Region:Asia

Author(s):Rebecca

Product Code:KRAA5106

Pages:97

Published On:September 2025

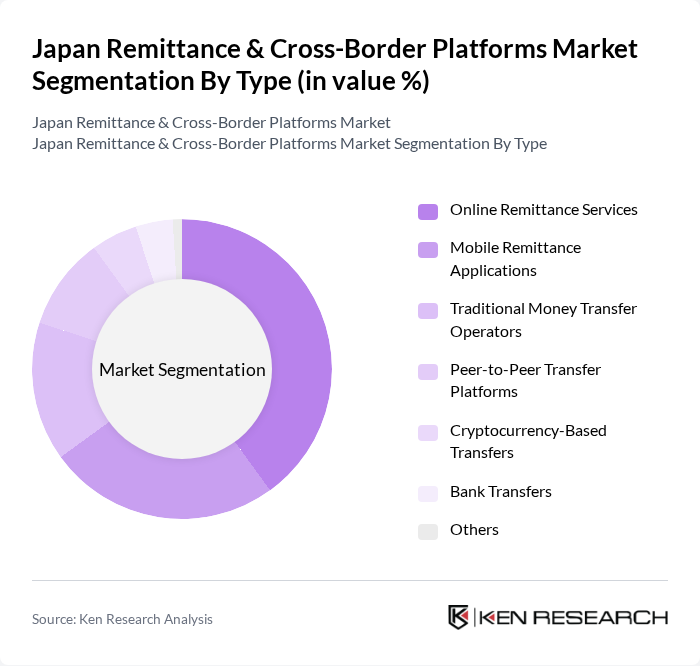

By Type:

The market is segmented into various types, including Online Remittance Services, Mobile Remittance Applications, Traditional Money Transfer Operators, Peer-to-Peer Transfer Platforms, Cryptocurrency-Based Transfers, Bank Transfers, and Others. Among these, Online Remittance Services dominate the market due to their convenience and accessibility. Consumers increasingly prefer digital platforms for their remittance needs, driven by the ease of use and lower transaction costs. Mobile Remittance Applications are also gaining traction, particularly among younger demographics who favor mobile banking solutions.

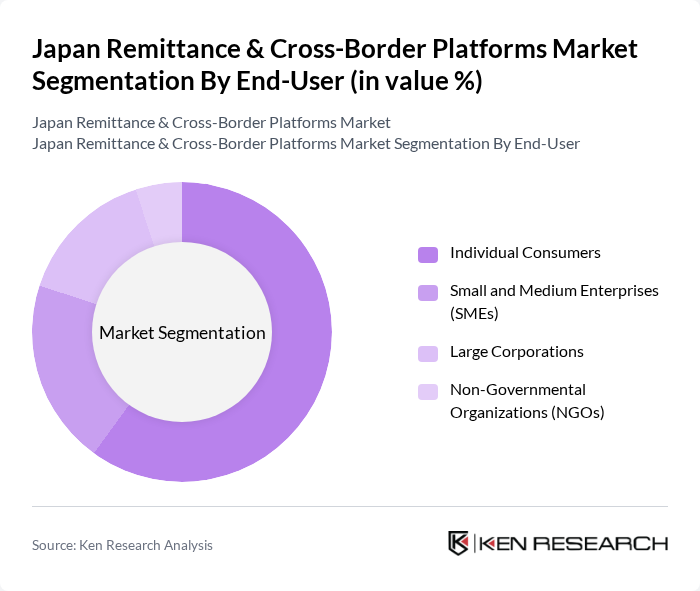

By End-User:

The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Individual Consumers represent the largest segment, as they frequently send remittances to family and friends abroad. The growing trend of globalization and the increasing number of international students and workers contribute to the high demand for remittance services among individual users. SMEs are also significant players, utilizing remittance services for cross-border transactions and payments.

The Japan Remittance & Cross-Border Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as MoneyGram International, Inc., Western Union Company, PayPal Holdings, Inc., TransferWise Ltd., Remitly, Inc., WorldRemit Ltd., Xoom Corporation, Ria Money Transfer, SBI Remit Co., Ltd., Rakuten Remit, JCB Co., Ltd., Payoneer Inc., Alipay, LINE Pay, PayPay Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan remittance and cross-border platforms market appears promising, driven by technological advancements and evolving consumer preferences. The integration of blockchain technology is expected to enhance transaction speed and security, while the rise of fintech startups will foster innovation. Additionally, as financial literacy improves among consumers, more individuals will seek digital solutions for remittances, further expanding the market. Overall, these trends indicate a dynamic landscape with significant growth potential in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Remittance Services Mobile Remittance Applications Traditional Money Transfer Operators Peer-to-Peer Transfer Platforms Cryptocurrency-Based Transfers Bank Transfers Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Credit/Debit Cards Bank Transfers E-Wallets Cash Payments |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Customer Demographics | Age Group (18-24, 25-34, 35-44, etc.) Income Level (Low, Middle, High) Employment Status (Employed, Unemployed, Student) |

| By Geographic Reach | Domestic Transfers International Transfers Regional Transfers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Domestic Remittance Users | 150 | Individuals aged 18-65, frequent remittance senders |

| Expatriate Community Insights | 100 | Foreign nationals living in Japan, regular remittance users |

| Small Business Owners | 80 | Owners of businesses engaged in cross-border trade |

| Financial Service Providers | 70 | Executives from remittance and payment service companies |

| Regulatory Stakeholders | 50 | Policy makers and compliance officers in financial institutions |

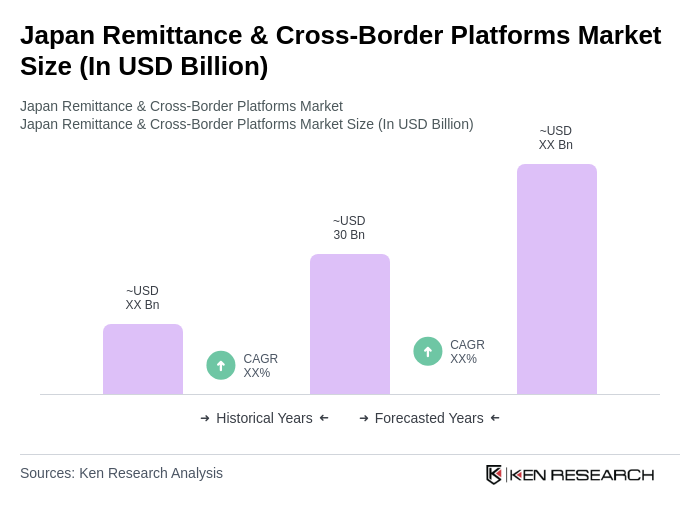

The Japan Remittance & Cross-Border Platforms Market is valued at approximately USD 30 billion, reflecting significant growth driven by the increasing number of expatriates and the rising adoption of digital payment solutions.