Region:Africa

Author(s):Rebecca

Product Code:KRAA6089

Pages:85

Published On:September 2025

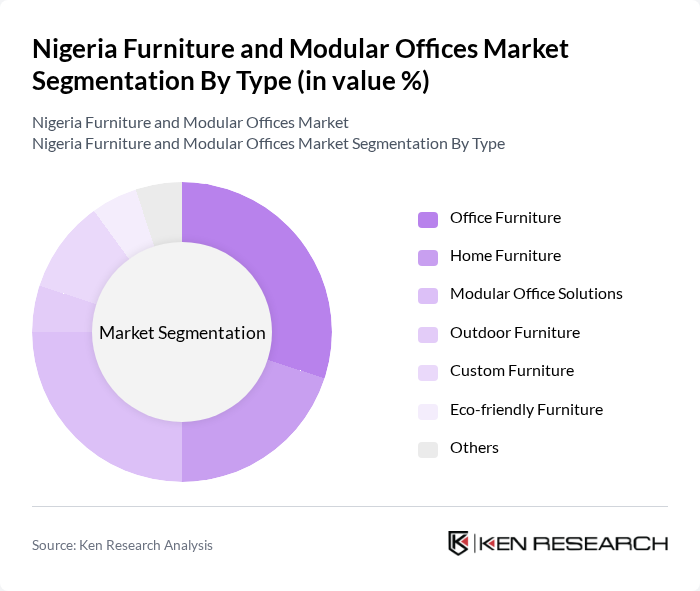

By Type:The market is segmented into various types, including Office Furniture, Home Furniture, Modular Office Solutions, Outdoor Furniture, Custom Furniture, Eco-friendly Furniture, and Others. Among these, Office Furniture and Modular Office Solutions are particularly significant due to the increasing demand for functional and adaptable workspaces. The trend towards remote and flexible working arrangements has further accelerated the adoption of modular solutions, which can be easily reconfigured to meet changing needs.

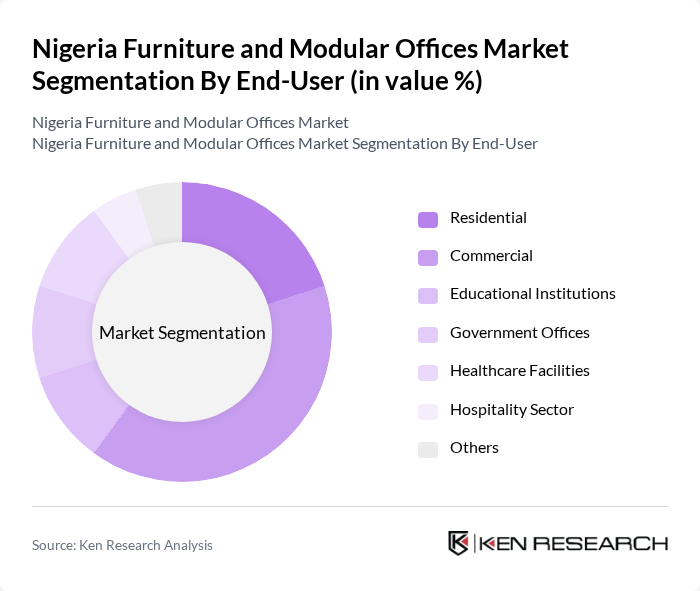

By End-User:The end-user segmentation includes Residential, Commercial, Educational Institutions, Government Offices, Healthcare Facilities, Hospitality Sector, and Others. The Commercial sector is the leading segment, driven by the rapid growth of businesses and the need for modern office environments. The increasing focus on employee well-being and productivity has led to a surge in demand for ergonomic and aesthetically pleasing office furniture.

The Nigeria Furniture and Modular Offices Market is characterized by a dynamic mix of regional and international players. Leading participants such as IKEA Nigeria, Mabeo Furniture, Aso Rock Furniture, Tetra Furniture, Office Furniture Nigeria, Dufil Prima Foods, Green Furniture, Konga Furniture, Jumia Furniture, A & A Furniture, Royal Furniture, Zenith Furniture, FURNITURE 360, Dura Furniture, Eko Furniture contribute to innovation, geographic expansion, and service delivery in this space.

The Nigeria furniture and modular offices market is poised for significant transformation as urbanization accelerates and consumer preferences evolve. With a growing emphasis on sustainability, manufacturers are likely to adopt eco-friendly materials and practices. Additionally, the rise of e-commerce platforms will facilitate easier access to furniture products, enhancing market reach. As local manufacturing capabilities improve, the market is expected to witness increased competition, driving innovation and quality in furniture design and production.

| Segment | Sub-Segments |

|---|---|

| By Type | Office Furniture Home Furniture Modular Office Solutions Outdoor Furniture Custom Furniture Eco-friendly Furniture Others |

| By End-User | Residential Commercial Educational Institutions Government Offices Healthcare Facilities Hospitality Sector Others |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales Showrooms Others |

| By Price Range | Budget Mid-range Premium Luxury Others |

| By Material | Wood Metal Plastic Fabric Composite Materials Others |

| By Design Style | Modern Traditional Contemporary Minimalist Industrial Others |

| By Application | Office Spaces Residential Spaces Public Spaces Retail Spaces Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Furniture Market | 150 | Homeowners, Interior Designers |

| Modular Office Solutions | 100 | Office Managers, Facility Coordinators |

| Commercial Furniture Sector | 80 | Business Owners, Procurement Managers |

| Custom Furniture Design | 70 | Architects, Custom Furniture Makers |

| Furniture Retail Trends | 90 | Retail Managers, Sales Executives |

The Nigeria Furniture and Modular Offices Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by urbanization, a rising middle class, and increasing demand for modern office spaces.