Region:Asia

Author(s):Dev

Product Code:KRAB6088

Pages:89

Published On:October 2025

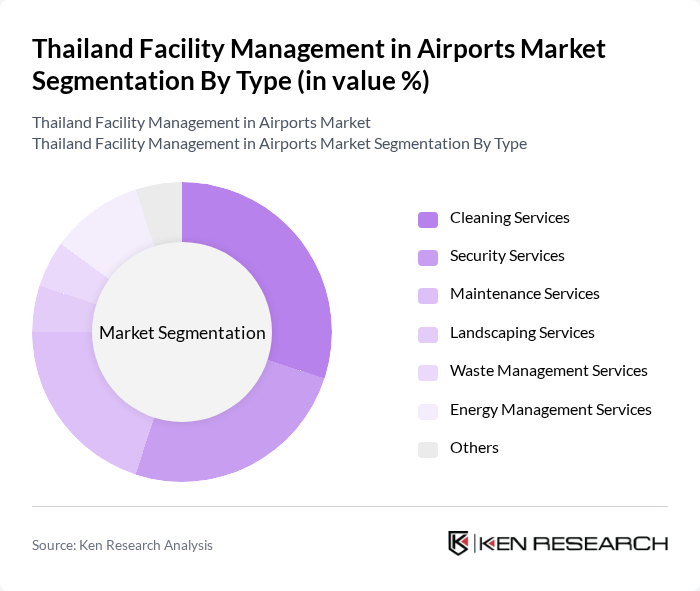

By Type:The facility management services in airports can be categorized into several types, including cleaning services, security services, maintenance services, landscaping services, waste management services, energy management services, and others. Among these, cleaning and security services are the most critical, as they directly impact passenger experience and safety. The demand for these services is driven by the increasing focus on hygiene and security in the post-pandemic era.

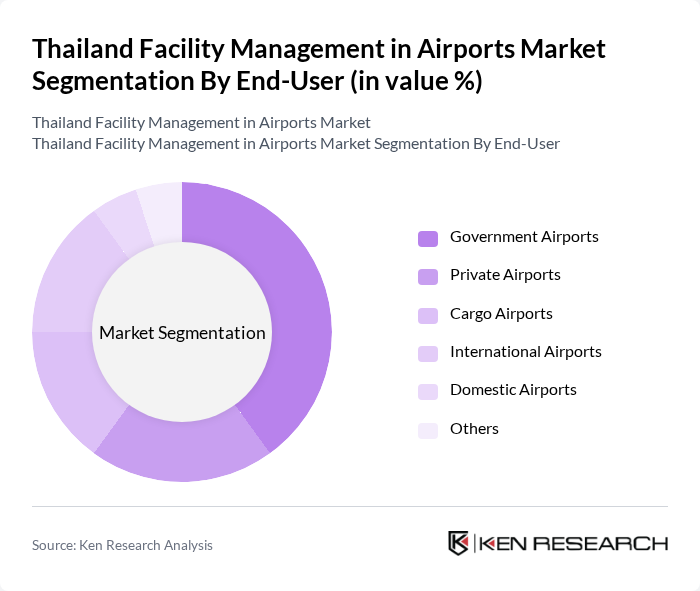

By End-User:The end-users of facility management services in airports include government airports, private airports, cargo airports, international airports, domestic airports, and others. Government airports dominate the market due to their larger budgets and higher passenger volumes, which necessitate comprehensive facility management solutions. The increasing number of private and cargo airports also contributes to the growing demand for specialized services.

The Thailand Facility Management in Airports Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airports of Thailand Public Company Limited, Changi Airport Group, SITA, ISS Facility Services, G4S, JLL (Jones Lang LaSalle), CBRE Group, Cushman & Wakefield, Mitie Group, Serco Group, OCS Group, Compass Group, ABM Industries, Engie Group, Sodexo contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Thailand's airports appears promising, driven by ongoing investments in infrastructure and a growing emphasis on operational efficiency. As passenger traffic continues to rise, the demand for advanced facility management solutions will increase. Additionally, the integration of smart technologies and data analytics will enhance decision-making processes, leading to improved service delivery. The focus on sustainability will also shape future developments, as airports strive to minimize their environmental impact while maintaining high operational standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Security Services Maintenance Services Landscaping Services Waste Management Services Energy Management Services Others |

| By End-User | Government Airports Private Airports Cargo Airports International Airports Domestic Airports Others |

| By Service Model | In-house Management Outsourced Management Hybrid Model |

| By Region | Central Thailand Northern Thailand Southern Thailand Eastern Thailand Western Thailand Others |

| By Facility Type | Terminals Runways Hangars Parking Areas Cargo Facilities Others |

| By Contract Type | Fixed Contracts Variable Contracts Performance-based Contracts |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Airport Facility Management Services | 100 | Facility Managers, Operations Directors |

| Security and Safety Management | 80 | Security Managers, Compliance Officers |

| Cleaning and Maintenance Services | 70 | Maintenance Supervisors, Cleaning Service Providers |

| Passenger Experience Enhancements | 60 | Customer Experience Managers, Airport Operations Staff |

| Technology Integration in Facility Management | 90 | IT Managers, Facility Technology Specialists |

The Thailand Facility Management in Airports Market is valued at approximately USD 1.2 billion, driven by increasing passenger traffic and the demand for efficient airport operations and maintenance services.