Region:Asia

Author(s):Shubham

Product Code:KRAA4701

Pages:87

Published On:September 2025

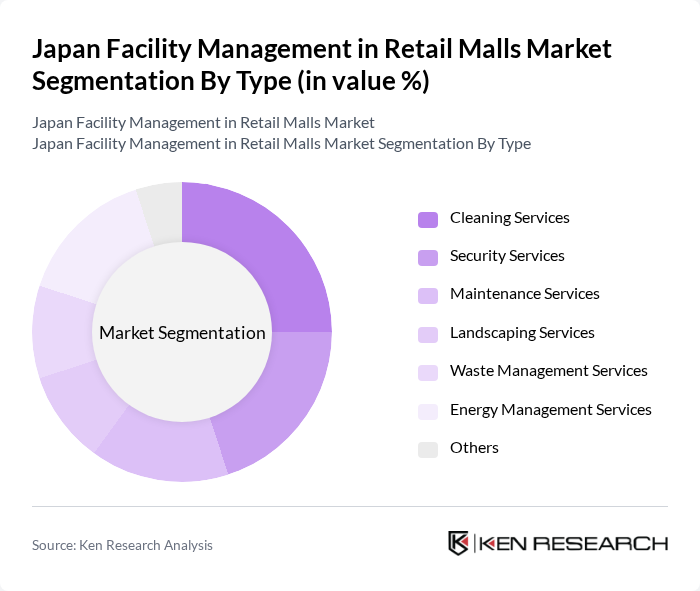

By Type:The facility management services in retail malls can be categorized into several types, including Cleaning Services, Security Services, Maintenance Services, Landscaping Services, Waste Management Services, Energy Management Services, and Others. Each of these services plays a crucial role in ensuring the smooth operation of retail environments, enhancing customer satisfaction, and maintaining the overall aesthetic and functional quality of the malls.

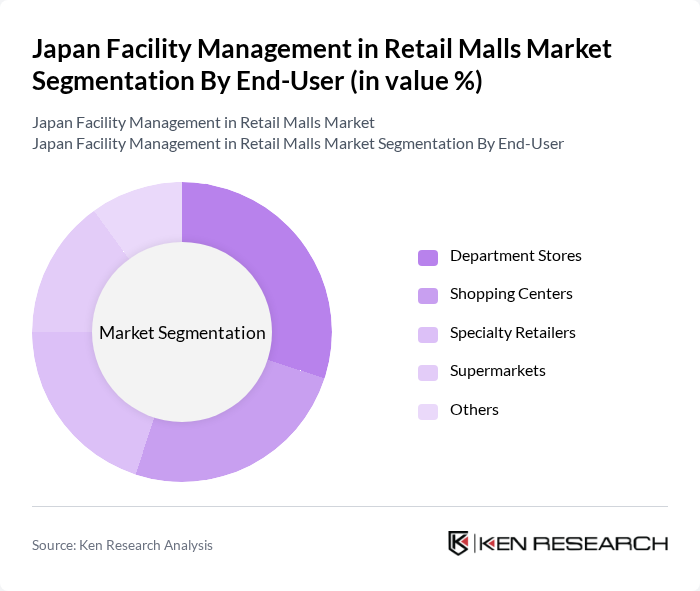

By End-User:The end-users of facility management services in retail malls include Department Stores, Shopping Centers, Specialty Retailers, Supermarkets, and Others. Each segment has unique requirements and expectations from facility management providers, which influences the type and extent of services utilized.

The Japan Facility Management in Retail Malls Market is characterized by a dynamic mix of regional and international players. Leading participants such as JLL (Jones Lang LaSalle), CBRE Group, Inc., ISS Facility Services, Sodexo, Cushman & Wakefield, GDI Integrated Facility Services, Mitie Group plc, ABM Industries Incorporated, Serco Group plc, OCS Group Limited, EMCOR Group, Inc., Aramark, C&W Services, SODEXO Japan, Daiseki Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Japan's retail malls is poised for transformation, driven by technological advancements and evolving consumer preferences. As digital solutions become more prevalent, the integration of smart technologies will enhance operational efficiency and customer engagement. Additionally, the focus on sustainability will shape facility management practices, with an increasing number of malls adopting eco-friendly initiatives. These trends indicate a shift towards more innovative, customer-centric approaches that prioritize both operational excellence and environmental responsibility in the retail sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Security Services Maintenance Services Landscaping Services Waste Management Services Energy Management Services Others |

| By End-User | Department Stores Shopping Centers Specialty Retailers Supermarkets Others |

| By Service Model | Outsourced Services In-House Services Hybrid Services |

| By Contract Type | Fixed-Term Contracts Open-Ended Contracts Project-Based Contracts |

| By Geographic Presence | Urban Areas Suburban Areas Rural Areas |

| By Customer Segment | Large Retail Chains Independent Retailers Franchise Operations |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-Based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Facility Management in Shopping Malls | 150 | Facility Managers, Operations Directors |

| Retail Space Maintenance Services | 100 | Maintenance Supervisors, Service Providers |

| Security and Safety Management | 80 | Security Managers, Risk Assessment Officers |

| Cleaning and Sanitation Services | 70 | Cleaning Service Managers, Quality Control Inspectors |

| Energy Management Solutions | 60 | Energy Managers, Sustainability Coordinators |

The Japan Facility Management in Retail Malls Market is valued at approximately USD 15 billion, reflecting a significant growth driven by the increasing demand for efficient management of retail spaces and enhanced customer experiences.