Region:Global

Author(s):Rebecca

Product Code:KRAA2905

Pages:93

Published On:August 2025

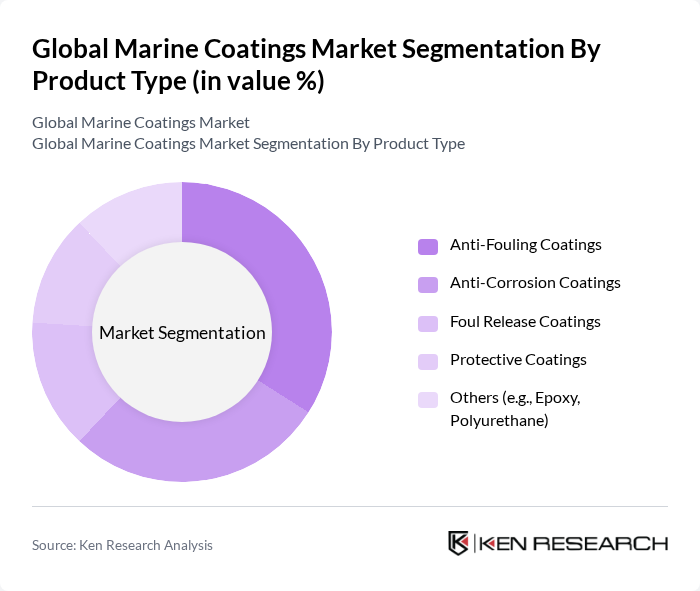

By Product Type:The marine coatings market is segmented into various product types, including Anti-Fouling Coatings, Anti-Corrosion Coatings, Foul Release Coatings, Protective Coatings, and Others (e.g., Epoxy, Polyurethane). Among these, Anti-Fouling Coatings are leading the market due to their essential role in preventing marine organisms from adhering to ship hulls, thereby enhancing fuel efficiency and reducing maintenance costs. The increasing focus on environmental regulations has also driven the demand for eco-friendly anti-fouling solutions.

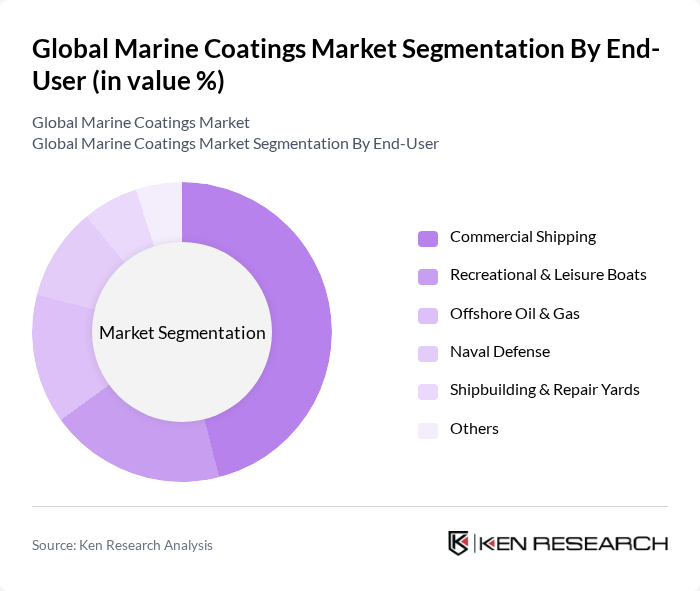

By End-User:The marine coatings market is categorized by end-users, including Commercial Shipping, Recreational & Leisure Boats, Offshore Oil & Gas, Naval Defense, Shipbuilding & Repair Yards, and Others. The Commercial Shipping segment dominates the market, driven by the increasing global trade and the need for efficient shipping solutions. The demand for durable and high-performance coatings in commercial vessels is essential for maintaining operational efficiency and compliance with environmental regulations.

The Global Marine Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as AkzoNobel N.V., PPG Industries, Inc., Hempel A/S, Jotun A/S, BASF SE, The Sherwin-Williams Company, RPM International Inc., Chugoku Marine Paints, Ltd., Nippon Paint Marine Coatings Co., Ltd., KCC Corporation, Sika AG, Axalta Coating Systems Ltd., Kansai Paint Co., Ltd., 3M Company, Tikkurila Oyj contribute to innovation, geographic expansion, and service delivery in this space.

The future of the marine coatings market appears promising, driven by ongoing technological advancements and a growing emphasis on sustainability. As the industry adapts to stringent regulations, manufacturers are likely to invest in innovative solutions that enhance performance while minimizing environmental impact. Additionally, the expansion of the shipping industry in emerging markets will create new opportunities for growth, particularly in regions with increasing maritime activities and infrastructure development.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Anti-Fouling Coatings Anti-Corrosion Coatings Foul Release Coatings Protective Coatings Others (e.g., Epoxy, Polyurethane) |

| By End-User | Commercial Shipping Recreational & Leisure Boats Offshore Oil & Gas Naval Defense Shipbuilding & Repair Yards Others |

| By Application | Cargo Ships Tankers Fishing Vessels Yachts Offshore Platforms Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Outlets Others |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| By Price Range | Economy Mid-Range Premium |

| By Technology | Waterborne Coatings Solvent-borne Coatings Powder Coatings UV-Cured Coatings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Shipbuilding Sector | 60 | Project Managers, Procurement Officers |

| Marine Repair and Maintenance | 50 | Maintenance Supervisors, Technical Directors |

| Coatings Distribution Channels | 40 | Sales Managers, Distribution Coordinators |

| Regulatory Compliance in Coatings | 45 | Compliance Officers, Environmental Managers |

| End-user Feedback on Coating Performance | 55 | Marine Engineers, Fleet Managers |

The Global Marine Coatings Market is valued at approximately USD 4.1 billion, driven by the increasing demand for protective coatings in the marine industry, particularly for corrosion resistance and anti-fouling solutions.