Japan Furniture and Modular Offices Market Overview

- The Japan Furniture and Modular Offices Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for flexible workspaces, the rise of remote working trends, and a growing emphasis on ergonomic furniture solutions. The market has seen a significant shift towards modular office designs that cater to the evolving needs of businesses and employees alike.

- Tokyo, Osaka, and Yokohama are the dominant cities in the Japan Furniture and Modular Offices Market. Tokyo, as the capital, is a major business hub with a high concentration of corporate offices and startups, driving demand for innovative office solutions. Osaka and Yokohama also contribute significantly due to their robust economic activities and urban development projects, which further enhance the need for modern furniture and modular office setups.

- In 2023, the Japanese government implemented regulations aimed at promoting sustainable office environments. This includes guidelines for the use of eco-friendly materials in furniture production and incentives for companies that adopt modular office designs that enhance space efficiency and reduce waste. These regulations are part of a broader initiative to foster sustainable urban development and improve workplace environments across the country.

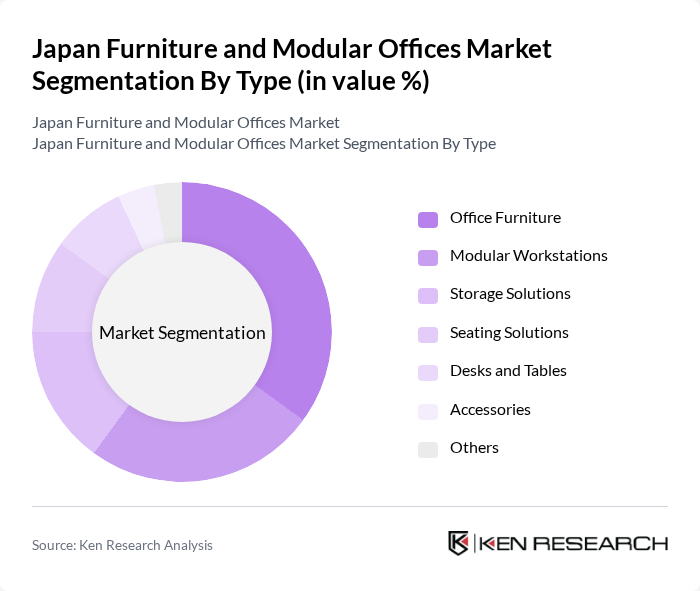

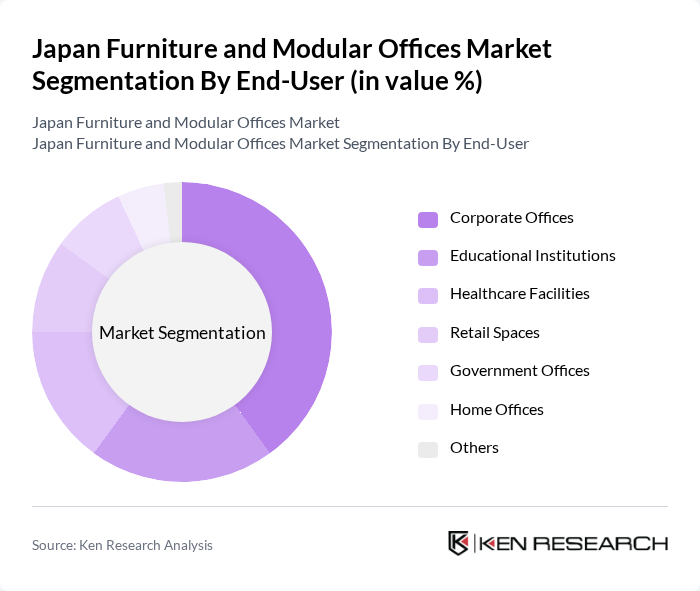

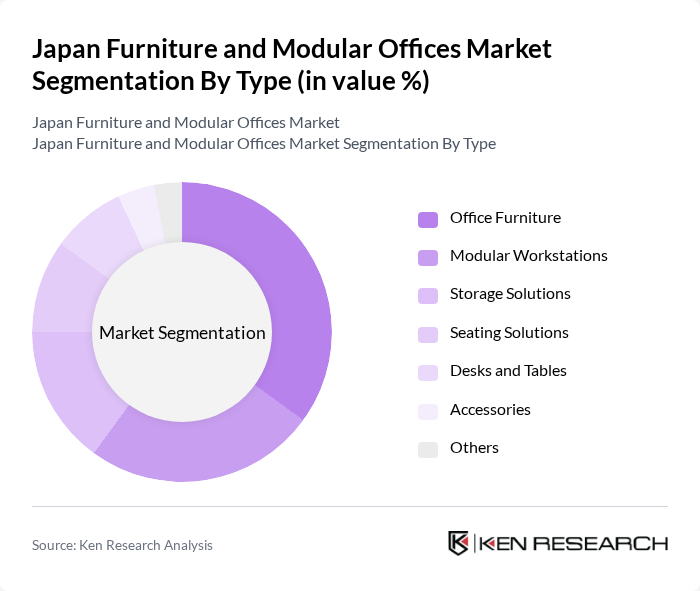

Japan Furniture and Modular Offices Market Segmentation

By Type:The market is segmented into various types of furniture and modular office solutions. The key subsegments include Office Furniture, Modular Workstations, Storage Solutions, Seating Solutions, Desks and Tables, Accessories, and Others. Among these, Office Furniture is the leading subsegment, driven by the increasing demand for ergonomic and aesthetically pleasing designs that enhance productivity in corporate settings. Modular Workstations are also gaining traction as businesses seek flexible solutions that can adapt to changing workspace needs.

