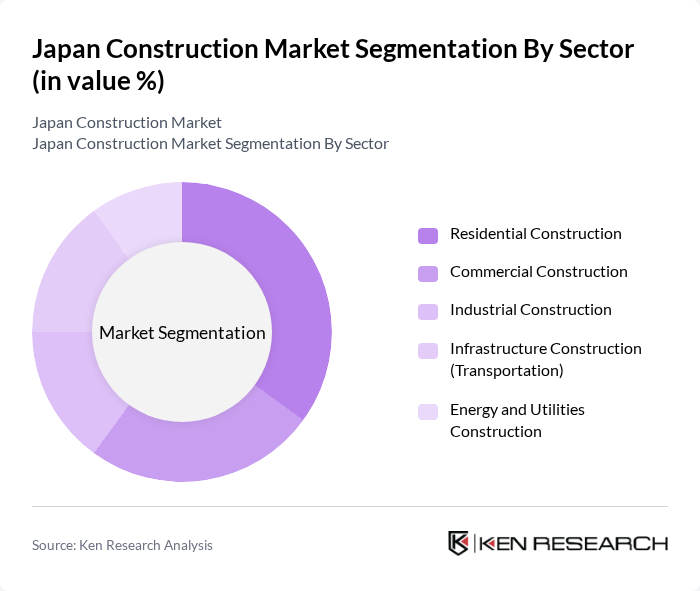

By Sector:The construction market is segmented into residential, commercial, industrial, infrastructure, and energy and utilities construction. Each sector plays a crucial role in the overall market dynamics. Residential construction remains a significant contributor, driven by urbanization and sustained housing demand. Infrastructure construction is also vital, supported by government investments in transportation, public facilities, and disaster resilience. Commercial and industrial segments are expanding due to business investments and redevelopment projects, while energy and utilities construction is increasingly focused on renewable energy and smart grid infrastructure .

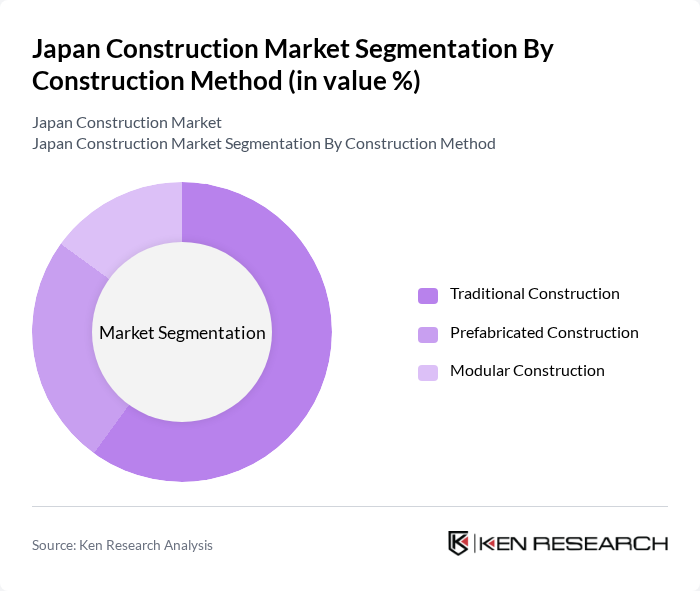

By Construction Method:The construction market is also categorized by construction methods, including traditional, prefabricated, and modular construction. Traditional construction remains the most widely used method due to established practices and workforce familiarity. However, prefabricated and modular construction methods are gaining traction, driven by the need for faster project completion, labor efficiency, and cost control. The prefabricated segment, in particular, is experiencing robust growth as developers seek to address labor shortages and sustainability goals .

The Japan Construction Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shimizu Corporation, Obayashi Corporation, Taisei Corporation, Kajima Corporation, Takenaka Corporation, Penta-Ocean Construction Co., Ltd., Daiwa House Industry Co., Ltd., Sekisui House, Ltd., Sumitomo Realty & Development Co., Ltd., Tokyu Construction Co., Ltd., Nishimatsu Construction Co., Ltd., Haseko Corporation, Maeda Corporation, Toda Corporation, Asahi Kasei Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The Japan construction market is poised for transformative growth driven by urbanization, government investments, and sustainability initiatives. As the population continues to urbanize, the demand for modern infrastructure will escalate, necessitating innovative construction methods. Additionally, the integration of smart technologies and green building practices will reshape the industry landscape. The focus on enhancing resilience against natural disasters will further stimulate investment in infrastructure, creating a robust environment for construction firms to thrive.

| Segment | Sub-Segments |

|---|---|

| By Sector | Residential Construction Commercial Construction Industrial Construction Infrastructure Construction (Transportation) Energy and Utilities Construction |

| By Construction Method | Traditional Construction Prefabricated Construction Modular Construction |

| By Project Size | Small Scale Projects Medium Scale Projects Large Scale Projects |

| By End-User | Private Sector Public Sector Institutional/Non-Profit Organizations |

| By Application | Residential Buildings Commercial Spaces Infrastructure Projects Industrial Facilities Energy & Utilities Facilities |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support for Green Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 120 | Project Managers, Site Supervisors |

| Commercial Building Developments | 90 | Architects, Construction Executives |

| Infrastructure and Public Works | 70 | Government Officials, Civil Engineers |

| Green Building Initiatives | 50 | Sustainability Consultants, Project Leads |

| Construction Technology Adoption | 60 | IT Managers, Innovation Officers |

The Japan Construction Market is valued at approximately USD 625 billion, driven by government infrastructure spending, urban redevelopment, and investments in disaster-resilient and sustainable buildings. This growth reflects ongoing urbanization and demand for both residential and commercial properties.