Region:Africa

Author(s):Dev

Product Code:KRAA0472

Pages:87

Published On:August 2025

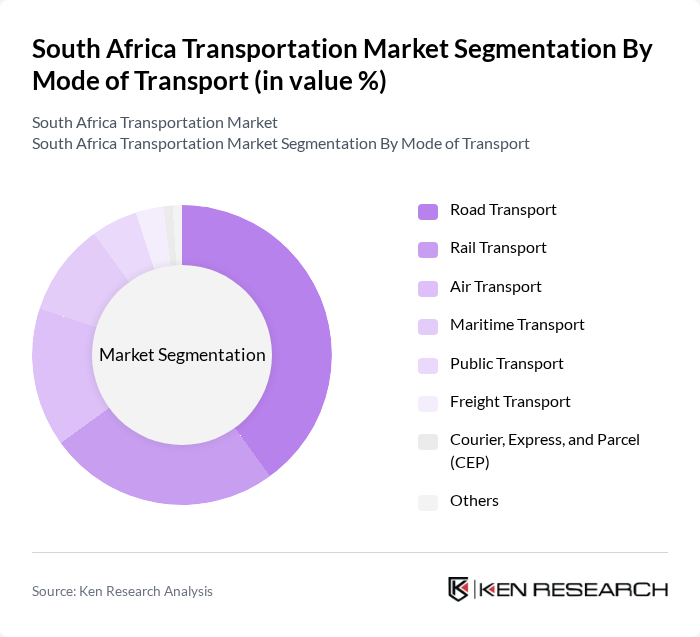

By Mode of Transport:The South Africa Transportation Market is segmented by various modes of transport, including road, rail, air, maritime, public transport, freight transport, courier, express, and parcel services, among others. Each mode plays a crucial role in the overall transportation ecosystem, catering to different consumer needs and preferences. Road transport remains the dominant mode for both passenger and freight movement, while rail and maritime modes are critical for bulk goods and international trade. Air transport is increasingly important for high-value and time-sensitive shipments, and the courier, express, and parcel (CEP) segment is growing rapidly due to e-commerce expansion .

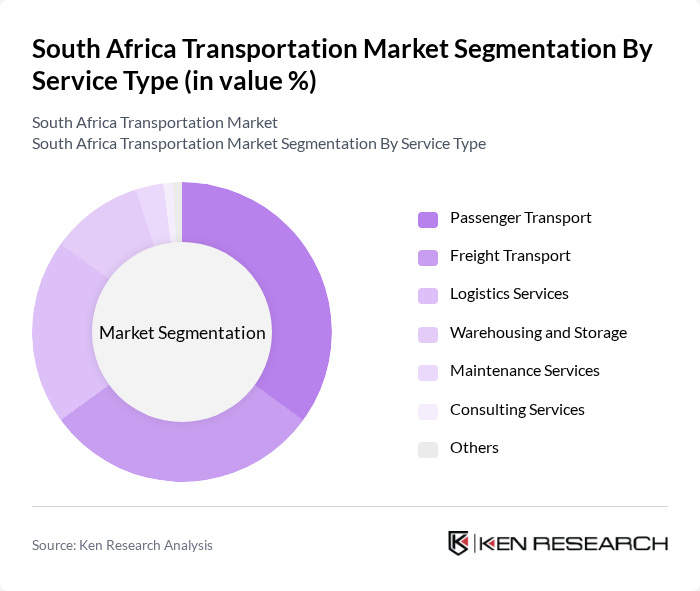

By Service Type:The market is also segmented by service types, including passenger transport, freight transport, logistics services, warehousing and storage, maintenance services, consulting services, and others. Each service type addresses specific needs within the transportation sector, contributing to the overall efficiency and effectiveness of transport operations. Logistics services and warehousing are experiencing strong growth due to the rise of e-commerce and regional trade integration, while passenger and freight transport remain foundational to the sector .

The South Africa Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Transnet SOC Ltd, Passenger Rail Agency of South Africa (PRASA), Metrorail, Gautrain Management Agency, South African Airways (SAA), SAA Cargo, Imperial Logistics (a DP World company), Bidvest Group Limited, Grindrod Limited, Barloworld Logistics, DHL Supply Chain South Africa, FedEx Express South Africa, Kuehne + Nagel South Africa, Uber South Africa, and Bolt South Africa contribute to innovation, geographic expansion, and service delivery in this space.

The South African transportation market is poised for significant transformation as urbanization and technological advancements reshape the landscape. In future, the focus will be on enhancing public transport systems and integrating smart technologies to improve efficiency. The rise of electric vehicles and sustainable transport initiatives will also play a crucial role in reducing environmental impact. As the government continues to invest in infrastructure, the sector is expected to adapt to changing consumer preferences and regulatory frameworks, fostering a more resilient transportation ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Mode of Transport | Road Transport Rail Transport Air Transport Maritime Transport Public Transport Freight Transport Courier, Express, and Parcel (CEP) Others |

| By Service Type | Passenger Transport Freight Transport Logistics Services Warehousing and Storage Maintenance Services Consulting Services Others |

| By End User Industry | Agriculture, Fishing, and Forestry Construction Manufacturing Oil and Gas, Mining and Quarrying Wholesale and Retail Trade Others |

| By Geographic Distribution | Gauteng Western Cape KwaZulu-Natal Eastern Cape Free State Limpopo Others |

| By Technology Adoption | Traditional Transport Smart Transport Solutions Electric Vehicles Autonomous Vehicles Others |

| By Environmental Impact | Low-Emission Transport High-Emission Transport Sustainable Transport Initiatives Others |

| By Investment Type | Public Investment Private Investment Foreign Direct Investment Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Road Freight Services | 80 | Logistics Managers, Fleet Operators |

| Rail Transportation | 50 | Railway Operations Managers, Infrastructure Planners |

| Air Cargo Services | 40 | Airline Cargo Managers, Freight Forwarders |

| Maritime Shipping | 40 | Port Authorities, Shipping Line Executives |

| Public Transport Systems | 50 | Transport Policy Makers, Public Transit Managers |

The South Africa Transportation Market is valued at approximately USD 14.7 billion, driven by urbanization, infrastructure investments, and the growth of e-commerce. This market is expected to continue evolving as demand for efficient logistics and transportation services increases.