Region:Central and South America

Author(s):Rebecca

Product Code:KRAA2122

Pages:80

Published On:August 2025

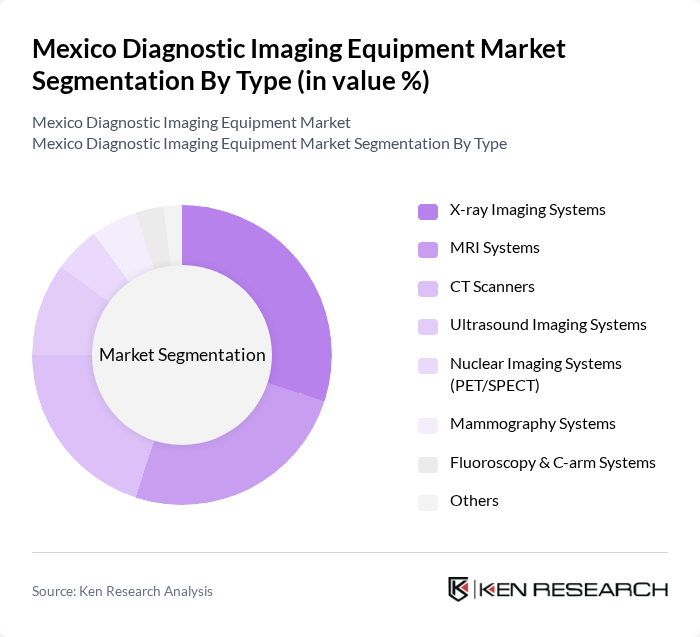

By Type:The diagnostic imaging equipment market is segmented into various types, including X-ray Imaging Systems, MRI Systems, CT Scanners, Ultrasound Imaging Systems, Nuclear Imaging Systems (PET/SPECT), Mammography Systems, Fluoroscopy & C-arm Systems, and Others. Among these, X-ray Imaging Systems and MRI Systems are the most prominent due to their widespread use in hospitals and diagnostic centers. The increasing demand for non-invasive diagnostic procedures, the adoption of digital and AI-enabled imaging solutions, and the growing prevalence of diseases requiring imaging diagnostics are key factors driving the growth of these segments .

By End-User:The end-user segmentation includes Hospitals, Diagnostic Centers, Academic Institutes and Research Organizations, Outpatient Facilities, and Others. Hospitals are the leading end-users of diagnostic imaging equipment, driven by the increasing patient load and the need for comprehensive diagnostic services. Diagnostic centers also play a significant role, as they provide specialized imaging services, catering to the growing demand for outpatient diagnostic procedures. The expansion of imaging services into outpatient and ambulatory care settings is also contributing to market growth .

The Mexico Diagnostic Imaging Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, GE HealthCare, Philips Healthcare, Canon Medical Systems, Fujifilm Healthcare, Hitachi Healthcare (now part of FUJIFILM Healthcare), Carestream Health, Hologic, Inc., Agfa HealthCare, Mindray Medical International Limited, Samsung Medison, Varian Medical Systems (a Siemens Healthineers company), United Imaging Healthcare, Neusoft Medical Systems, Esaote S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the diagnostic imaging equipment market in Mexico appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence in imaging processes is expected to enhance diagnostic accuracy and efficiency. Additionally, the expansion of telemedicine services will facilitate remote consultations, further driving demand for imaging services. As healthcare providers adapt to these trends, the market is likely to experience significant growth, improving access to quality diagnostic services across the country.

| Segment | Sub-Segments |

|---|---|

| By Type | X-ray Imaging Systems MRI Systems CT Scanners Ultrasound Imaging Systems Nuclear Imaging Systems (PET/SPECT) Mammography Systems Fluoroscopy & C-arm Systems Others |

| By End-User | Hospitals Diagnostic Centers Academic Institutes and Research Organizations Outpatient Facilities Others |

| By Application | Oncology Cardiology Neurology and Spine Orthopedics and Musculoskeletal Obstetrics and Gynecology Health General Imaging Breast Health Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Northern Mexico Central Mexico Southern Mexico Others |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Technology | Analog Imaging Digital Imaging Hybrid Imaging Mobile/Portable Imaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 100 | Radiologists, Imaging Technologists |

| Private Diagnostic Centers | 80 | Center Managers, Procurement Officers |

| Healthcare Policy Makers | 40 | Health Administrators, Policy Analysts |

| Medical Equipment Distributors | 60 | Sales Managers, Product Specialists |

| Research Institutions | 50 | Clinical Researchers, Academic Professors |

The Mexico Diagnostic Imaging Equipment Market is valued at approximately USD 1.1 billion, driven by factors such as the increasing prevalence of chronic diseases, advancements in imaging technologies, and rising healthcare expenditure.