Region:Asia

Author(s):Dev

Product Code:KRAA1618

Pages:98

Published On:August 2025

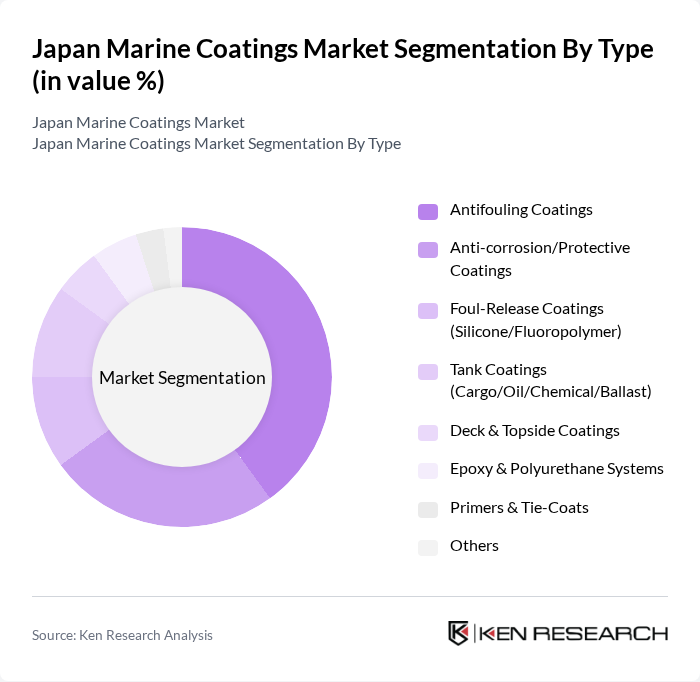

By Type:The market is segmented into various types of coatings, each serving specific functions and applications. The primary subsegments include Antifouling Coatings, Anti-corrosion/Protective Coatings, Foul-Release Coatings (Silicone/Fluoropolymer), Tank Coatings (Cargo/Oil/Chemical/Ballast), Deck & Topside Coatings, Epoxy & Polyurethane Systems, Primers & Tie-Coats, and Others. Among these, Antifouling Coatings are particularly dominant due to their essential role in preventing marine growth on vessels, which enhances fuel efficiency and reduces maintenance costs .

