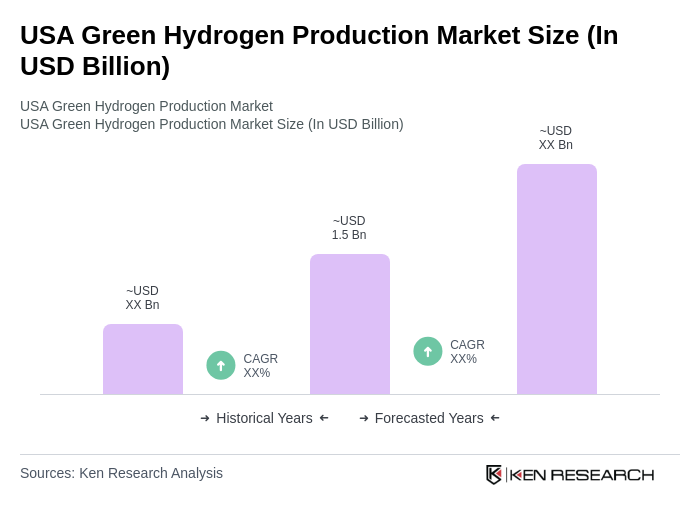

USA Green Hydrogen Production Market Overview

- The USA Green Hydrogen Production Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing investments in renewable energy technologies, government incentives, and a rising demand for clean energy solutions to combat climate change. The market is witnessing a surge in interest from various sectors, including transportation and industrial applications, as companies seek to reduce their carbon footprints.

- Key players in this market include California, Texas, and New York, which dominate due to their robust renewable energy infrastructure, supportive government policies, and significant investments in green hydrogen projects. These states have established themselves as leaders in the transition to sustainable energy, attracting both domestic and international investments in hydrogen production technologies.

- In 2023, the U.S. government implemented the Hydrogen Production Tax Credit, which provides financial incentives for the production of green hydrogen. This regulation aims to stimulate investment in hydrogen technologies and promote the use of renewable energy sources, thereby accelerating the transition to a low-carbon economy.

