Region:Asia

Author(s):Geetanshi

Product Code:KRAB1369

Pages:84

Published On:October 2025

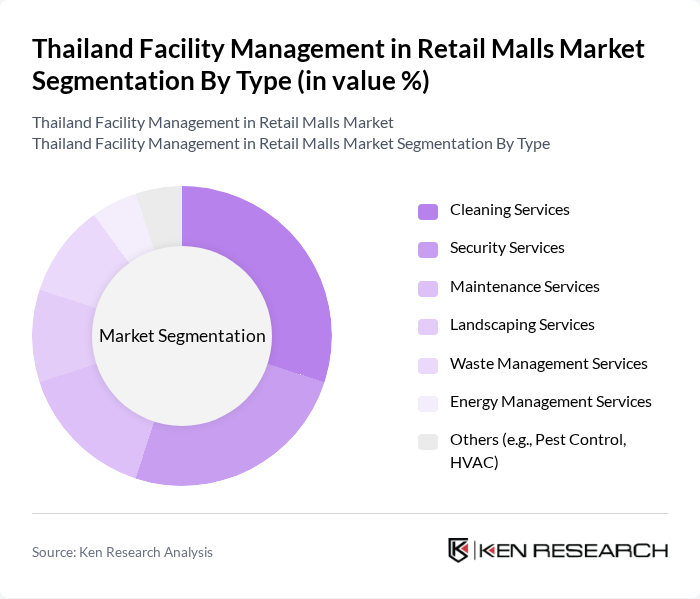

By Type:The facility management services in retail malls can be categorized into several types, including Cleaning Services, Security Services, Maintenance Services, Landscaping Services, Waste Management Services, Energy Management Services, and Others (e.g., Pest Control, HVAC). Among these, Cleaning Services and Security Services are particularly significant due to the high demand for maintaining hygiene and safety in retail environments. The increasing focus on customer experience, sustainability, and safety has led to a surge in the adoption of these services, with digital tools and automation playing a growing role in service delivery .

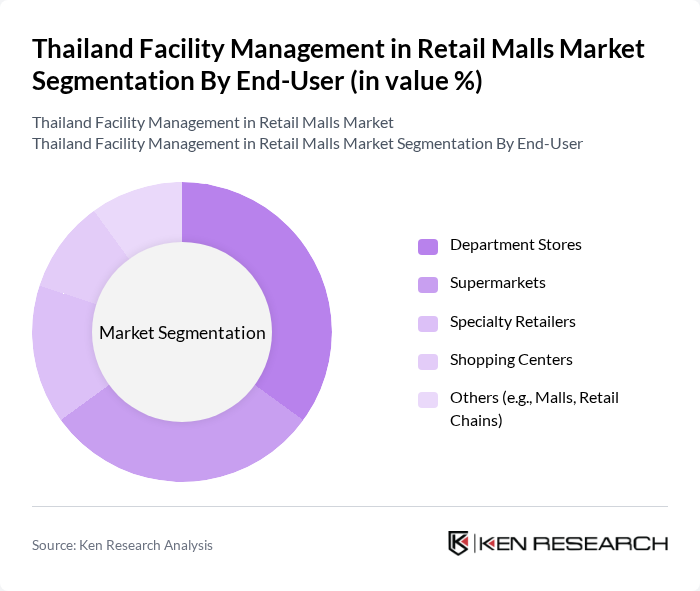

By End-User:The end-users of facility management services in retail malls include Department Stores, Supermarkets, Specialty Retailers, Shopping Centers, and Others (e.g., Malls, Retail Chains). Department Stores and Supermarkets are the leading segments due to their large foot traffic and the necessity for comprehensive facility management to ensure a pleasant shopping experience. The growing trend of specialty retailing, coupled with increased focus on health and safety standards, also contributes to the demand for tailored facility management solutions .

The Thailand Facility Management in Retail Malls Market is characterized by a dynamic mix of regional and international players. Leading participants such as CBRE (Thailand) Co., Ltd., Jones Lang LaSalle (Thailand) Ltd., ISS Facility Services, Sodexo S.A., G4S Security Services (Thailand) Limited, Plus Property, Swift Dynamics, Amata Facility Service, IFS Facility Service Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of facility management in Thailand's retail malls is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As sustainability becomes a priority, facility management practices will increasingly focus on eco-friendly solutions. Additionally, the integration of smart technologies will enhance operational efficiency and customer engagement. Retailers will likely seek partnerships with facility management firms to leverage these innovations, ensuring a competitive edge in a rapidly changing market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Services Security Services Maintenance Services Landscaping Services Waste Management Services Energy Management Services Others (e.g., Pest Control, HVAC) |

| By End-User | Department Stores Supermarkets Specialty Retailers Shopping Centers Others (e.g., Malls, Retail Chains) |

| By Service Model | Integrated Facility Management Bundled Services Standalone Services Others (e.g., Hybrid Models) |

| By Contract Type | Fixed-Term Contracts Service Level Agreements On-Demand Services Others (e.g., Customized Contracts) |

| By Geographic Coverage | Urban Areas Suburban Areas Rural Areas Others (e.g., Tourist Areas) |

| By Pricing Model | Hourly Rates Fixed Pricing Performance-Based Pricing Others (e.g., Tiered Pricing) |

| By Customer Segment | Large Retail Chains Independent Retailers Franchise Operations Others (e.g., Small Retailers) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Facility Management in Shopping Malls | 100 | Facility Managers, Operations Directors |

| Cleaning Services in Retail Spaces | 60 | Service Providers, Quality Assurance Managers |

| Security Management in Retail Environments | 50 | Security Managers, Risk Assessment Officers |

| Maintenance Services for Retail Facilities | 40 | Maintenance Supervisors, Technical Managers |

| Energy Management in Retail Malls | 40 | Sustainability Officers, Energy Managers |

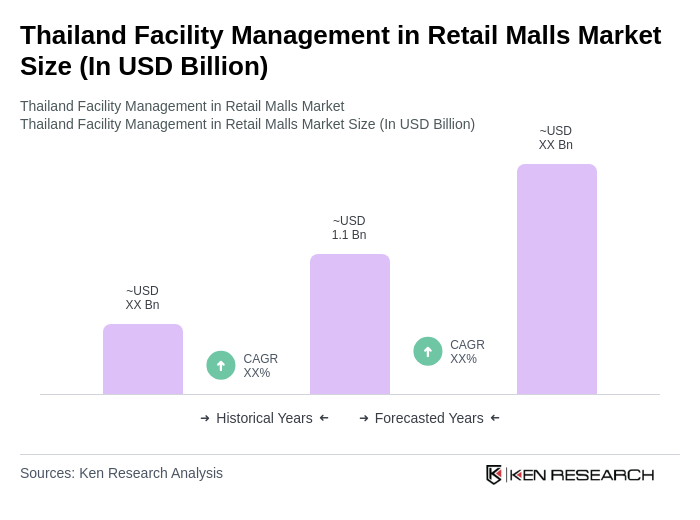

The Thailand Facility Management in Retail Malls Market is valued at approximately USD 1.1 billion, driven by factors such as urbanization, an expanding middle class, and the increasing number of retail malls requiring professional management services.