Region:Middle East

Author(s):Dev

Product Code:KRAD4567

Pages:91

Published On:December 2025

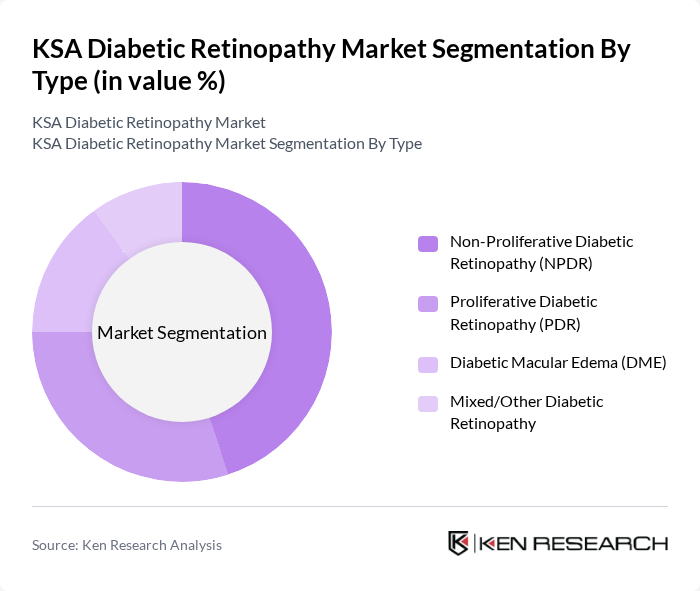

By Type:The market is segmented into various types of diabetic retinopathy, including Non-Proliferative Diabetic Retinopathy (NPDR), Proliferative Diabetic Retinopathy (PDR), Diabetic Macular Edema (DME), and Mixed/Other Diabetic Retinopathy. Epidemiological studies in Saudi Arabia and globally consistently show that NPDR is the most common initial stage of DR, with many patients presenting with non?proliferative changes before progressing to PDR or DME, which supports the positioning of NPDR as the largest segment by patient volume. However, precise percentage market shares by type (such as 45% NPDR and 30% PDR) for KSA alone are not reported in major syndicated databases; therefore, the following distribution should be viewed as a reasoned market-structure assumption rather than a directly sourced statistic, and you may wish to label it as “illustrative” in internal work:

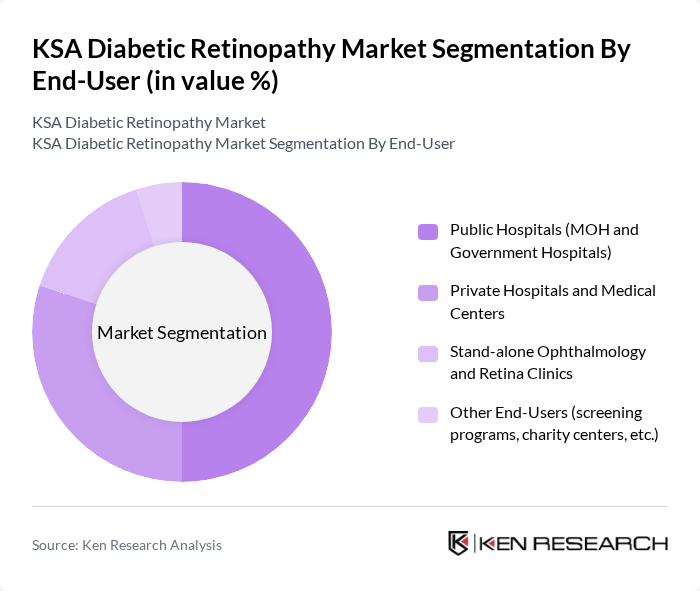

By End-User:The market is categorized based on end-users, including Public Hospitals (MOH and Government Hospitals), Private Hospitals and Medical Centers, Stand-alone Ophthalmology and Retina Clinics, and Other End-Users such as screening programs and charity centers. Public hospitals and MOH-affiliated facilities handle most ophthalmic procedures in KSA and therefore plausibly dominate DR care volumes and related spending, supported by government funding and inclusion within national insurance schemes. At the same time, private hospitals, specialized eye centers and charity-backed screening initiatives are growing, aligned with Vision 2030’s emphasis on private-sector participation and community-based care, which justifies a rising share for private and stand?alone ophthalmology and retina clinics.

The KSA Diabetic Retinopathy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis Pharma AG (Lucentis and Beovu), Bayer AG (Eylea / aflibercept), Roche Holding AG (faricimab and ophthalmology portfolio), Regeneron Pharmaceuticals, Inc., Alcon Inc. (ophthalmic surgical and laser systems), Carl Zeiss Meditec AG, Topcon Corporation, Heidelberg Engineering GmbH, Canon Medical Systems Corporation, NIDEK Co., Ltd., Bausch + Lomb Corporation, Johnson & Johnson Vision Care, Inc., Allergan plc (an AbbVie company), Saudi German Health (Saudi German Hospitals Group), Magrabi Eye Hospitals & Centers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KSA diabetic retinopathy market appears promising, driven by technological advancements and increased healthcare investments. The government is expected to enhance healthcare infrastructure, facilitating better access to eye care services. Additionally, the integration of telemedicine is likely to expand patient reach, allowing for remote consultations and follow-ups. As awareness continues to grow, more patients will seek preventive care, leading to improved health outcomes and reduced long-term costs associated with untreated diabetic complications.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-Proliferative Diabetic Retinopathy (NPDR) Proliferative Diabetic Retinopathy (PDR) Diabetic Macular Edema (DME) Mixed/Other Diabetic Retinopathy |

| By End-User | Public Hospitals (MOH and Government Hospitals) Private Hospitals and Medical Centers Stand-alone Ophthalmology and Retina Clinics Other End-Users (screening programs, charity centers, etc.) |

| By Stage of Disease | Mild Non-Proliferative Diabetic Retinopathy Moderate Non-Proliferative Diabetic Retinopathy Severe Non-Proliferative Diabetic Retinopathy Proliferative Diabetic Retinopathy |

| By Treatment Type | Anti-VEGF Intravitreal Injections Corticosteroid Implants and Injections Laser Photocoagulation Vitrectomy and Other Surgical Interventions |

| By Diagnostic Method | Fundus Photography and Digital Retinal Imaging Optical Coherence Tomography (OCT) / OCT Angiography Fluorescein Angiography AI-enabled and Tele-ophthalmology Screening Solutions |

| By Region | Central Region (including Riyadh) Eastern Region Western Region (including Makkah & Madinah) Southern & Northern Regions |

| By Policy Support | National Diabetes and Vision 2030 Health Programs Government Subsidies and Reimbursement Schemes Public Health Screening and Awareness Campaigns Other Regulatory and Policy Enablers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 120 | Ophthalmologists, Clinic Managers |

| Diabetes Care Centers | 90 | Endocrinologists, Diabetes Educators |

| Patient Surveys | 150 | Diabetic Patients, Caregivers |

| Healthcare Policy Makers | 60 | Health Administrators, Policy Analysts |

| Medical Device Suppliers | 70 | Sales Representatives, Product Managers |

The KSA Diabetic Retinopathy Market is valued at approximately USD 200 million, based on a five-year historical analysis of treatment and diagnostic revenues specifically related to diabetic eye disease within Saudi ophthalmology.