Region:Asia

Author(s):Rebecca

Product Code:KRAC8400

Pages:80

Published On:November 2025

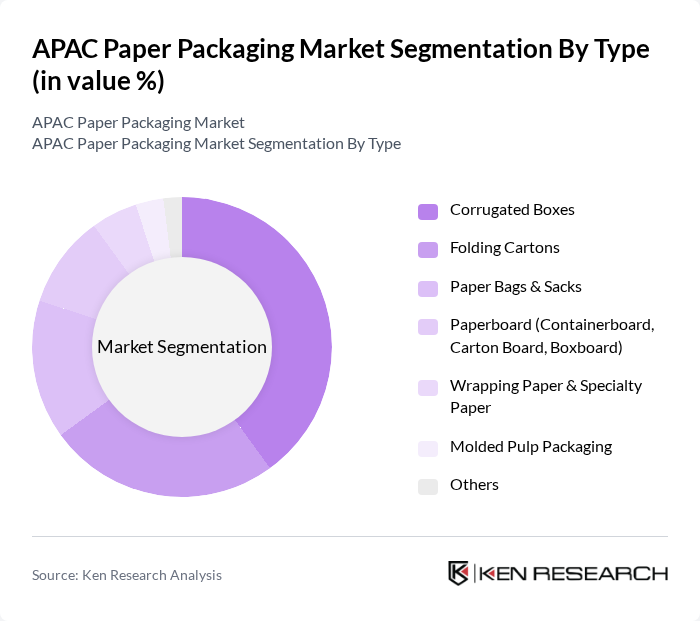

By Type:The paper packaging market is segmented into Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Paperboard (Containerboard, Carton Board, Boxboard), Wrapping Paper & Specialty Paper, Molded Pulp Packaging, and Others. Among these, corrugated boxes are the most dominant due to their versatility, strength, and cost-effectiveness, making them ideal for shipping and storage across various industries. Containerboard, which is the base material for corrugated boxes, holds the highest revenue share in the region, reflecting the strong demand from e-commerce and retail sectors .

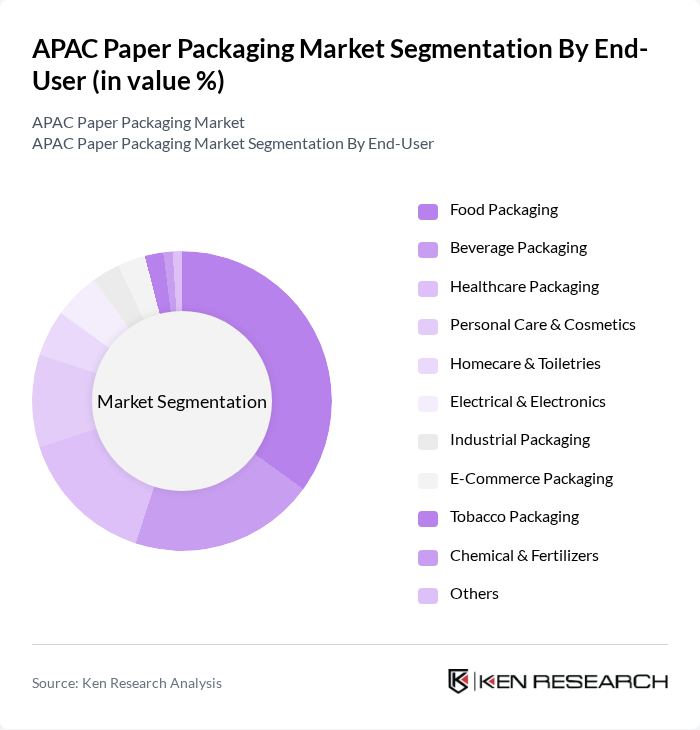

By End-User:The end-user segmentation includes Food Packaging, Beverage Packaging, Healthcare Packaging, Personal Care & Cosmetics, Homecare & Toiletries, Electrical & Electronics, Industrial Packaging, E-Commerce Packaging, Tobacco Packaging, Chemical & Fertilizers, and Others. The food packaging segment is the largest due to the increasing demand for packaged food products and the need for safe and hygienic packaging solutions. The beverage, healthcare, and personal care sectors are also significant contributors, supported by rising consumer health awareness and premiumization trends .

