Region:Asia

Author(s):Dev

Product Code:KRAA0430

Pages:95

Published On:August 2025

By Type:The transportation market in South Korea is segmented into road transport, rail transport, air transport, maritime transport, public transport, freight and logistics services, ride-sharing and mobility services, and others. Road transport remains the most dominant segment, driven by the extensive highway network and high vehicle ownership. Rail transport follows, benefiting from advanced high-speed rail systems that efficiently connect major cities. The growing demand for logistics and freight services is also a significant contributor, supported by the country's strong export-oriented economy and advanced port infrastructure .

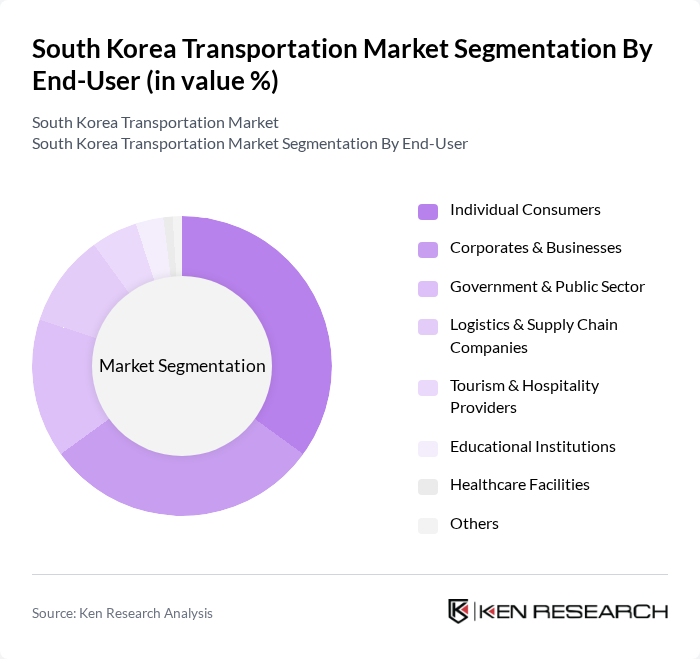

By End-User:The end-user segmentation of the transportation market includes individual consumers, corporates and businesses, government and public sector, logistics and supply chain companies, tourism and hospitality providers, educational institutions, healthcare facilities, and others. Individual consumers represent the largest segment, driven by the growing demand for personal mobility solutions and convenience. Corporates and businesses utilize transportation services for logistics and employee commuting, while the government sector focuses on public transport and infrastructure development. The logistics and supply chain segment is expanding due to the rise in e-commerce and export activities .

The South Korea Transportation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hyundai Motor Company, Kia Corporation, Samsung C&T Corporation, GS Engineering & Construction, Daewoo Engineering & Construction, Hanjin Transportation, CJ Logistics, Korea Railroad Corporation (KORAIL), Seoul Metro, Korean Air, Asiana Airlines, Korea Expressway Corporation, SK Telecom, LG CNS, and T'way Air contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean transportation market is poised for significant transformation driven by technological advancements and a focus on sustainability. In future, the rise of Mobility-as-a-Service (MaaS) is expected to reshape urban mobility, offering integrated transport solutions. Additionally, the expansion of electric vehicle infrastructure will support the transition to greener transport options, aligning with global sustainability goals. These trends indicate a shift towards more efficient, user-friendly, and environmentally responsible transportation systems in South Korea.

| Segment | Sub-Segments |

|---|---|

| By Type | Road Transport Rail Transport Air Transport Maritime Transport Public Transport (Metro, Bus, Taxi) Freight & Logistics Services Ride-Sharing & Mobility Services Others |

| By End-User | Individual Consumers Corporates & Businesses Government & Public Sector Logistics & Supply Chain Companies Tourism & Hospitality Providers Educational Institutions Healthcare Facilities Others |

| By Vehicle Type | Passenger Cars Buses Trucks & Commercial Vehicles Motorcycles & Scooters Trains Ships & Ferries Aircraft Others |

| By Service Type | Scheduled Passenger Services On-Demand Mobility Services Freight & Cargo Services Logistics & Supply Chain Solutions Maintenance & Support Services Infrastructure Management Services Others |

| By Region | Seoul Busan Incheon Daegu Daejeon Gwangju Ulsan Others |

| By Technology | Electric Vehicles (EVs) Hybrid Vehicles Autonomous Vehicles Smart Traffic Management Systems Connected Vehicle Platforms Mobility Apps & Digital Platforms Others |

| By Policy Support | EV Subsidies & Incentives Public Transport Tax Benefits Infrastructure Development Grants R&D Support for Mobility Innovation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Usage | 100 | Commuters, Public Transport Authorities |

| Logistics and Freight Services | 80 | Logistics Managers, Freight Forwarders |

| Smart Transportation Technologies | 60 | Technology Developers, Urban Planners |

| Infrastructure Development Projects | 50 | Project Managers, Civil Engineers |

| Environmental Impact Assessments | 40 | Sustainability Officers, Environmental Consultants |

The South Korea Transportation Market is valued at approximately USD 2.3 billion, reflecting significant growth driven by urbanization, smart mobility solutions, and increased demand for efficient logistics and transportation services.