Region:Asia

Author(s):Dev

Product Code:KRAB0361

Pages:91

Published On:August 2025

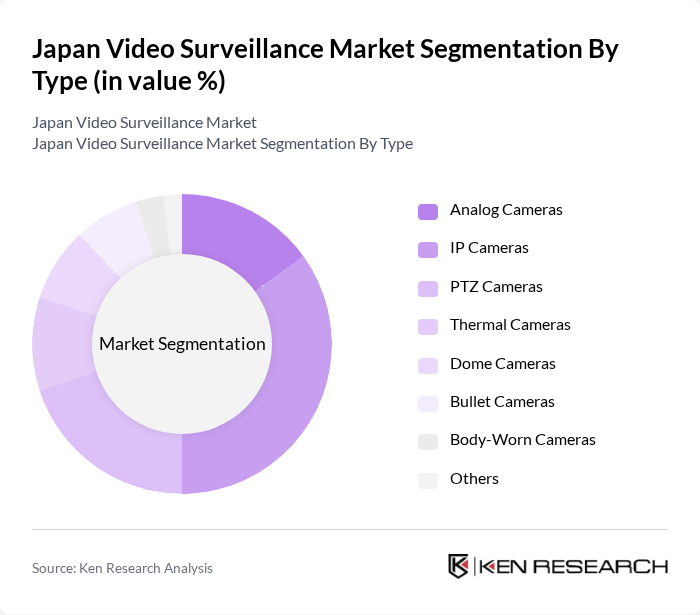

By Type:The market is segmented into various types of video surveillance systems, including Analog Cameras, IP Cameras, PTZ Cameras, Thermal Cameras, Dome Cameras, Bullet Cameras, Body-Worn Cameras, and Others. Among these, IP Cameras are gaining significant traction due to their superior image quality, remote accessibility, and compatibility with AI-powered analytics, making them the preferred choice for both commercial and residential applications .

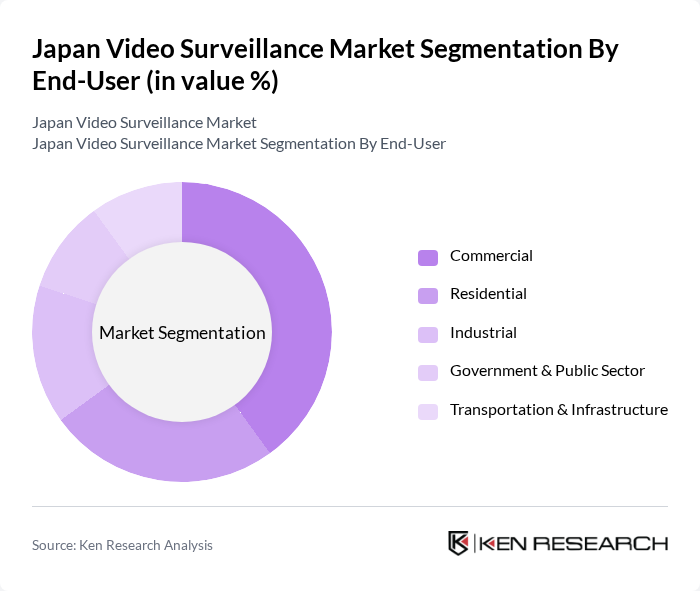

By End-User:The end-user segmentation includes Commercial, Residential, Industrial, Government & Public Sector, and Transportation & Infrastructure. The Commercial sector is the leading segment, driven by the increasing need for security in retail spaces, offices, and public venues, which has led to a surge in the installation of advanced surveillance systems. Industrial and transportation sectors are also rapidly adopting video surveillance solutions for critical infrastructure protection and operational safety .

The Japan Video Surveillance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Panasonic Holdings Corporation, Sony Group Corporation, Fujitsu Limited, NEC Corporation, Hitachi, Ltd., Canon Inc., Toshiba Corporation, Seiko Instruments Inc., Axis Communications AB, Hanwha Vision Co., Ltd., Hikvision Digital Technology Co., Ltd., Dahua Technology Co., Ltd., Avigilon Corporation (Motorola Solutions), Genetec Inc., Milestone Systems A/S contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Japan video surveillance market appears promising, driven by ongoing technological innovations and increasing urbanization. As cities expand, the integration of smart surveillance systems will become essential for public safety and crime prevention. Additionally, the growing emphasis on cybersecurity will lead to the development of more secure surveillance solutions. Companies that adapt to these trends and invest in advanced technologies are likely to gain a competitive edge in this evolving landscape, ensuring robust market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Analog Cameras IP Cameras PTZ Cameras Thermal Cameras Dome Cameras Bullet Cameras Body-Worn Cameras Others |

| By End-User | Commercial Residential Industrial Government & Public Sector Transportation & Infrastructure |

| By Application | Retail & Mall Security Traffic & City Surveillance Public Safety & Law Enforcement Critical Infrastructure Protection Home Security & Elderly Monitoring Banking & Financial Services Others |

| By Component | Hardware (Cameras, Storage Devices, Monitors) Software (Video Management, Analytics) Services (Installation, Maintenance, Cloud Storage) Accessories Others |

| By Sales Channel | Direct Sales Distributors/Dealers Online Retail/E-commerce System Integrators Others |

| By Distribution Mode | Wholesale Retail E-commerce Others |

| By Price Range | Low-End Mid-Range High-End Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Surveillance Solutions | 80 | Security Managers, Store Operations Directors |

| Transportation Security Systems | 60 | Transport Safety Officers, Fleet Managers |

| Public Safety and Law Enforcement | 50 | Police Department Officials, Security Analysts |

| Corporate Security Installations | 40 | Facility Managers, Corporate Security Directors |

| Smart City Surveillance Initiatives | 40 | Urban Planners, City Security Coordinators |

The Japan Video Surveillance Market is valued at approximately USD 4.0 billion, driven by increasing security concerns, the adoption of AI technologies, and the demand for smart city initiatives. This growth reflects a significant investment in advanced surveillance systems across various sectors.