Region:Asia

Author(s):Dev

Product Code:KRAC0497

Pages:81

Published On:August 2025

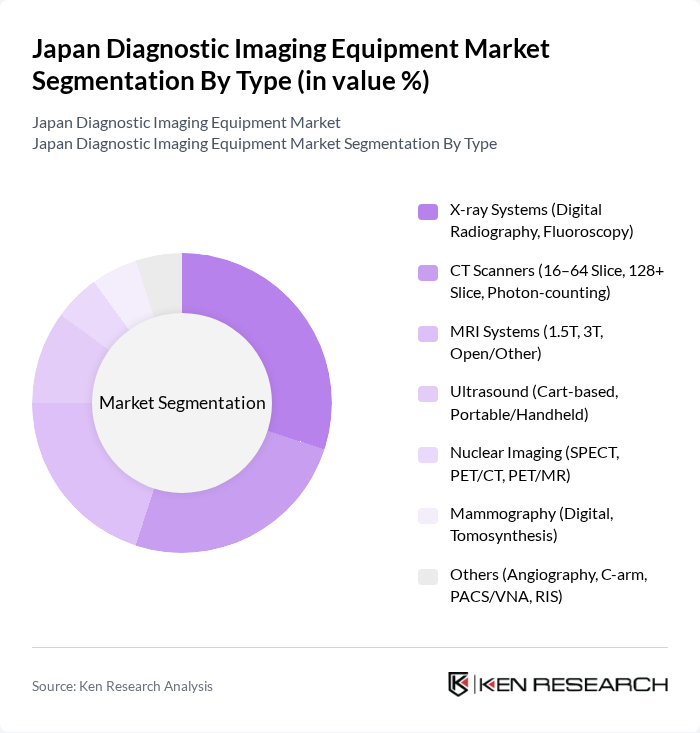

By Type:The diagnostic imaging equipment market can be segmented into various types, including X-ray Systems, CT Scanners, MRI Systems, Ultrasound, Nuclear Imaging, Mammography, and Others. Each of these sub-segments plays a crucial role in the overall market dynamics, with specific applications and technological advancements driving their growth. Ongoing trends include wider deployment of digital radiography, higher-slice CT (including photon-counting pilots), 3T MRI adoption, and expansion of portable ultrasound for point-of-care in elder-care and outpatient settings .

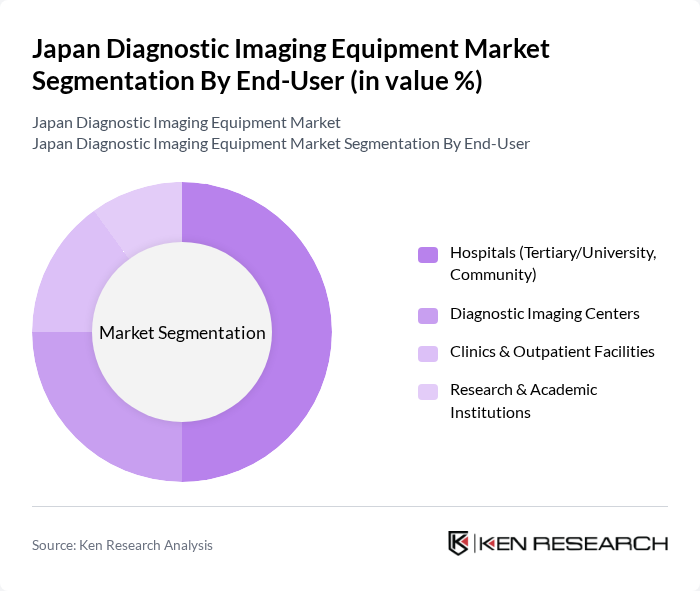

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Clinics & Outpatient Facilities, and Research & Academic Institutions. Each of these segments has unique requirements and contributes differently to the overall market, with hospitals being the largest consumers of diagnostic imaging equipment. Growth in outpatient imaging centers and point-of-care ultrasound is notable, driven by convenience, cost-control, and elder-care needs .

The Japan Diagnostic Imaging Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Canon Medical Systems Corporation, Siemens Healthineers, GE HealthCare, Philips, Fujifilm Healthcare Corporation (Fujifilm Holdings), Shimadzu Corporation, Hitachi, Ltd. (Healthcare business/Hitachi Healthcare legacy), Hologic, Inc., Carestream Health, Agfa-Gevaert Group, Mindray (Shenzhen Mindray Bio-Medical Electronics Co., Ltd.), Neusoft Medical Systems, Samsung Medison, EIZO Corporation, United Imaging Healthcare contribute to innovation, geographic expansion, and service delivery in this space .

The future of the diagnostic imaging equipment market in Japan appears promising, driven by technological advancements and an increasing focus on preventive healthcare. The integration of artificial intelligence in imaging processes is expected to enhance diagnostic accuracy and efficiency. Additionally, the shift towards value-based care models will encourage healthcare providers to invest in advanced imaging technologies that improve patient outcomes while managing costs effectively, fostering a more sustainable healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray Systems (Digital Radiography, Fluoroscopy) CT Scanners (16–64 Slice, 128+ Slice, Photon-counting) MRI Systems (1.5T, 3T, Open/Other) Ultrasound (Cart-based, Portable/Handheld) Nuclear Imaging (SPECT, PET/CT, PET/MR) Mammography (Digital, Tomosynthesis) Others (Angiography, C-arm, PACS/VNA, RIS) |

| By End-User | Hospitals (Tertiary/University, Community) Diagnostic Imaging Centers Clinics & Outpatient Facilities Research & Academic Institutions |

| By Application | Oncology Cardiology Neurology Orthopedics & Musculoskeletal Obstetrics & Gynecology General Radiology & Emergency |

| By Distribution Channel | Direct Sales (OEM) Authorized Distributors Online/Procurement Platforms |

| By Region | Kanto Kansai Chubu Kyushu Tohoku Chugoku & Shikoku Hokkaido & Okinawa |

| By Price Range | Premium Mid-range Budget |

| By Technology | Digital Imaging Analog Imaging Hybrid Imaging (e.g., PET/CT, SPECT/CT) AI-enabled & Advanced Workflow (CAD, Reconstruction, PACS/AI) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Directors |

| Private Clinics and Diagnostic Centers | 90 | Clinic Owners, Medical Directors |

| Medical Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 40 | Health Administrators, Policy Analysts |

| Radiology Technologists | 70 | Technologists, Equipment Operators |

The Japan Diagnostic Imaging Equipment Market is valued at approximately USD 2.2 billion, reflecting steady demand driven by an aging population and technological advancements in imaging modalities.