US Lubricants Market Overview

- The US Lubricants Market is valued at approximately USD 22.9 billion, based on a five-year analysis. This growth is primarily driven by the increasing demand for automotive and industrial lubricants, as well as advancements in lubricant formulations that enhance performance and efficiency. The market is further supported by heightened awareness of the importance of lubrication in machinery maintenance and the expanding automotive sector. Notably, the rise in electric and hybrid vehicles is prompting innovation in specialized lubricants for gearboxes and drivetrains, while industrial demand remains robust due to ongoing manufacturing and infrastructure activities .

- Key players in this market are concentrated in major cities such as Houston, Los Angeles, and Chicago, which dominate due to their robust industrial bases and significant automotive manufacturing presence. The presence of leading lubricant manufacturers and distributors in these regions further strengthens their market position, facilitating easier access to consumers and businesses .

- The Clean Air Act, administered by the US Environmental Protection Agency (EPA), sets national standards for air quality and emissions from vehicles and industrial equipment. Under the Clean Air Act (42 U.S.C. §7401 et seq., as amended), the EPA has implemented increasingly stringent emissions standards, which encourage the use of high-performance lubricants that reduce emissions and improve fuel efficiency. These regulatory requirements drive innovation and growth in the lubricants market by promoting the adoption of advanced, environmentally friendly lubricant formulations .

US Lubricants Market Segmentation

By Product Type:The product type segmentation of the lubricants market includes categories such as engine oils, hydraulic oils, gear oils, greases, metalworking fluids, compressor oils, circulation fluids, wind turbine oils, gas turbine oils, heat transfer oils, rust preventive oils, and others. Among these, engine oils remain the most dominant segment, driven by the large and aging vehicle fleet, increasing vehicle miles traveled, and the growing trend toward high-performance and synthetic engine oils. The rise of electric vehicles is also creating demand for new lubricant formulations, particularly for e-transmission fluids and thermal management .

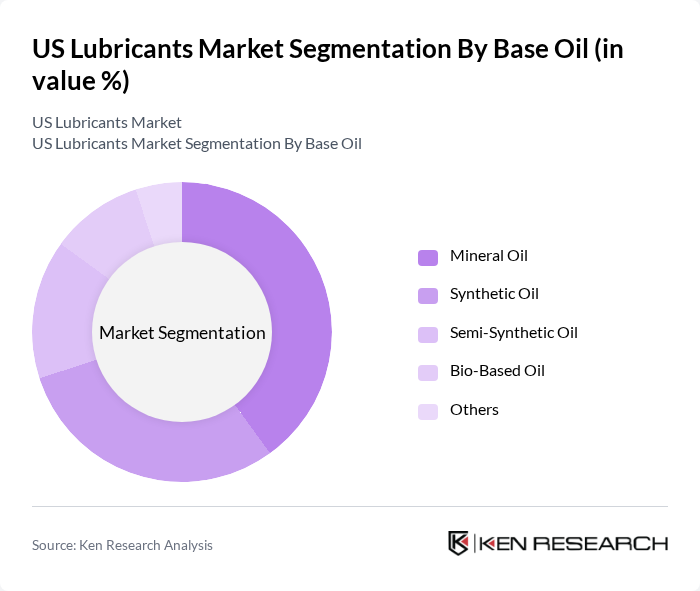

By Base Oil:The base oil segmentation includes mineral oil, synthetic oil, semi-synthetic oil, bio-based oil, and others. Synthetic oils are gaining traction due to their superior performance characteristics, such as better thermal stability, lower volatility, and extended drain intervals. This segment is particularly favored in high-performance and heavy-duty applications, as well as in electric and hybrid vehicles, where advanced lubricants are required for optimal efficiency and protection. The increasing consumer preference for synthetic and bio-based oils is driving their market share upward, supported by regulatory and sustainability trends .

US Lubricants Market Competitive Landscape

The US Lubricants Market is characterized by a dynamic mix of regional and international players. Leading participants such as ExxonMobil Corporation, Chevron Corporation, Shell USA, Inc., BP America Inc., TotalEnergies Marketing USA, Inc., Fuchs Lubricants Co., Valvoline Inc., Castrol (BP), Phillips 66 Company, Lukoil Lubricants Company, Motul USA Inc., AMSOIL Inc., Chevron Oronite Company LLC, Klüber Lubrication NA LP, Idemitsu Lubricants America Corporation contribute to innovation, geographic expansion, and service delivery in this space.

US Lubricants Market Industry Analysis

Growth Drivers

- Increasing Demand from Automotive Sector:The automotive sector is a significant driver of lubricant demand, with over 280 million registered vehicles in the U.S. as of now. The American Automobile Association (AAA) reported that vehicle miles traveled reached over 3.2 trillion, indicating a robust need for high-performance lubricants. This trend is expected to continue, as the automotive industry anticipates producing approximately 15 million light vehicles in future, further boosting lubricant consumption.

- Technological Advancements in Lubricant Formulations:Innovations in lubricant formulations are enhancing performance and efficiency. The U.S. lubricant market saw a notable increase in the adoption of synthetic lubricants, with synthetic lubricants accounting for approximately 25% of total lubricant demand, driven by advancements in chemical engineering. According to the American Petroleum Institute, these formulations can improve fuel economy by up to 2%, which is crucial as the U.S. aims for a 40% reduction in greenhouse gas emissions in future, promoting further adoption of advanced lubricants.

- Rising Industrial Activities:The U.S. industrial sector is projected to grow by approximately 3.5% in future, leading to increased lubricant demand across manufacturing and construction. The U.S. Bureau of Economic Analysis reported that industrial production rose by approximately 4.2%, indicating a strong recovery post-pandemic. This growth is expected to drive the need for high-quality lubricants, particularly in machinery and equipment, which are essential for maintaining operational efficiency and reducing downtime.

Market Challenges

- Volatility in Raw Material Prices:The lubricant industry faces significant challenges due to fluctuating raw material prices. In recent periods, crude oil prices averaged around $80 per barrel, impacting the cost of base oils, which constitute approximately 70% of lubricant formulations. The U.S. Energy Information Administration forecasts that crude oil prices may rise to $85 per barrel in future, further straining profit margins for lubricant manufacturers and potentially leading to higher retail prices for consumers.

- Competition from Alternative Products:The rise of alternative products, such as bio-lubricants and plant-based oils, poses a challenge to traditional lubricants. The U.S. bio-lubricant market is projected to grow by approximately 8% annually, driven by increasing consumer awareness and demand for sustainable products. This shift could lead to a decline in market share for conventional lubricants, compelling manufacturers to innovate and adapt to changing consumer preferences to remain competitive.

US Lubricants Market Future Outlook

The U.S. lubricants market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The shift towards electric vehicles is expected to reshape lubricant formulations, as these vehicles require specialized products. Additionally, the increasing focus on sustainability will likely accelerate the development of biodegradable lubricants. As e-commerce platforms expand, they will provide new distribution channels, enhancing market accessibility and driving growth in the lubricant sector.

Market Opportunities

- Growth in Electric Vehicle Market:The electric vehicle market is projected to reach 7 million units sold in the U.S. by future, creating opportunities for specialized lubricants. These vehicles require unique formulations that enhance performance and efficiency, presenting a lucrative market segment for lubricant manufacturers to explore and innovate.

- Development of Biodegradable Lubricants:The demand for eco-friendly products is rising, with the biodegradable lubricant market expected to grow by approximately 10% annually. This trend presents an opportunity for manufacturers to invest in research and development of sustainable lubricants, catering to environmentally conscious consumers and aligning with regulatory pressures for greener products.