Region:Asia

Author(s):Shubham

Product Code:KRAB1281

Pages:99

Published On:October 2025

By Type:The facility management services in airports can be categorized into various types, including cleaning services, maintenance services, security services, landscaping services, waste management services, energy management services, baggage handling & support services, HVAC & environmental control services, passenger assistance & mobility services, and others. Each of these services plays a vital role in ensuring the smooth operation of airport facilities.Hard servicessuch as maintenance, HVAC, and energy management form the backbone of operational resilience, whilesoft serviceslike cleaning and security are increasingly prioritized due to heightened hygiene and passenger experience standards .

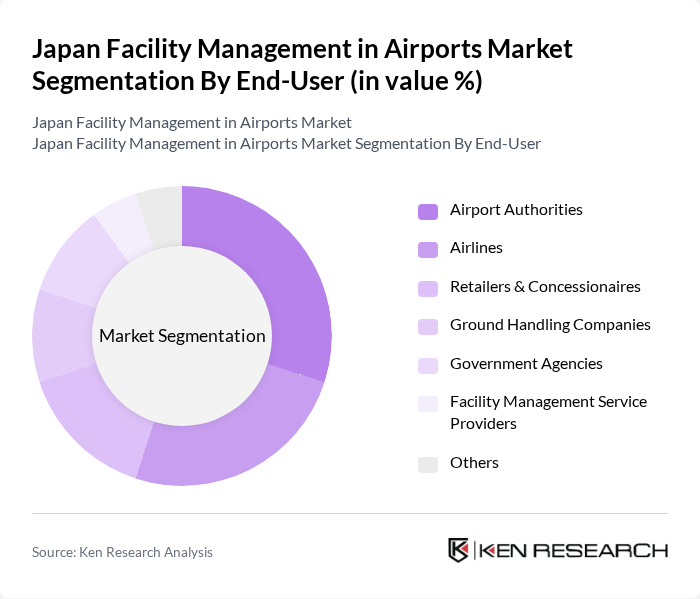

By End-User:The end-users of facility management services in airports include airport authorities, airlines, retailers & concessionaires, ground handling companies, government agencies, facility management service providers, and others. Each of these end-users has specific requirements that drive the demand for tailored facility management solutions.Airport authorities and airlinesremain the largest end-users, focusing on operational efficiency and regulatory compliance, while retailers and concessionaires increasingly demand integrated services to enhance passenger engagement .

The Japan Facility Management in Airports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Japan Airport Terminal Co., Ltd., Airport Facilities Co., Ltd., JALUX Inc., NTT Facilities, Inc., Taisei Corporation, Shimizu Corporation, Tokyu Construction Co., Ltd., Kintetsu Group Holdings Co., Ltd., Mitsui Fudosan Co., Ltd., Obayashi Corporation, Sumitomo Corporation, Daiseki Co., Ltd., Sato Kogyo Co., Ltd., Fujita Corporation, Asahi Kasei Corporation, Kokusai Kogyo Co., Ltd., Tokyo Airport Heating & Cooling Co., Ltd., AFC Asset Management Co., Ltd., S Cube Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Japanese airports is poised for transformation, driven by technological advancements and a focus on sustainability. As passenger traffic continues to rise, airports will increasingly adopt integrated management systems that leverage data analytics for operational efficiency. Additionally, the emphasis on enhancing customer experience will lead to the implementation of smart technologies, ensuring that facilities are not only efficient but also responsive to passenger needs, ultimately shaping a more sustainable and user-friendly airport environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Maintenance Services Security Services Landscaping Services Waste Management Services Energy Management Services Baggage Handling & Support Services HVAC & Environmental Control Services Passenger Assistance & Mobility Services Others |

| By End-User | Airport Authorities Airlines Retailers & Concessionaires Ground Handling Companies Government Agencies Facility Management Service Providers Others |

| By Service Model | Outsourced Services In-house Services Hybrid Services |

| By Contract Type | Fixed-term Contracts Performance-based Contracts Time and Material Contracts |

| By Technology Integration | IoT-enabled Services AI and Automation Cloud-based Management Systems Smart Surveillance & Security Systems |

| By Geographic Coverage | Domestic Airports International Airports |

| By Investment Source | Private Investments Public Funding Joint Ventures |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Facility Management Services | 100 | Facility Managers, Operations Directors |

| Cleaning and Maintenance Services | 60 | Service Providers, Contract Managers |

| Security Management Solutions | 50 | Security Managers, Compliance Officers |

| Technology Integration in Facility Management | 40 | IT Managers, Technology Consultants |

| Passenger Experience Enhancement Services | 45 | Customer Experience Managers, Marketing Directors |

The Japan Facility Management in Airports Market is valued at approximately USD 2.1 billion, reflecting a significant growth driven by increased air travel, enhanced operational efficiency, and the integration of advanced technologies in facility management services.