By End-User:The market is segmented by end-users, including Corporate Offices, Educational Institutions, Healthcare Facilities, Retail Spaces, Government Offices, Home Offices, and Others. Corporate Offices dominate the market, driven by the need for modern and adaptable work environments that enhance employee productivity and satisfaction. The increasing trend of remote work has also led to a rise in demand for Home Offices, as individuals seek to create functional workspaces within their residences.

Japan Furniture and Modular Offices Market Competitive Landscape

The Japan Furniture and Modular Offices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Okamura Corporation, Kokuyo Co., Ltd., HAYASHI KOGYO Co., Ltd., Takara Belmont Corporation, Nitori Holdings Co., Ltd., Muji Co., Ltd., Tansu Co., Ltd., Maruni Wood Industry, Inc., Kawai Musical Instruments Manufacturing Co., Ltd., Yamazaki Home, Inc., Seki Furniture Co., Ltd., Sato Co., Ltd., Sato Shokai Co., Ltd., Kuroda Seiko Co., Ltd., Tansu Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Japan Furniture and Modular Offices Market Industry Analysis

Growth Drivers

- Increasing Demand for Flexible Workspaces:The demand for flexible workspaces in Japan is projected to reach 1.5 million square meters in future, driven by the rise of remote work and co-working spaces. According to the Japan Office Space Market Report, flexible workspace providers have increased by 30% since 2020, indicating a significant shift in workplace preferences. This trend is further supported by the 2023 survey from the Ministry of Land, Infrastructure, Transport and Tourism, which reported that 60% of companies are adopting hybrid work models.

- Rising Urbanization and Population Density:Japan's urban population is expected to exceed 90% in future, leading to increased demand for space-efficient furniture solutions. The World Bank reports that urban areas are growing at a rate of 0.5% annually, intensifying the need for modular and multifunctional furniture. Additionally, the Tokyo Metropolitan Government has noted a 15% increase in residential space constraints, prompting consumers to seek innovative furniture designs that maximize utility in smaller living environments.

- Technological Advancements in Furniture Design:The integration of technology in furniture design is revolutionizing the market, with smart furniture sales projected to reach ¥200 billion in future. Innovations such as IoT-enabled desks and adjustable ergonomic chairs are gaining traction, as reported by the Japan Furniture Manufacturers Association. Furthermore, 40% of consumers express a preference for tech-enhanced furniture, indicating a strong market shift towards products that combine functionality with modern technology.

Market Challenges

- High Competition Among Local and International Players:The Japanese furniture market is characterized by intense competition, with over 1,000 registered manufacturers. According to the Japan Furniture Industry Association, local brands hold a 55% market share, while international brands are rapidly increasing their presence. This competitive landscape pressures companies to innovate continuously and maintain competitive pricing, which can strain profit margins and market positioning.

- Fluctuating Raw Material Prices:The volatility of raw material prices poses a significant challenge for furniture manufacturers in Japan. In future, the price of wood increased by 20% due to supply chain disruptions and rising demand. The Ministry of Economy, Trade and Industry reported that these fluctuations can lead to increased production costs, forcing manufacturers to either absorb the costs or pass them onto consumers, potentially affecting sales and market stability.

Japan Furniture and Modular Offices Market Future Outlook

The future of the Japan furniture and modular offices market appears promising, driven by evolving consumer preferences and technological advancements. As urbanization continues to rise, the demand for space-efficient and multifunctional furniture will likely increase. Additionally, the growing emphasis on sustainability will push manufacturers to innovate eco-friendly products. Companies that adapt to these trends and invest in smart technology will be well-positioned to capture market share and meet the needs of a diverse consumer base in the coming years.

Market Opportunities

- Expansion of Co-Working Spaces:The co-working space sector is projected to grow by 25% annually, creating opportunities for furniture manufacturers to supply tailored solutions. With over 1,200 co-working spaces in Japan, the demand for modular and flexible furniture is expected to rise, allowing companies to cater to diverse workspace needs and enhance user experience.

- Increasing Focus on Sustainable Furniture:The shift towards sustainability is creating a market for eco-friendly furniture, with sales expected to reach ¥150 billion in future. As consumers become more environmentally conscious, manufacturers that prioritize sustainable materials and practices will attract a growing segment of the market, enhancing brand loyalty and competitive advantage.