Region:Asia

Author(s):Dev

Product Code:KRAA1679

Pages:96

Published On:August 2025

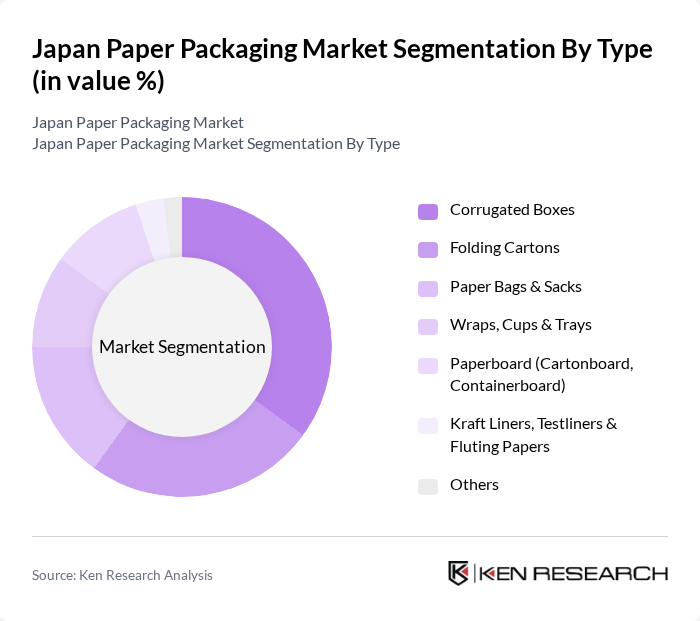

By Type:The market is segmented into various types of paper packaging, including Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Wraps, Cups & Trays, Paperboard (Cartonboard, Containerboard), Kraft Liners, Testliners & Fluting Papers, and Others. Each type serves distinct purposes across different industries, catering to the diverse needs of consumers and businesses.

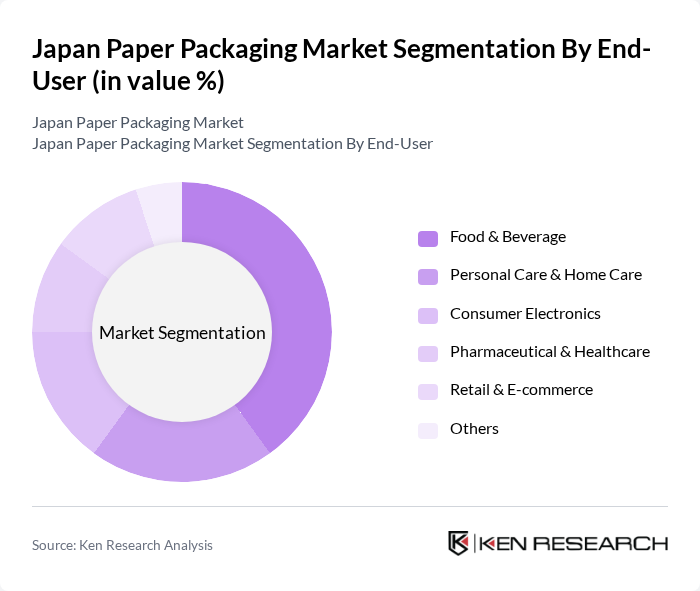

By End-User:The end-user segmentation includes Food & Beverage, Personal Care & Home Care, Consumer Electronics, Pharmaceutical & Healthcare, Retail & E-commerce, and Others. Each sector has unique packaging requirements, influencing the demand for specific types of paper packaging.

The Japan Paper Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, Daio Paper Corporation, Rengo Co., Ltd., Toyo Seikan Group Holdings, Ltd., Seiko PMC Corporation, Kokusai Pulp & Paper Co., Ltd., Sumitomo Forestry Co., Ltd., Hokuetsu Corporation, Mitsubishi Paper Mills Limited, Oji Nepia Co., Ltd., Marubeni Pulp & Paper Co., Ltd., Toppan Inc., FP Corporation (FPCO), Sato Holdings Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan paper packaging market appears promising, driven by increasing consumer awareness and regulatory support for sustainable practices. As e-commerce continues to expand, the demand for innovative and eco-friendly packaging solutions will likely rise. Companies are expected to invest in advanced technologies to enhance product functionality and sustainability. Additionally, collaboration with e-commerce platforms will be crucial in developing tailored packaging solutions that meet consumer expectations while adhering to environmental standards.

| Segment | Sub-Segments |

|---|---|

| By Type | Corrugated Boxes Folding Cartons Paper Bags & Sacks Wraps, Cups & Trays Paperboard (Cartonboard, Containerboard) Kraft Liners, Testliners & Fluting Papers Others |

| By End-User | Food & Beverage Personal Care & Home Care Consumer Electronics Pharmaceutical & Healthcare Retail & E-commerce Others |

| By Application | Retail Packaging Industrial/B2B Transit Packaging E-commerce Shipping & Fulfillment Foodservice & QSR Packaging Luxury & Premium Packaging Others |

| By Distribution Channel | Direct (Mill/Converter to Brand) Online B2B Portals Distributors Wholesalers Others |

| By Material Type | Recycled Paper Virgin Paper Kraft Paper Coated & Barrier-coated Paper Uncoated Paper Others |

| By Price Range | Economy Mid-range Premium |

| By Sustainability Level | Fully Recyclable/Compostable Recycled Content (?50%) FSC/PEFC Certified Plastic-reduction/Plastic-free Designs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 140 | Packaging Managers, Quality Assurance Officers |

| Consumer Electronics Packaging | 100 | Product Managers, Supply Chain Coordinators |

| Retail Packaging Solutions | 80 | Marketing Directors, Procurement Specialists |

| Sustainable Packaging Initiatives | 70 | Sustainability Managers, R&D Directors |

| Logistics and Distribution Packaging | 90 | Logistics Managers, Operations Supervisors |

The Japan Paper Packaging Market is valued at approximately USD 18.9 billion, reflecting a significant growth trend driven by the increasing demand for sustainable packaging solutions and the rise of e-commerce and food delivery services.