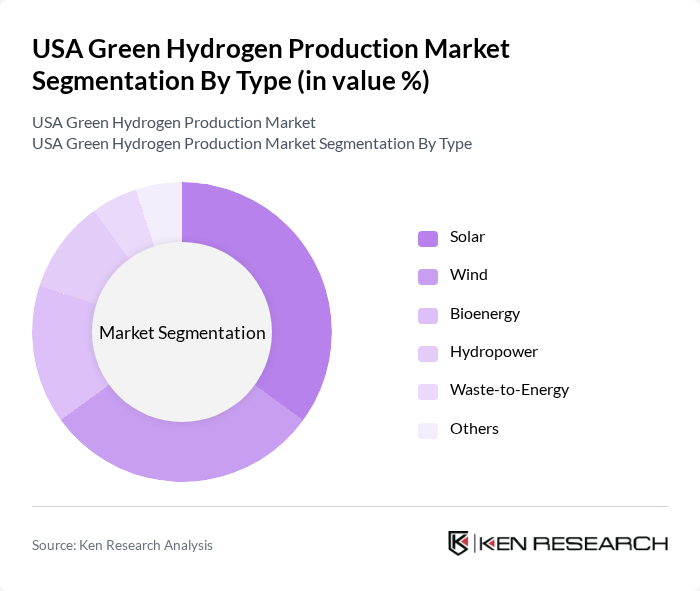

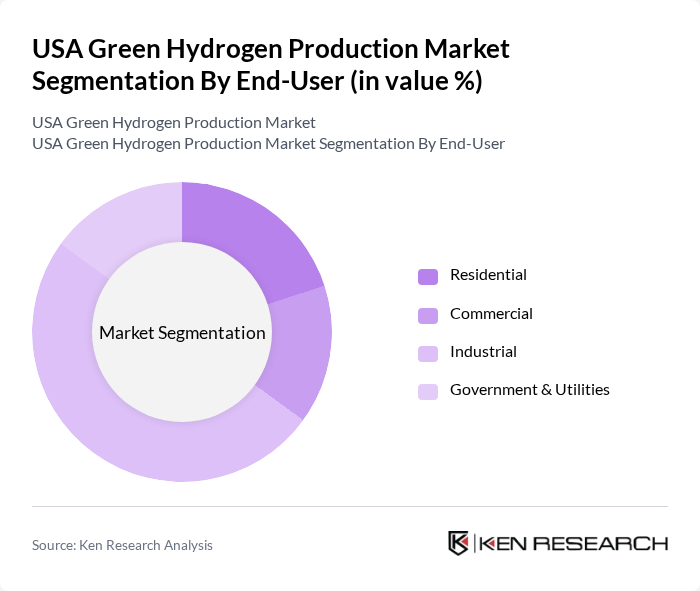

USA Green Hydrogen Production Market Segmentation

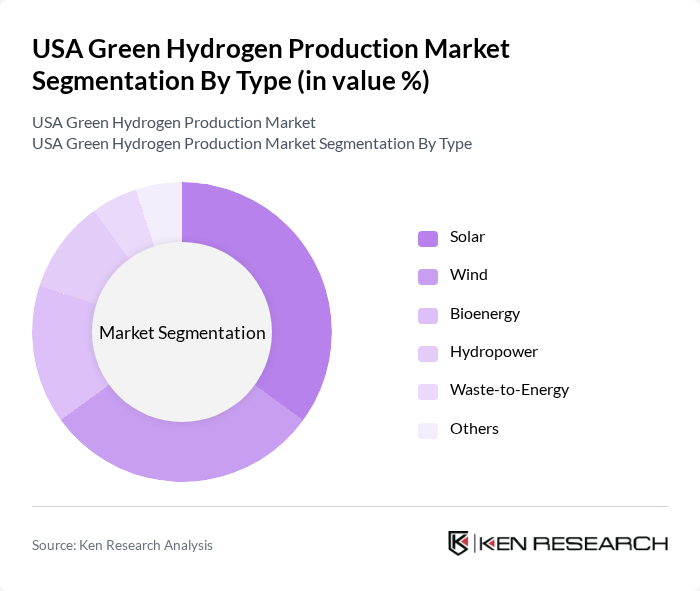

By Type:The market is segmented into various types of green hydrogen production methods, including solar, wind, bioenergy, hydropower, waste-to-energy, and others. Among these, solar and wind are the most prominent due to their scalability and decreasing costs. Solar energy, in particular, has gained traction as technology advances, making it a preferred choice for many producers. The increasing efficiency of solar panels and wind turbines has led to a significant rise in their adoption for hydrogen production, catering to both industrial and residential needs.

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities. The industrial sector is the leading end-user, driven by the need for sustainable energy solutions in manufacturing processes. Industries such as chemicals, steel, and transportation are increasingly adopting green hydrogen to meet their energy requirements and reduce emissions. The growing emphasis on sustainability and regulatory pressures are pushing industries to transition towards cleaner energy sources, making them significant contributors to the market.

USA Green Hydrogen Production Market Competitive Landscape

The USA Green Hydrogen Production Market is characterized by a dynamic mix of regional and international players. Leading participants such as Air Products and Chemicals, Inc., Plug Power Inc., Nel ASA, Linde plc, ITM Power plc, Ballard Power Systems Inc., Siemens Energy AG, Cummins Inc., Hydrogenics Corporation, H2U Technologies, McPhy Energy S.A., Enel Green Power S.p.A., FirstElement Fuel, Inc., FuelCell Energy, Inc., Thyssenkrupp AG contribute to innovation, geographic expansion, and service delivery in this space.

USA Green Hydrogen Production Market Industry Analysis

Growth Drivers

- Increasing Demand for Clean Energy:The USA's energy consumption reached approximately 4,000 million MWh in the recent past, with a significant shift towards renewable sources. The demand for clean energy is projected to increase by 20% in the near future, driven by corporate sustainability goals and consumer preferences for eco-friendly solutions. This trend is further supported by the Biden administration's commitment to achieving a 50-52% reduction in greenhouse gas emissions in the future, creating a favorable environment for green hydrogen production.

- Government Incentives and Subsidies:The U.S. government allocated $8 billion in the recent past for hydrogen production initiatives under the Infrastructure Investment and Jobs Act. This funding aims to support the development of green hydrogen projects, enhancing the economic viability of production. Additionally, tax credits and grants are expected to stimulate investments in hydrogen technologies, with an estimated $15 billion in federal and state incentives projected for the near future, further driving market growth.

- Technological Advancements in Electrolysis:The efficiency of electrolysis technology has improved significantly, with costs dropping to around $3.50 per kilogram of hydrogen produced in the recent past. Innovations in electrolyzer design and materials are expected to reduce costs by an additional 30% in the near future. This technological progress is crucial for making green hydrogen competitive with fossil fuels, thereby increasing its adoption across various sectors, including transportation and industrial applications.

Market Challenges

- High Production Costs:Despite advancements, the production cost of green hydrogen remains high, averaging $4.50 per kilogram in the recent past. This cost is primarily due to the expensive renewable energy inputs and electrolysis equipment. As the market matures, achieving cost parity with conventional hydrogen sources, which are priced around $1.50 per kilogram, remains a significant challenge that could hinder widespread adoption and investment in the sector.

- Limited Infrastructure:The current hydrogen infrastructure in the USA is underdeveloped, with only 1,600 miles of hydrogen pipelines operational in the recent past. This limited infrastructure poses logistical challenges for distribution and storage, making it difficult for producers to reach end-users efficiently. The lack of refueling stations for hydrogen vehicles further exacerbates this issue, potentially stalling market growth and adoption rates in the transportation sector.

USA Green Hydrogen Production Market Future Outlook

The future of the USA green hydrogen production market appears promising, driven by increasing investments in renewable energy and technological innovations. In the near future, the market is expected to witness a surge in strategic partnerships between energy companies and technology providers, enhancing production capabilities. Additionally, the integration of green hydrogen into existing energy systems will likely accelerate, particularly in sectors focused on decarbonization, positioning the USA as a leader in sustainable energy solutions.

Market Opportunities

- Expansion of Renewable Energy Sources:The USA is projected to add 100 GW of renewable energy capacity in the near future, creating a robust foundation for green hydrogen production. This expansion will facilitate the use of excess renewable energy for hydrogen generation, enhancing overall energy efficiency and sustainability in the energy sector.

- Development of Hydrogen Fuel Cells:The hydrogen fuel cell market is expected to grow to $20 billion in the near future, driven by advancements in technology and increasing applications in transportation and stationary power. This growth presents significant opportunities for green hydrogen producers to supply fuel cells, further integrating hydrogen into the energy landscape and promoting cleaner alternatives.