Region:Africa

Author(s):Geetanshi

Product Code:KRAA2038

Pages:84

Published On:August 2025

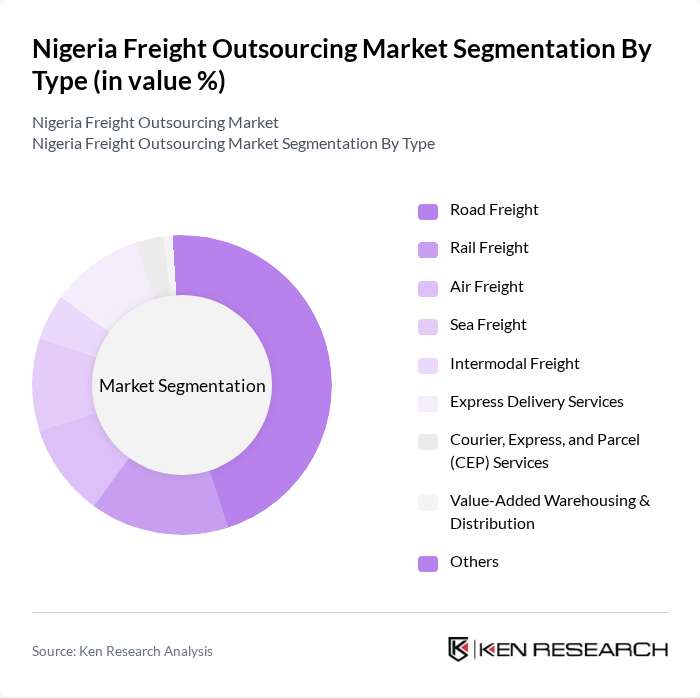

By Type:The freight outsourcing market is segmented into various types, including Road Freight, Rail Freight, Air Freight, Sea Freight, Intermodal Freight, Express Delivery Services, Courier, Express, and Parcel (CEP) Services, Value-Added Warehousing & Distribution, and Others. Among these, Road Freight is the most dominant segment due to its flexibility, cost-effectiveness, and Nigeria’s extensive road network, which is the largest in West Africa. Rail Freight is gaining traction, particularly for bulk goods, while Air Freight is favored for time-sensitive deliveries. The Express Delivery Services and CEP segments are experiencing rapid growth, driven by the e-commerce boom and the need for efficient last-mile delivery .

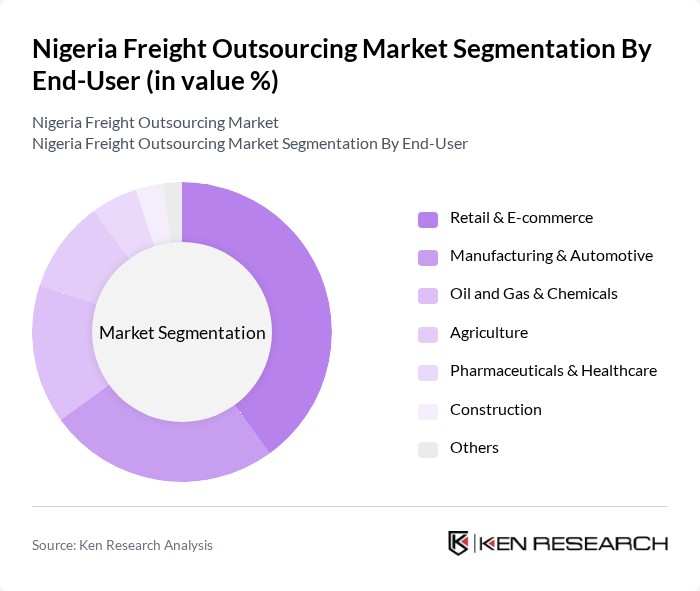

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing & Automotive, Oil and Gas & Chemicals, Agriculture, Pharmaceuticals & Healthcare, Construction, and Others. The Retail & E-commerce segment is the leading end-user, driven by the surge in online shopping and the need for efficient logistics solutions to meet consumer demands. The Manufacturing & Automotive sector also significantly contributes to the market, requiring reliable freight services for raw materials and finished goods. The Oil and Gas sector remains a critical player, given Nigeria's status as a major oil producer. Agriculture and pharmaceuticals are also growing segments, supported by increasing demand for cold chain and specialized logistics .

The Nigeria Freight Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Nigeria, Maersk Nigeria, Kuehne + Nagel Nigeria, FedEx Nigeria, Bolloré Transport & Logistics Nigeria, Agility Logistics Nigeria, GIG Logistics, Red Star Express, JOF Nigeria Limited, Nigerian Ports Authority, Africa Access 3PL Limited, Jumia Logistics, ABC Transport Plc, CMA CGM Nigeria, UPS Nigeria, Redline Logistics, Transport Services Limited, Starlink Logistics, Cargo Services Limited, Swift Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Nigeria freight outsourcing market appears promising, driven by technological advancements and a growing emphasis on sustainability. As logistics companies increasingly adopt digital solutions, such as automated tracking systems and AI-driven analytics, operational efficiency is expected to improve significantly. Furthermore, the shift towards eco-friendly practices will likely influence logistics strategies, encouraging companies to invest in greener transportation options. This evolving landscape presents opportunities for innovation and collaboration within the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express Delivery Services Courier, Express, and Parcel (CEP) Services Value-Added Warehousing & Distribution Others |

| By End-User | Retail & E-commerce Manufacturing & Automotive Oil and Gas & Chemicals Agriculture Pharmaceuticals & Healthcare Construction Others |

| By Service Type | Freight Forwarding Customs Brokerage Warehousing Distribution Last-Mile Delivery Logistics Consulting Temperature-Controlled Logistics Others |

| By Delivery Mode | Standard Delivery Expedited Delivery Same-Day Delivery Scheduled Delivery Others |

| By Pricing Model | Flat Rate Variable Rate Subscription-Based Others |

| By Geographic Coverage | Urban Areas Rural Areas Cross-Border Regional/International Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Corporations Government Agencies Non-Governmental Organizations Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Freight Management | 50 | Logistics Coordinators, Supply Chain Managers |

| Agricultural Product Distribution | 40 | Procurement Managers, Distribution Supervisors |

| Manufacturing Supply Chain Logistics | 45 | Operations Managers, Warehouse Supervisors |

| Retail Freight Outsourcing | 40 | Logistics Directors, E-commerce Managers |

| Third-Party Logistics Providers | 40 | Business Development Managers, Client Relationship Managers |

The Nigeria Freight Outsourcing Market is valued at approximately USD 11 billion, reflecting significant growth driven by increased demand for logistics services, e-commerce expansion, and infrastructure development across the country.