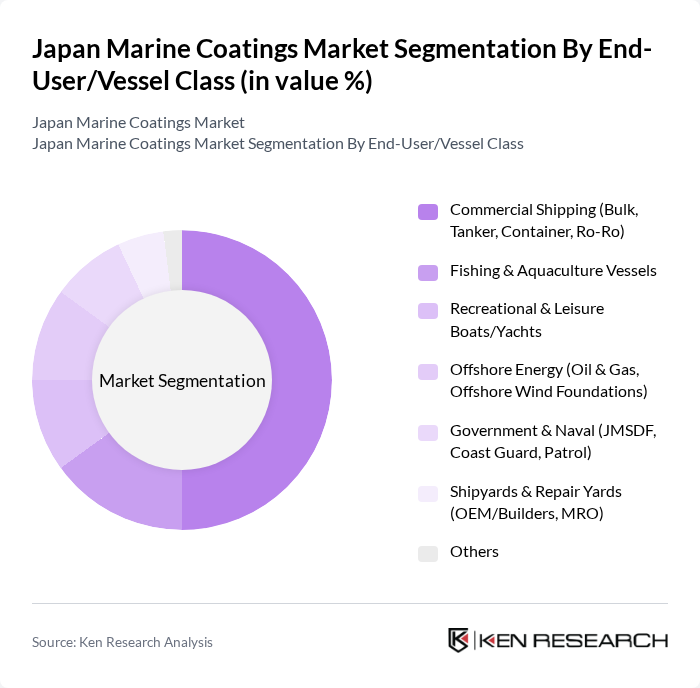

By End-User/Vessel Class:The market is further segmented by end-user or vessel class, which includes Commercial Shipping (Bulk, Tanker, Container, Ro-Ro), Fishing & Aquaculture Vessels, Recreational & Leisure Boats/Yachts, Offshore Energy (Oil & Gas, Offshore Wind Foundations), Government & Naval (JMSDF, Coast Guard, Patrol), Shipyards & Repair Yards (OEM/Builders, MRO), and Others. The Commercial Shipping segment is the largest due to the high volume of trade and the need for regular maintenance of large vessels; antifouling and hull protection demand is sustained by frequent dry-dock cycles and biofouling control requirements in merchant fleets .

The Japan Marine Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Paint Marine Coatings Co., Ltd., Chugoku Marine Paints, Ltd. (CMP), Jotun Japan Ltd., Hempel Japan K.K., PPG Industries, Inc. (PPG Marine Coatings), AkzoNobel N.V. (International Paint Ltd.), Kansai Paint Co., Ltd. (Kansai Helios/Marine), The Sherwin-Williams Company, KCC Corporation, BASF SE (Marine Solutions/Resins), JCU Corporation (Electroplating/Marine Surface Solutions), Daishin Chemical Co., Ltd. (Marine Paints), Taiho Paint & Chemical Co., Ltd., Chiyoda Paint Co., Ltd., RPM International Inc. (Carboline) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan marine coatings market appears promising, driven by technological advancements and a strong focus on sustainability. As the industry adapts to stringent regulations, manufacturers are likely to invest in innovative, eco-friendly products that meet market demands. Additionally, the increasing integration of digital technologies in coating applications will enhance operational efficiency and product performance. This evolving landscape presents opportunities for growth and expansion, particularly in emerging markets and through strategic partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Antifouling Coatings Anti-corrosion/Protective Coatings Foul-Release Coatings (Silicone/Fluoropolymer) Tank Coatings (Cargo/Oil/Chemical/Ballast) Deck & Topside Coatings Epoxy & Polyurethane Systems Primers & Tie-Coats Others |

| By End-User/Vessel Class | Commercial Shipping (Bulk, Tanker, Container, Ro-Ro) Fishing & Aquaculture Vessels Recreational & Leisure Boats/Yachts Offshore Energy (Oil & Gas, Offshore Wind Foundations) Government & Naval (JMSDF, Coast Guard, Patrol) Shipyards & Repair Yards (OEM/Builders, MRO) Others |

| By Application Area | Newbuilding (Hull, Topsides, Tanks) Dry-docking Maintenance & Repair In-service Maintenance (Afloat/Spot Repairs) Retrofit/Conversion (Scrubber, BWTS, LNG) Others |

| By Technology/Formulation | Water-Borne (Low/Zero VOC) Solvent-Borne (High-Solid, Solvented) Powder Coatings (Select Components) UV/LED-Curable & Rapid-Cure Systems Others |

| By Region (Japan) | Kanto (Tokyo/Yokohama) Kansai (Osaka/Kobe) Chubu (Nagoya) Kyushu (Nagasaki/Kitakyushu) Hokkaido/Tohoku Chugoku/Shikoku Okinawa Others |

| By Price Range | Economy Mid-Range Premium |

| By Application Method | Airless Spray Conventional Spray Brush Roller Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Vessel Coatings | 120 | Shipyard Managers, Procurement Officers |

| Recreational Boat Coatings | 80 | Boat Manufacturers, Retailers |

| Marine Coatings for Offshore Structures | 60 | Project Managers, Marine Engineers |

| Anti-fouling Coatings | 90 | Environmental Compliance Officers, Coating Technicians |

| Protective Coatings for Marine Equipment | 50 | Maintenance Managers, Equipment Suppliers |

The Japan Marine Coatings Market is valued at approximately USD 360 million, based on a five-year historical analysis. This figure aligns with estimates from various industry sources, reflecting the market's scale within Japan's maritime supply chain and ship repair base.