Region:Europe

Author(s):Shubham

Product Code:KRAA0779

Pages:89

Published On:August 2025

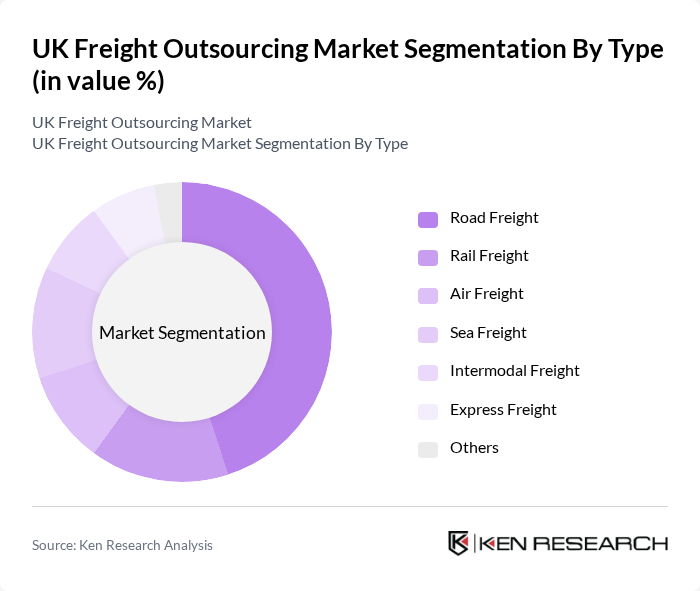

By Type:The freight outsourcing market is segmented into various types, including road freight, rail freight, air freight, sea freight, intermodal freight, express freight, and others. Among these, road freight is the most dominant segment due to its flexibility, extensive network, and ability to provide door-to-door services. The increasing demand for quick deliveries, especially in e-commerce, has further solidified road freight's position as the leading mode of transportation. Roadways are recognized as the most reliable and flexible mode for both inbound and outbound logistics, especially for e-commerce and retail operations .

By End-User:The end-user segmentation includes wholesale and retail trade, manufacturing & construction, healthcare, automotive, food and beverage, e-commerce, agriculture, fishing and forestry, energy & utilities, government and public utilities, and others. The e-commerce sector is currently the most significant end-user, driven by the surge in online shopping and the demand for rapid delivery services. This trend has led to increased reliance on freight outsourcing to meet consumer expectations for speed and efficiency. Value-added services, such as flexible packaging, labeling, and inventory tracking, are increasingly demanded by sectors like retail, healthcare, and automotive to enhance supply chain efficiency .

The UK Freight Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DB Schenker, UPS Supply Chain Solutions, FedEx Logistics, Geodis, DSV, CEVA Logistics, C.H. Robinson, Wincanton, Eddie Stobart Logistics, Clipper Logistics, Palletways, GXO Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The UK freight outsourcing market is poised for transformative growth driven by technological advancements and evolving consumer expectations. As companies increasingly adopt digital freight platforms, the focus on sustainability will intensify, prompting logistics providers to innovate. The integration of AI and automation will streamline operations, enhancing efficiency and reducing costs. Additionally, the expansion of last-mile delivery services will cater to the growing demand for rapid fulfillment, positioning the market for significant evolution in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Freight Rail Freight Air Freight Sea Freight Intermodal Freight Express Freight Others |

| By End-User | Wholesale and Retail Trade Manufacturing & Construction Healthcare Automotive Food and Beverage E-commerce Agriculture, Fishing and Forestry Energy & Utilities Government and Public Utilities Others |

| By Service Type | Freight Forwarding Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Warehousing and Distribution Customs Clearance Inventory Management Packaging Others |

| By Delivery Mode | Standard Delivery Expedited Delivery Scheduled Delivery Same-Day Delivery Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage International Coverage Others |

| By Customer Type | B2B B2C Government Non-Profit Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Freight Outsourcing | 60 | Logistics Managers, Supply Chain Executives |

| Manufacturing Logistics Solutions | 50 | Operations Managers, Procurement Specialists |

| E-commerce Fulfillment Services | 40 | eCommerce Directors, Warehouse Operations Managers |

| Third-Party Logistics Providers | 45 | Business Development Managers, Account Executives |

| Transport and Freight Management | 45 | Fleet Managers, Compliance Officers |

The UK Freight Outsourcing Market is valued at approximately USD 90 billion, driven by the increasing demand for efficient logistics solutions, the rise of e-commerce, and the need for cost-effective transportation options.