Region:Asia

Author(s):Dev

Product Code:KRAA0456

Pages:82

Published On:August 2025

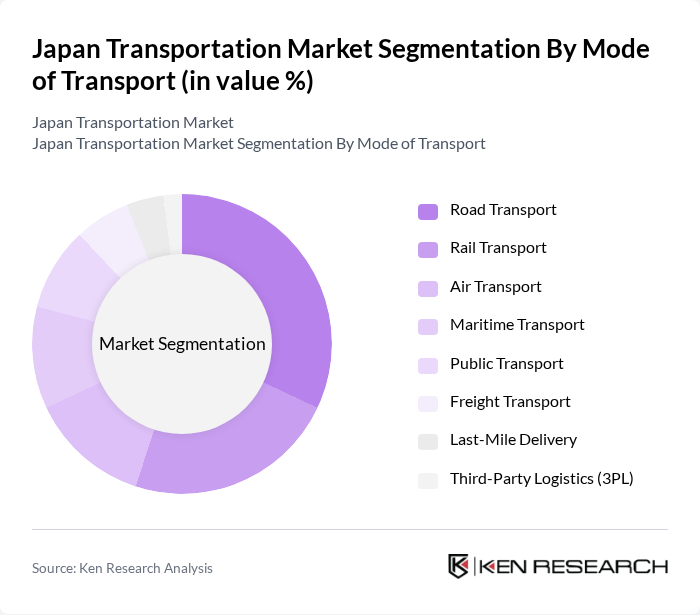

By Mode of Transport:The transportation market in Japan can be segmented into various modes, including road, rail, air, maritime, public transport, freight transport, last-mile delivery, and third-party logistics (3PL). Each mode plays a crucial role in the overall transportation ecosystem, catering to different consumer needs and preferences. Road transport is the largest segment, driven by domestic freight and last-mile delivery, followed by rail transport which is vital for both passenger and cargo movement. Air and maritime transport support international trade and logistics, while public transport remains essential for urban mobility. Third-party logistics and last-mile delivery are growing rapidly due to the rise of e-commerce and changing consumer expectations .

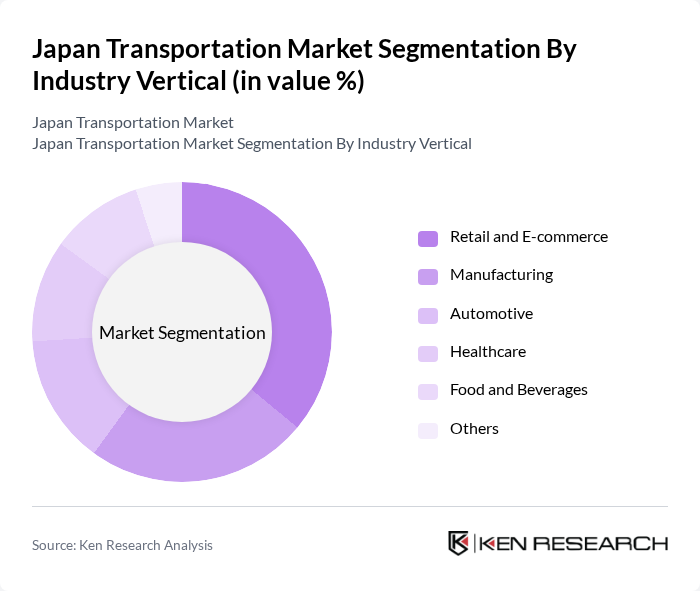

By Industry Vertical:The transportation market is also segmented by industry verticals, including retail and e-commerce, manufacturing, automotive, healthcare, food and beverages, and others. Retail and e-commerce are the leading verticals, driven by the surge in online shopping and demand for rapid delivery services. Manufacturing and automotive sectors rely heavily on efficient logistics for supply chain management, while healthcare and food and beverages require specialized transport solutions for temperature-sensitive and time-critical goods .

The Japan Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as East Japan Railway Company (JR East), West Japan Railway Company (JR West), Central Japan Railway Company (JR Central), Tokyo Metro Co., Ltd., Keikyu Corporation, Tokyu Corporation, All Nippon Airways (ANA Holdings Inc.), Japan Airlines Co., Ltd. (JAL), Nippon Express Holdings, Inc., Yamato Holdings Co., Ltd., Sagawa Express Co., Ltd., Seino Holdings Co., Ltd., Hitachi Transport System, Ltd., Japan Post Holdings Co., Ltd., Kintetsu Group Holdings Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of Japan's transportation market is poised for significant transformation, driven by technological advancements and a focus on sustainability. As urbanization continues, the demand for efficient public transport solutions will rise, prompting further government investment in infrastructure. Additionally, the integration of smart technologies and autonomous vehicles will enhance operational efficiency. The shift towards electric and sustainable transport options will also play a crucial role in shaping the market, aligning with global environmental goals and consumer preferences for greener alternatives.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Transport Rail Transport Air Transport Maritime Transport Public Transport Freight Transport Last-Mile Delivery Third-Party Logistics (3PL) |

| By Industry Vertical | Retail and E-commerce Manufacturing Automotive Healthcare Food and Beverages Others |

| By Service Type | Passenger Transport Services Freight and Logistics Services Ride-Sharing Services Delivery Services Warehousing Services Freight Forwarding Others |

| By Technology Adoption | Traditional Technologies Smart Transportation Solutions Electric Vehicles Autonomous Vehicles Hybrid Ticketing & Traffic Management Systems Others |

| By Geographic Distribution | Kanto Region Kansai Region Chubu Region Northern Japan Southern Japan Others |

| By Environmental Impact | Low-Emission Transport High-Emission Transport Sustainable Transport Solutions Others |

| By Investment Type | Public Investment Private Investment Foreign Direct Investment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Usage | 100 | Commuters, Public Transport Authorities |

| Logistics and Freight Services | 80 | Logistics Managers, Freight Forwarders |

| Last-Mile Delivery Solutions | 60 | Delivery Service Providers, E-commerce Managers |

| Rail Transportation Insights | 50 | Railway Operators, Infrastructure Planners |

| Maritime Transport Trends | 40 | Shipping Company Executives, Port Authorities |

The Japan Transportation Market is valued at approximately USD 133 billion, reflecting significant growth driven by urbanization, e-commerce expansion, and advancements in transportation technology, including IoT-enabled logistics and automated systems.