Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3858

Pages:91

Published On:November 2025

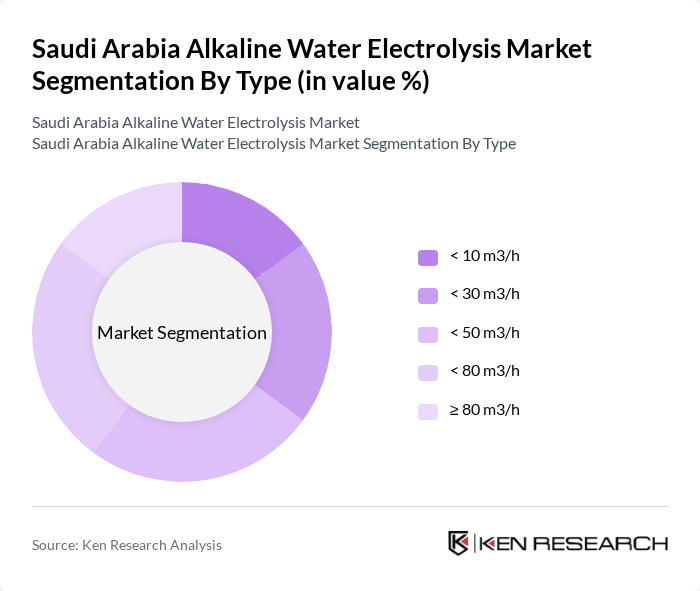

By Type:The market is segmented into various types based on the production capacity of electrolyzers. The subsegments include < 10 m/h, < 30 m/h, < 50 m/h, < 80 m/h, and ? 80 m/h. The demand for larger capacity electrolyzers is increasing, driven by the expansion of industrial-scale hydrogen projects and the need for higher operational efficiency. The ? 80 m/h subsegment is currently leading the market, supported by ongoing investments in mega-projects and the deployment of advanced hydrogen infrastructure .

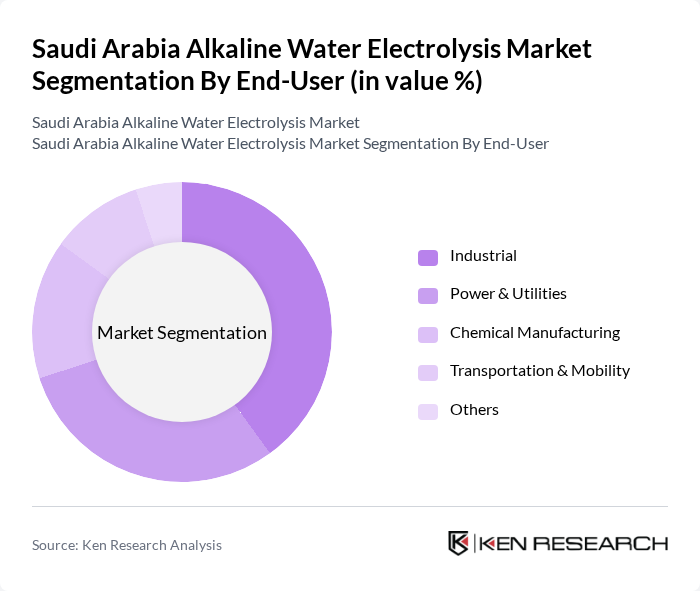

By End-User:The market is segmented based on end-users, including Industrial, Power & Utilities, Chemical Manufacturing, Transportation & Mobility, and Others. The industrial sector remains the largest consumer of alkaline water electrolysis technology, primarily due to its use in refining and chemical production. Power & Utilities are increasingly adopting hydrogen to support grid stability and decarbonization, while the transportation sector is seeing early-stage adoption for fuel cell vehicles and logistics .

The Saudi Arabia Alkaline Water Electrolysis Market is characterized by a dynamic mix of regional and international players. Leading participants such as ACWA Power, Saudi Aramco, Air Products and Chemicals, Inc., Siemens Energy AG, Thyssenkrupp AG, Linde plc, Nel ASA, ITM Power PLC, Cummins Inc., Green Hydrogen Systems A/S, McPhy Energy SA, Asahi Kasei Corporation, John Cockerill, Sunfire GmbH, Enapter AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the alkaline water electrolysis market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and a strong governmental push towards sustainable practices. By future, the market is expected to witness a surge in hydrogen production projects, supported by technological advancements and international collaborations. The focus on green hydrogen will likely lead to enhanced energy security and economic diversification, positioning Saudi Arabia as a leader in the global hydrogen economy.

| Segment | Sub-Segments |

|---|---|

| By Type | < 10 m3/h < 30 m3/h < 50 m3/h < 80 m3/h ? 80 m3/h |

| By End-User | Industrial Power & Utilities Chemical Manufacturing Transportation & Mobility Others |

| By Application | Green Hydrogen Production Ammonia Production Energy Storage Power-to-Gas Others |

| By Distribution Channel | Direct Sales EPC Contractors Distributors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Water Treatment Systems | 100 | Homeowners, Water Quality Specialists |

| Commercial Water Solutions | 80 | Facility Managers, Procurement Officers |

| Industrial Electrolysis Applications | 70 | Operations Managers, Process Engineers |

| Research and Development in Water Technologies | 50 | R&D Directors, Technical Consultants |

| Government Water Policy Makers | 40 | Policy Analysts, Environmental Officers |

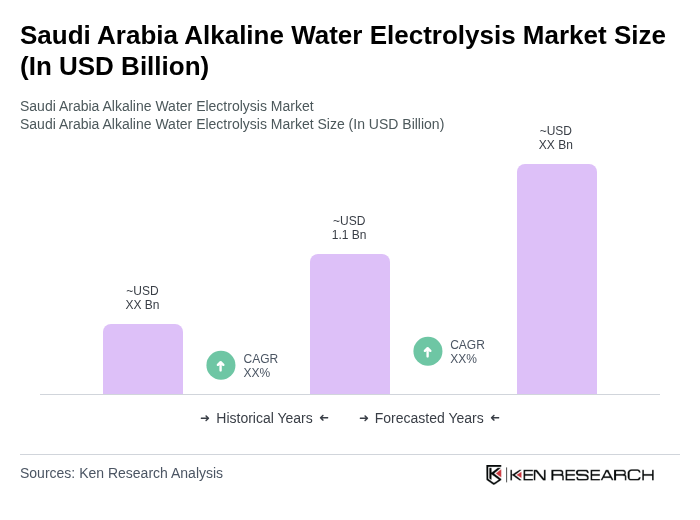

The Saudi Arabia Alkaline Water Electrolysis Market is valued at approximately USD 1.1 billion, reflecting a significant growth trajectory driven by the increasing demand for green hydrogen production and government initiatives under Saudi Vision 2030.