Region:Asia

Author(s):Shubham

Product Code:KRAA1851

Pages:91

Published On:August 2025

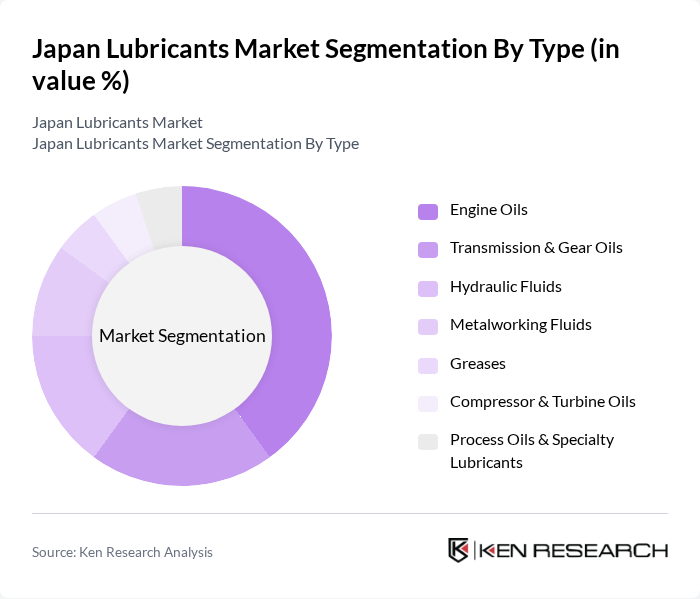

By Type:The lubricants market can be segmented into various types, including Engine Oils, Transmission & Gear Oils, Hydraulic Fluids, Metalworking Fluids, Greases, Compressor & Turbine Oils, and Process Oils & Specialty Lubricants. Among these, Engine Oils are the most significant segment, driven by the high demand from the automotive sector, where performance and efficiency are critical. The trend towards synthetic and high-mileage engine oils is also influencing consumer preferences, leading to increased market penetration.

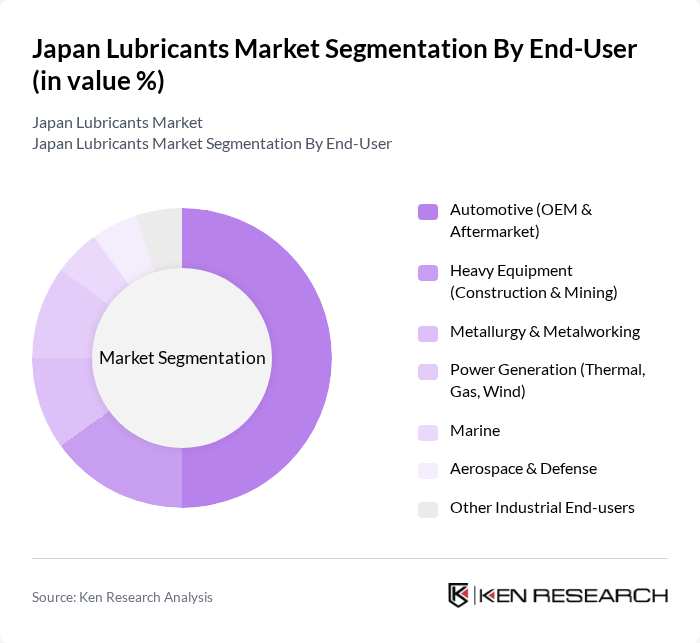

By End-User:The end-user segmentation includes Automotive (OEM & Aftermarket), Heavy Equipment (Construction & Mining), Metallurgy & Metalworking, Power Generation (Thermal, Gas, Wind), Marine, Aerospace & Defense, and Other Industrial End-users. The Automotive sector is the leading end-user, driven by the increasing vehicle production and the growing trend of vehicle maintenance and servicing, which requires high-quality lubricants to ensure optimal performance and longevity.

The Japan Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as ENEOS Corporation, Idemitsu Kosan Co., Ltd., Cosmo Energy Holdings Co., Ltd. (Cosmo Oil Lubricants), ExxonMobil Yugen Kaisha (ExxonMobil Japan), Shell Japan Ltd. (Royal Dutch Shell), BP Japan K.K. (Castrol Japan), TotalEnergies Marketing Japan K.K., FUCHS Japan Ltd. (FUCHS Petrolub SE), Chevron Japan Ltd. (Chevron Oronite/Caltex), Gulf Oil Japan (Gulf Oil International), Klüber Lubrication Japan Ltd. (Freudenberg Group), PETRONAS Lubricants Japan KK, Valvoline Japan LLC, Repsol Lubricants Japan, Nippon Grease Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Japan lubricants market is poised for significant transformation, driven by technological advancements and a shift towards sustainability. As the automotive sector increasingly embraces electric vehicles, the demand for specialized lubricants will evolve, necessitating innovative formulations. Additionally, the industrial sector's focus on energy efficiency will further propel the adoption of high-performance lubricants. Companies that invest in research and development to create eco-friendly products will likely gain a competitive edge, positioning themselves favorably in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Engine Oils Transmission & Gear Oils Hydraulic Fluids Metalworking Fluids Greases Compressor & Turbine Oils Process Oils & Specialty Lubricants |

| By End-User | Automotive (OEM & Aftermarket) Heavy Equipment (Construction & Mining) Metallurgy & Metalworking Power Generation (Thermal, Gas, Wind) Marine Aerospace & Defense Other Industrial End-users |

| By Application | Passenger Vehicle Lubrication Commercial Vehicle & Off-Highway Equipment Industrial Machinery & Metal Cutting/Forming Powertrain & Hydraulic Systems Marine Engines & Auxiliary Systems Others |

| By Distribution Channel | Direct to OEM/Industrial Accounts Authorized Distributors/Dealers Retail Outlets (Service Stations, Workshops) Online Channels Others |

| By Packaging Type | Bulk (IBC, Tanker) Drums Pails Bottles (Consumer Packs) Cartridges & Specialty Packs |

| By Price Range | Economy Mid-Range Premium/Synthetic Others |

| By Base Oil | Mineral Semi-Synthetic Full Synthetic Bio-based |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Lubricants | 150 | Fleet Managers, Automotive Service Center Owners |

| Industrial Lubricants | 120 | Plant Managers, Maintenance Supervisors |

| Marine Lubricants | 80 | Marine Engineers, Ship Maintenance Managers |

| Specialty Lubricants | 70 | R&D Managers, Product Development Engineers |

| Retail Lubricants | 90 | Retail Store Managers, Supply Chain Coordinators |

The Japan Lubricants Market is valued at approximately USD 5.4 billion, reflecting a robust demand for high-performance lubricants in automotive and industrial applications, driven by sustainability and energy efficiency trends.