Region:North America

Author(s):Geetanshi

Product Code:KRAB1392

Pages:84

Published On:October 2025

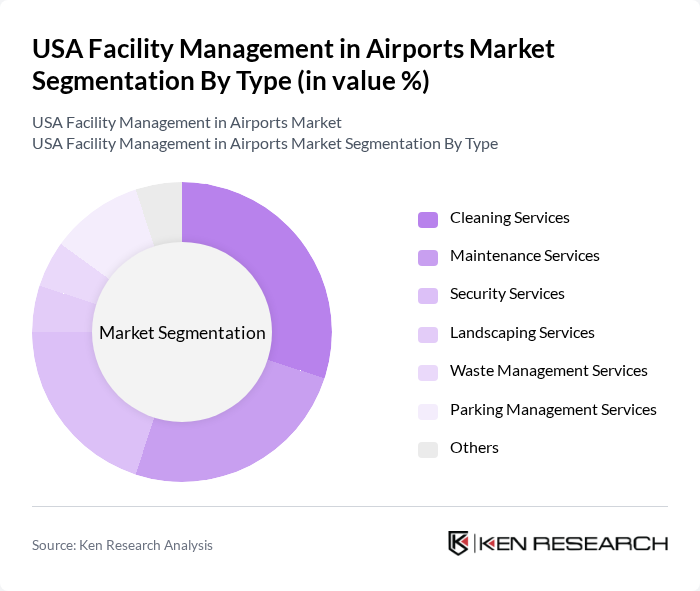

By Type:The facility management services in airports can be categorized into several types, including cleaning services, maintenance services, security services, landscaping services, waste management services, parking management services, and others such as HVAC and electrical services. Among these, cleaning and maintenance services are particularly dominant due to the high standards of hygiene and operational efficiency required in airport environments. The increasing focus on passenger experience and safety has led to a growing demand for these essential services. Hard services, which include critical infrastructure upkeep such as HVAC, electrical, and mechanical systems, represent the largest segment by service type in the broader facility management market, reflecting their non-deferrable nature in airport operations.

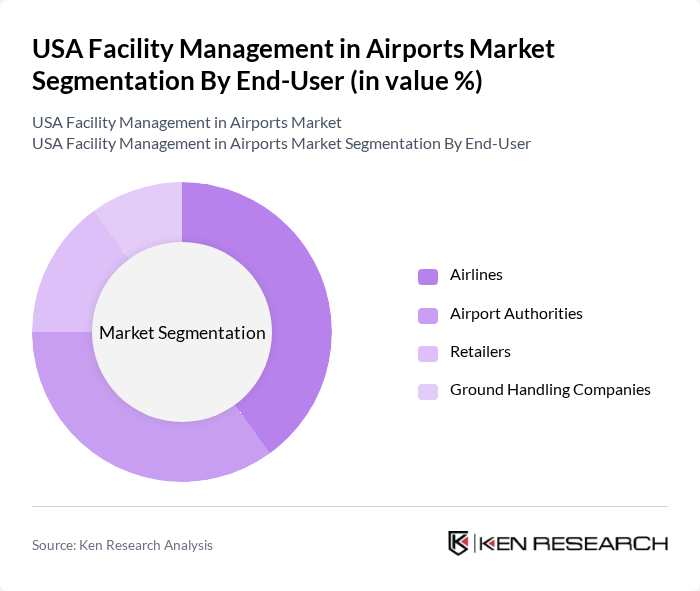

By End-User:The end-users of facility management services in airports include airlines, airport authorities, retailers, and ground handling companies. Airlines and airport authorities are the primary consumers, as they require comprehensive management solutions to ensure smooth operations and enhance passenger satisfaction. The increasing competition among airlines and the need for efficient airport operations drive the demand for specialized facility management services. Large enterprises dominate the broader facility management market by organization size, reflecting the scale and complexity of airport operations.

The USA Facility Management in Airports Market is characterized by a dynamic mix of regional and international players. Leading participants such as ABM Industries Incorporated, ISS Facility Services, CBRE Group, Inc., JLL (Jones Lang LaSalle), G4S plc, Securitas AB, Aramark Corporation, Compass Group PLC, Sodexo S.A., Mitie Group PLC, Serco Group PLC, OCS Group Limited, EMCOR Group, Inc., C&W Services, Vantage Airport Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in USA airports is poised for transformation, driven by technological innovations and a focus on sustainability. As airports increasingly adopt integrated management solutions, the emphasis on data analytics will enhance decision-making processes. Additionally, the shift towards outsourcing facility management services is expected to grow, allowing airports to focus on core operations while leveraging specialized expertise. This evolution will create a more efficient and responsive airport environment, ultimately improving passenger satisfaction and operational resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Maintenance Services Security Services Landscaping Services Waste Management Services Parking Management Services Others (Including HVAC and Electrical Services) |

| By End-User | Airlines Airport Authorities Retailers Ground Handling Companies |

| By Service Model | Outsourced Services In-House Services |

| By Facility Type | Terminals Runways Hangars Cargo Facilities |

| By Contract Type | Fixed-Price Contracts Cost-Plus Contracts |

| By Technology Integration | IoT Solutions AI and Machine Learning Cloud-Based Services |

| By Policy Support | Government Grants Tax Incentives Subsidies for Green Initiatives |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Major Airport Facility Management | 40 | Facility Managers, Operations Directors |

| Regional Airport Services | 40 | Airport Authority Representatives, Maintenance Supervisors |

| Cleaning and Maintenance Services | 40 | Service Providers, Contract Managers |

| Security and Safety Management | 40 | Security Managers, Compliance Officers |

| Technology Integration in Facility Management | 40 | IT Managers, Facility Technology Specialists |

The USA Facility Management in Airports Market is valued at approximately USD 60 billion, driven by increasing passenger traffic, operational efficiency needs, and heightened safety and security measures in airports.