Region:Middle East

Author(s):Shubham

Product Code:KRAE1007

Pages:90

Published On:December 2025

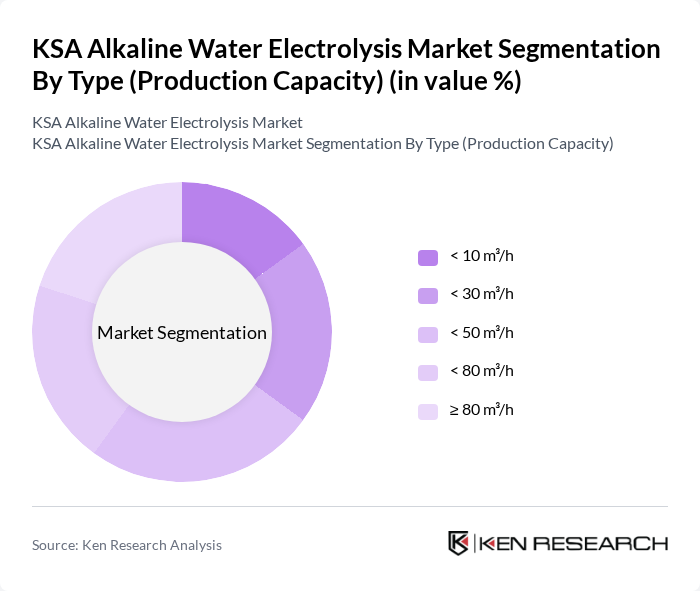

By Type (Production Capacity):The market is segmented based on production capacity, which includes various ranges of output. The subsegments include <10 m³/h, <30 m³/h, <50 m³/h, <80 m³/h, and ?80 m³/h. Each of these subsegments caters to different industrial needs, with larger capacities being favored for extensive industrial applications.

The subsegment of <50 m³/h is currently dominating the market due to its versatility and suitability for various industrial applications, including chemical production and energy storage. This capacity range is particularly favored by small to medium enterprises that require efficient and cost-effective solutions for hydrogen production. The growing trend towards sustainable energy solutions is further propelling the demand for this capacity range, making it a key player in the market.

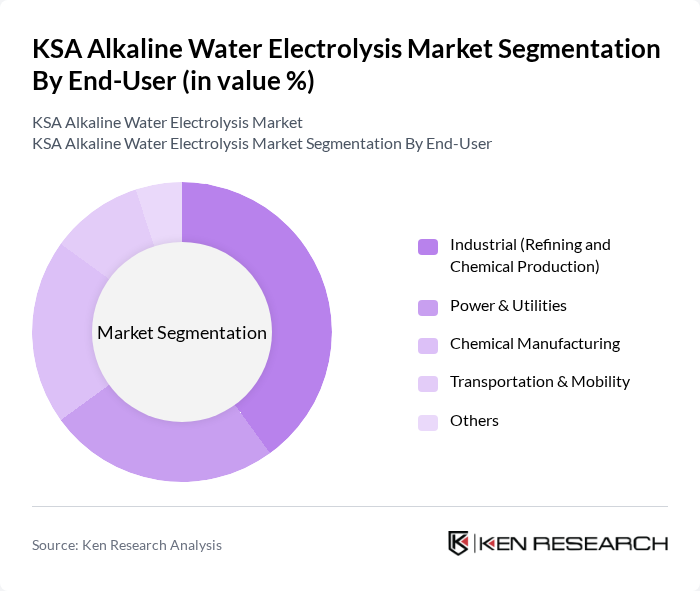

By End-User:The market is segmented based on end-users, which include Industrial (Refining and Chemical Production), Power & Utilities, Chemical Manufacturing, Transportation & Mobility, and Others. Each end-user segment has distinct requirements and applications for alkaline water electrolysis technology.

The Industrial (Refining and Chemical Production) segment leads the market due to the high demand for hydrogen in refining processes and chemical production. This sector's growth is driven by the increasing need for cleaner production methods and the transition towards sustainable energy sources. The significant investments in refining capacity and chemical production facilities in Saudi Arabia further bolster this segment's dominance. Large-scale projects such as the NEOM Green Hydrogen Project, designed to produce 600 tonnes of green hydrogen daily, exemplify the Kingdom's commitment to scaling hydrogen infrastructure for industrial applications.

The KSA Alkaline Water Electrolysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nel ASA, Thyssenkrupp Nucera, Cummins Inc., McPhy Energy, Asahi Kasei, Peric Hydrogen, Siemens AG, Linde AG, Air Products and Chemicals, Inc., Hydrogenics Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The KSA alkaline water electrolysis market is poised for significant growth, driven by increasing investments in hydrogen infrastructure and technological advancements. In the future, the integration of renewable energy sources with hydrogen production is expected to become more prevalent, enhancing the sustainability of the sector. Additionally, the government's commitment to decarbonization initiatives will likely foster a supportive regulatory environment, encouraging further innovation and investment in this emerging market.

| Segment | Sub-Segments |

|---|---|

| By Type (Production Capacity) | < 10 m³/h < 30 m³/h < 50 m³/h < 80 m³/h ? 80 m³/h |

| By End-User | Industrial (Refining and Chemical Production) Power & Utilities Chemical Manufacturing Transportation & Mobility Others |

| By Application | Green Hydrogen Production Ammonia Production Energy Storage Power-to-Gas Others |

| By Distribution Channel | Direct Sales EPC Contractors Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Water Treatment Systems | 45 | Homeowners, Water Quality Specialists |

| Commercial Water Purification | 40 | Facility Managers, Procurement Officers |

| Industrial Electrolysis Applications | 50 | Operations Managers, Process Engineers |

| Research and Development in Electrolysis | 35 | R&D Directors, Academic Researchers |

| Government Policy Makers on Water Sustainability | 30 | Policy Analysts, Environmental Consultants |

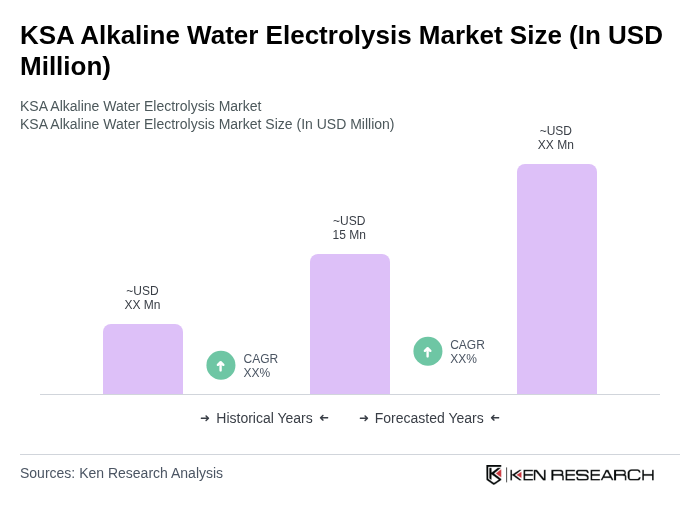

The KSA Alkaline Water Electrolysis Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for green hydrogen production and advancements in electrolyzer technology.