Region:Asia

Author(s):Dev

Product Code:KRAA0485

Pages:100

Published On:August 2025

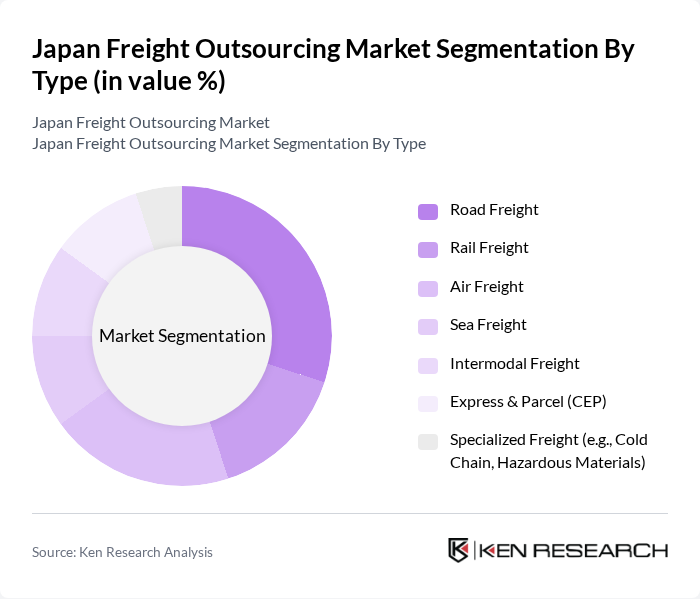

By Type:The freight outsourcing market can be segmented into Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express & Parcel (CEP), and Specialized Freight (such as Cold Chain and Hazardous Materials). Each segment addresses specific logistics needs, with road freight dominating due to Japan's extensive highway network and demand for last-mile delivery, while air and sea freight play critical roles in international trade and time-sensitive shipments. Specialized freight, including cold chain logistics, is growing in importance due to rising demand in pharmaceuticals and food sectors .

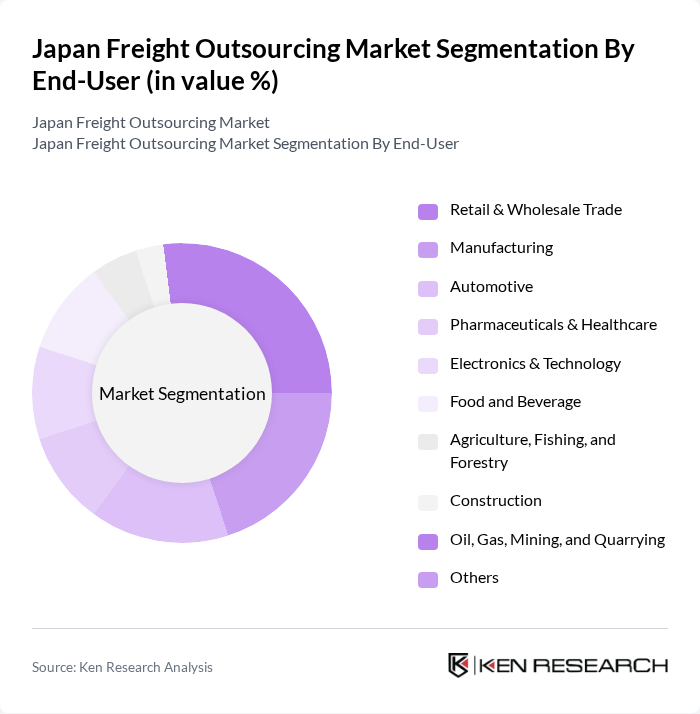

By End-User:The end-user segmentation includes Retail & Wholesale Trade, Manufacturing, Automotive, Pharmaceuticals & Healthcare, Electronics & Technology, Food and Beverage, Agriculture, Fishing, and Forestry, Construction, Oil, Gas, Mining, and Quarrying, and Others. Retail and e-commerce drive significant demand for logistics services, while manufacturing and automotive sectors rely on efficient freight networks for supply chain continuity. The food, pharmaceutical, and electronics industries increasingly require specialized and temperature-controlled logistics solutions .

The Japan Freight Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Express, Yamato Holdings, Sagawa Express, Kintetsu World Express, Seino Holdings, Hitachi Transport System, Mitsui-Soko Holdings, Marubeni Logistics, Fukuyama Transporting, Kuehne + Nagel, DB Schenker, CEVA Logistics, DHL Supply Chain Japan, DSV, and Yusen Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Japan freight outsourcing market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt digital freight platforms and integrate IoT solutions, operational efficiencies will improve significantly. Additionally, the emphasis on sustainability will shape logistics strategies, compelling providers to innovate and adapt. The market is expected to witness a shift towards more collaborative models, enhancing service delivery and customer satisfaction while addressing environmental concerns.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express & Parcel (CEP) Specialized Freight (e.g., Cold Chain, Hazardous Materials) |

| By End-User | Retail & Wholesale Trade Manufacturing Automotive Pharmaceuticals & Healthcare Electronics & Technology Food and Beverage Agriculture, Fishing, and Forestry Construction Oil, Gas, Mining, and Quarrying Others |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing and Storage Distribution & Last-Mile Delivery Supply Chain Management Value-Added Services (e.g., Packaging, Labeling) Others |

| By Delivery Mode | Standard Delivery Expedited Delivery Scheduled Delivery Same-Day/Next-Day Delivery Temperature-Controlled Delivery Others |

| By Region | Kanto Kansai Chubu Kyushu Hokkaido Shikoku Tohoku Chugoku Others |

| By Customer Type | B2B B2C Government & Public Sector Non-Profit Organizations Others |

| By Payment Method | Prepaid Postpaid Credit Terms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Freight Outsourcing | 100 | Logistics Coordinators, Supply Chain Managers |

| Electronics Supply Chain Management | 80 | Operations Managers, Procurement Specialists |

| Retail Logistics Solutions | 120 | Warehouse Managers, Distribution Directors |

| Pharmaceutical Freight Services | 70 | Quality Assurance Managers, Logistics Directors |

| Food and Beverage Distribution | 90 | Supply Chain Analysts, Operations Supervisors |

The Japan Freight Outsourcing Market is valued at approximately USD 322 billion, reflecting significant growth driven by the demand for efficient logistics solutions, the expansion of e-commerce, and the need for reliable transportation options.