Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9211

Pages:86

Published On:November 2025

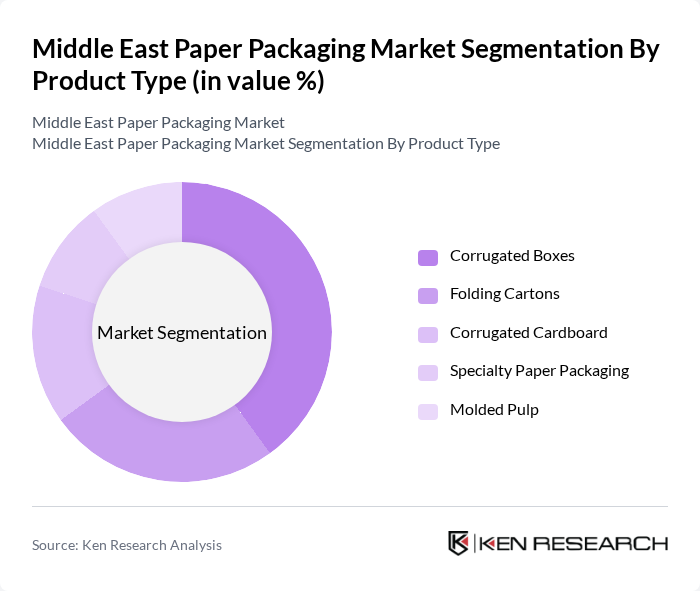

By Product Type:The product type segmentation includes various forms of paper packaging, each catering to different market needs. The subsegments are Corrugated Boxes, Folding Cartons, Corrugated Cardboard, Specialty Paper Packaging, and Molded Pulp. Among these, Corrugated Boxes are the most dominant due to their versatility, strength, and cost-effectiveness, making them ideal for shipping and storage across various industries. The dominance of corrugated packaging is reinforced by its widespread use in food, beverage, and e-commerce logistics .

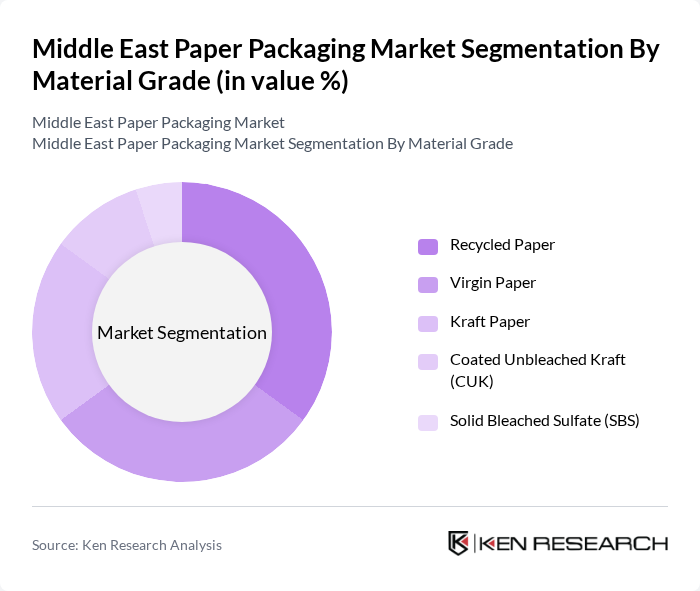

By Material Grade:The material grade segmentation encompasses Recycled Paper, Virgin Paper, Kraft Paper, Coated Unbleached Kraft (CUK), and Solid Bleached Sulfate (SBS). Recycled Paper is leading this segment due to the increasing emphasis on sustainability and the circular economy, as consumers and businesses alike are prioritizing eco-friendly materials in their packaging solutions. The adoption of recycled and renewable materials is further supported by regulatory initiatives and corporate sustainability commitments .

The Middle East Paper Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Paper Company, Mondi Group, Smurfit Kappa Group, WestRock Company, DS Smith Plc, Stora Enso, Sappi Limited, UPM-Kymmene Oyj, Nippon Paper Industries Co., Ltd., Oji Holdings Corporation, Georgia-Pacific LLC, Sonoco Products Company, Klabin S.A., Huhtamaki Oyj, Sealed Air Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East paper packaging market appears promising, driven by technological advancements and a strong focus on sustainability. As companies increasingly adopt digital printing technologies and smart packaging solutions, the market is expected to evolve rapidly. Additionally, the emphasis on circular economy practices will likely lead to innovative recycling initiatives, enhancing the overall sustainability of the packaging industry. These trends will create a dynamic environment for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Corrugated Boxes Folding Cartons Corrugated Cardboard Specialty Paper Packaging Molded Pulp |

| By Material Grade | Recycled Paper Virgin Paper Kraft Paper Coated Unbleached Kraft (CUK) Solid Bleached Sulfate (SBS) |

| By End-Use Application | Food and Beverage Healthcare and Pharmaceuticals Personal Care and Cosmetics Electronics and Electrical E-Commerce and Retail Industrial Packaging |

| By Packaging Level | Primary Packaging Secondary Packaging Tertiary Packaging |

| By Geography | Saudi Arabia United Arab Emirates (UAE) Turkey GCC Countries (Kuwait, Qatar, Bahrain, Oman) Israel Rest of Middle East |

| By Sustainability Level | Eco-Friendly and Sustainable Packaging Conventional Packaging Biodegradable and Compostable Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 120 | Packaging Managers, Product Development Managers |

| Cosmetics and Personal Care Packaging | 90 | Brand Managers, Supply Chain Managers |

| Electronics Packaging Solutions | 60 | Logistics Managers, Quality Assurance Managers |

| Retail Packaging Trends | 70 | Retail Operations Managers, Marketing Managers |

| Sustainable Packaging Initiatives | 50 | Sustainability Managers, Corporate Social Responsibility Managers |

The Middle East Paper Packaging Market is valued at approximately USD 3.9 billion, reflecting a significant growth trend driven by the demand for sustainable packaging solutions and the expansion of e-commerce in the region.