Region:Middle East

Author(s):Rebecca

Product Code:KRAA9304

Pages:80

Published On:November 2025

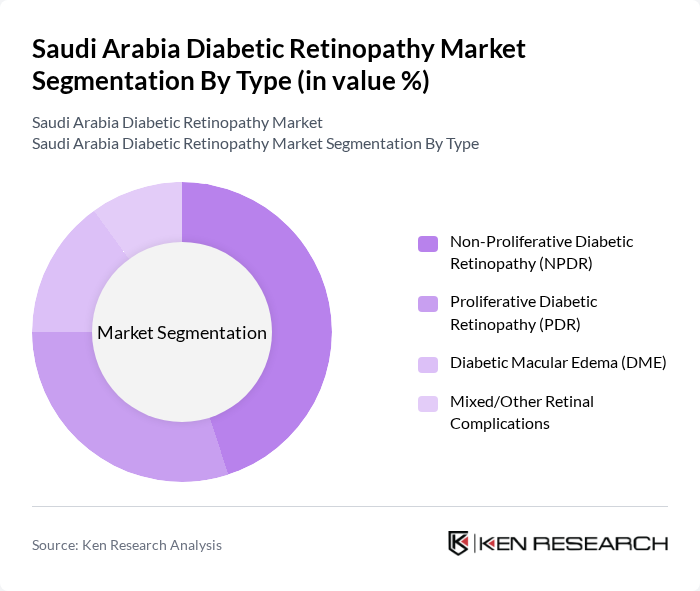

By Type:The market is segmented into four main types: Non-Proliferative Diabetic Retinopathy (NPDR), Proliferative Diabetic Retinopathy (PDR), Diabetic Macular Edema (DME), and Mixed/Other Retinal Complications. Among these,Non-Proliferative Diabetic Retinopathy (NPDR)is the most prevalent, accounting for a significant portion of cases due to its early-stage nature, which affects a larger demographic. The increasing awareness and screening programs have led to higher detection rates of NPDR, making it a focal point for treatment and management strategies.

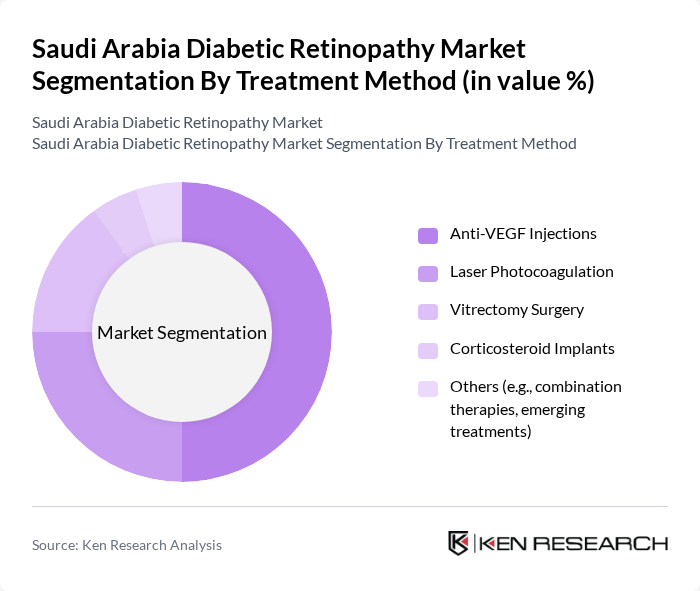

By Treatment Method:The treatment methods for diabetic retinopathy include Anti-VEGF Injections, Laser Photocoagulation, Vitrectomy Surgery, Corticosteroid Implants, and Others.Anti-VEGF Injectionsare currently the leading treatment method due to their effectiveness in managing both NPDR and PDR. The increasing adoption of these injections is driven by their ability to significantly improve visual outcomes and reduce the risk of vision loss, making them a preferred choice among healthcare providers.

The Saudi Arabia Diabetic Retinopathy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alcon Laboratories, Inc., Novartis AG, Bayer AG, Regeneron Pharmaceuticals, Inc., Roche Holding AG, Carl Zeiss Meditec AG, Topcon Corporation, Optos plc, Heidelberg Engineering GmbH, Canon Inc., Nidek Co., Ltd., Bausch + Lomb, Hoya Corporation, EssilorLuxottica, Santen Pharmaceutical Co., Ltd., King Khaled Eye Specialist Hospital (KKESH), Magrabi Hospitals & Centers, Al-Magrabi Optical, Saudi German Health, Dr. Sulaiman Al Habib Medical Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the diabetic retinopathy market in Saudi Arabia appears promising, driven by technological advancements and government support. In future, the integration of AI in diagnostics and the expansion of telemedicine are expected to enhance patient access to care. Additionally, increased public awareness campaigns will likely lead to earlier detection and treatment. These trends indicate a shift towards a more proactive approach in managing diabetic retinopathy, ultimately improving health outcomes for the growing diabetic population.

| Segment | Sub-Segments |

|---|---|

| By Type | Non-Proliferative Diabetic Retinopathy (NPDR) Proliferative Diabetic Retinopathy (PDR) Diabetic Macular Edema (DME) Mixed/Other Retinal Complications |

| By Treatment Method | Anti-VEGF Injections Laser Photocoagulation Vitrectomy Surgery Corticosteroid Implants Others (e.g., combination therapies, emerging treatments) |

| By Diagnostic Technology | Optical Coherence Tomography (OCT) Fundus Photography Fluorescein Angiography AI-based Retinal Screening Others |

| By Distribution Channel | Hospitals Ophthalmology Clinics Ambulatory Surgery Centers Online Pharmacies Others |

| By Age Group | Adults (18-64 Years) Elderly (65+ Years) Pediatric Others |

| By Healthcare Provider Type | Public Healthcare Providers Private Healthcare Providers Non-Governmental Organizations Others |

| By Patient Demographics | Gender Socioeconomic Status Urban vs Rural Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Ophthalmology Clinics | 100 | Ophthalmologists, Clinic Managers |

| Diabetes Care Centers | 70 | Endocrinologists, Diabetes Educators |

| Patient Advocacy Groups | 50 | Patient Representatives, Health Advocates |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Policy Analysts |

| Medical Device Suppliers | 60 | Sales Managers, Product Specialists |

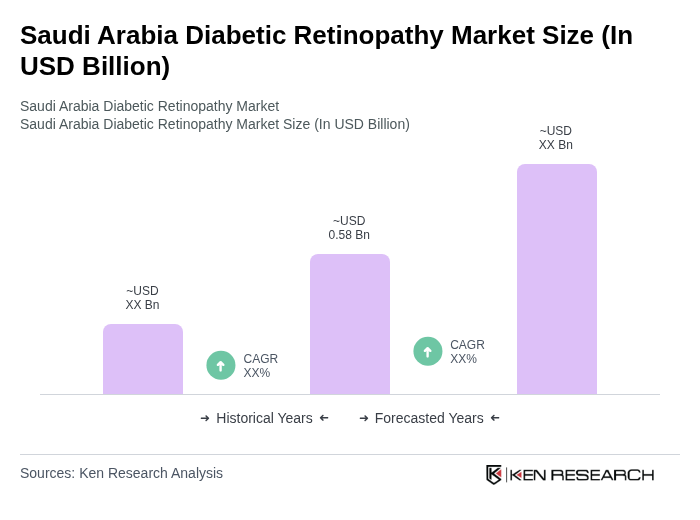

The Saudi Arabia Diabetic Retinopathy Market is valued at approximately USD 0.58 billion, reflecting a significant growth driven by the rising prevalence of diabetes and advancements in diagnostic and treatment technologies.