The APAC Paper Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Oji Holdings Corporation, Nippon Paper Industries Co., Ltd., Nine Dragons Paper (Holdings) Limited, Lee & Man Paper Manufacturing Ltd., Rengo Co., Ltd., Shandong Chenming Paper Holdings Ltd., International Paper Company, WestRock Company, Smurfit Kappa Group, Mondi Group, DS Smith Plc, Stora Enso, Sappi Limited, Huhtamaki Group, SCG Packaging Public Company Limited, YFY Inc., Zhejiang Jingxing Paper Joint Stock Co., Ltd., PT. Indah Kiat Pulp & Paper Tbk (APP Group), Klabin S.A., UPM-Kymmene Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC paper packaging market is poised for transformative growth, driven by increasing consumer demand for sustainable solutions and the expansion of e-commerce. Innovations in biodegradable materials and smart packaging technologies are expected to reshape the industry landscape. Additionally, regulatory pressures will likely accelerate the shift towards eco-friendly practices, compelling manufacturers to invest in sustainable production methods. As companies adapt to these trends, the market will witness enhanced collaboration with e-commerce platforms, further solidifying the role of paper packaging in the region's retail ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Corrugated Boxes Folding Cartons Paper Bags & Sacks Paperboard (Containerboard, Carton Board, Boxboard) Wrapping Paper & Specialty Paper Molded Pulp Packaging Others |

| By End-User | Food Packaging Beverage Packaging Healthcare Packaging Personal Care & Cosmetics Homecare & Toiletries Electrical & Electronics Industrial Packaging E-Commerce Packaging Tobacco Packaging Chemical & Fertilizers Others |

| By Region | China Japan South Korea India Australia Southeast Asia Rest of APAC |

| By Application | Retail Packaging Industrial Packaging Institutional Packaging Others |

| By Material Type | Recycled Paper Virgin Paper Kraft Paper Specialty Paper Others |

| By Printing Technology | Flexographic Printing Digital Printing Lithographic Printing Gravure Printing Others |

| By Design Type | Custom Designs Standard Designs Others |

| By Level of Packaging | Primary Packaging Secondary Packaging Tertiary Packaging |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food & Beverage Packaging | 100 | Packaging Managers, Quality Assurance Leads |

| Consumer Goods Packaging | 80 | Product Development Managers, Marketing Directors |

| Pharmaceutical Packaging | 60 | Regulatory Affairs Specialists, Production Managers |

| Sustainable Packaging Initiatives | 50 | Sustainability Managers, R&D Directors |

| Retail Packaging Solutions | 70 | Supply Chain Managers, Operations Directors |

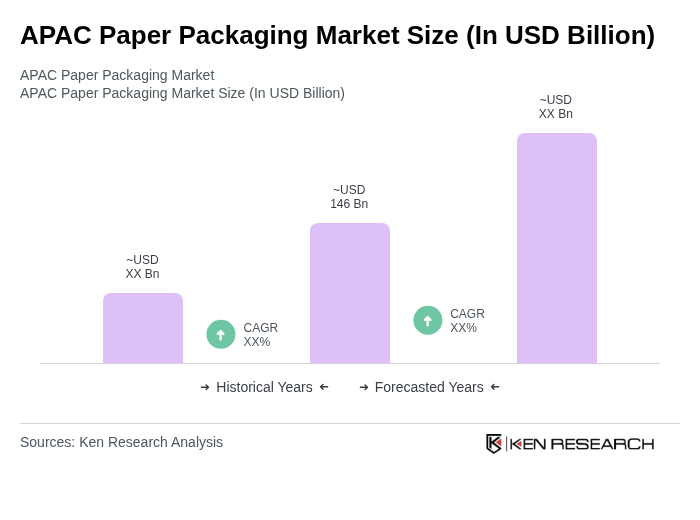

The APAC Paper Packaging Market is valued at approximately USD 146 billion, driven by the demand for sustainable packaging solutions, e-commerce growth, and the food and beverage sector's expansion. This market is expected to continue growing due to increasing consumer awareness and regulatory support.