Region:Middle East

Author(s):Dev

Product Code:KRAD4478

Pages:83

Published On:December 2025

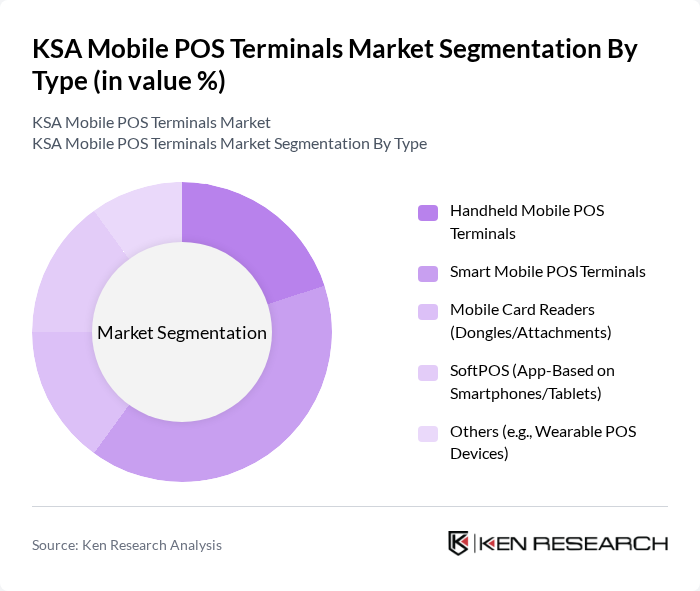

By Type:The market is segmented into various types of mobile POS terminals, including Handheld Mobile POS Terminals, Smart Mobile POS Terminals, Mobile Card Readers (Dongles/Attachments), SoftPOS (App-Based on Smartphones/Tablets), and Others (e.g., Wearable POS Devices). Among these, Smart Mobile POS Terminals are leading the market due to their advanced features, such as integrated payment processing, support for contactless/NFC and QR-code payments, and enhanced security measures such as EMV, tokenization, and biometric authentication. The growing trend of contactless payments, the rapid spread of smartphone-based acceptance, and the increasing demand for multifunctional devices that can handle payments, analytics, inventory, and loyalty programs are driving the adoption of smart terminals, making them the preferred choice for businesses.

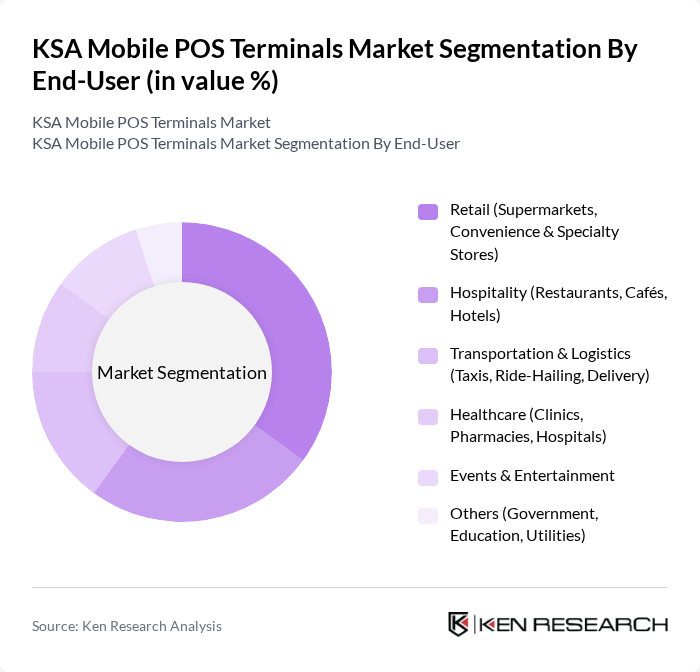

By End-User:The end-user segmentation includes Retail (Supermarkets, Convenience & Specialty Stores), Hospitality (Restaurants, Cafés, Hotels), Transportation & Logistics (Taxis, Ride-Hailing, Delivery), Healthcare (Clinics, Pharmacies, Hospitals), Events & Entertainment, and Others (Government, Education, Utilities). The Retail sector is the dominant end-user, driven by the rapid growth of e-commerce, the expansion of modern trade formats, and mandatory acceptance of digital payments at merchant locations. Retailers and hospitality operators are increasingly adopting mobile POS systems to support in-aisle checkout, tableside payments, and delivery integration, thereby enhancing customer service and streamlining checkout processes, which contributes significantly to market growth.

The KSA Mobile POS Terminals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Payments (mada), STC Pay, Geidea, HyperPay, HPS (Hightech Payment Systems), Network International KSA, Verifone, Ingenico, PAX Technology, Worldline, Fiserv, Adyen, Checkout.com, Amazon Payment Services, Tap Payments contribute to innovation, geographic expansion, and service delivery in this space.

The future of the KSA mobile POS terminals market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence and machine learning into payment solutions is expected to enhance transaction security and user experience. Additionally, the ongoing expansion of the retail and hospitality sectors will likely create new opportunities for mobile POS adoption, particularly in urban and rural areas, as businesses seek to streamline operations and improve customer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Handheld Mobile POS Terminals Smart Mobile POS Terminals Mobile Card Readers (Dongles/Attachments) SoftPOS (App-Based on Smartphones/Tablets) Others (e.g., Wearable POS Devices) |

| By End-User | Retail (Supermarkets, Convenience & Specialty Stores) Hospitality (Restaurants, Cafés, Hotels) Transportation & Logistics (Taxis, Ride-Hailing, Delivery) Healthcare (Clinics, Pharmacies, Hospitals) Events & Entertainment Others (Government, Education, Utilities) |

| By Payment Method | Card-Based Payments (Credit/Debit, mada) Mobile Wallets (Apple Pay, STC Pay, mada Pay, etc.) QR Code Payments NFC/Contactless Tap-to-Pay Others |

| By Deployment Mode | Standalone Mobile POS Devices Integrated mPOS with Legacy POS Cloud-Based mPOS Platforms SoftPOS on Merchant Smartphones/Tablets |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Jeddah, Makkah, Madinah) Eastern Region (incl. Dammam, Al Khobar) Southern Region Northern Region |

| By Industry Vertical | Food & Beverage Service Retail & E-commerce Merchants Transportation & Logistics Operators Healthcare & Pharmacies Government & Public Sector Others |

| By Customer Size | Micro Enterprises Small Enterprises Medium Enterprises Large Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sector Adoption | 150 | Store Managers, IT Directors |

| Hospitality Industry Usage | 100 | Operations Managers, Front Desk Supervisors |

| Transportation Services | 80 | Fleet Managers, Payment System Administrators |

| Small Business Implementation | 70 | Business Owners, Financial Officers |

| Technology Providers Insights | 60 | Product Managers, Sales Executives |

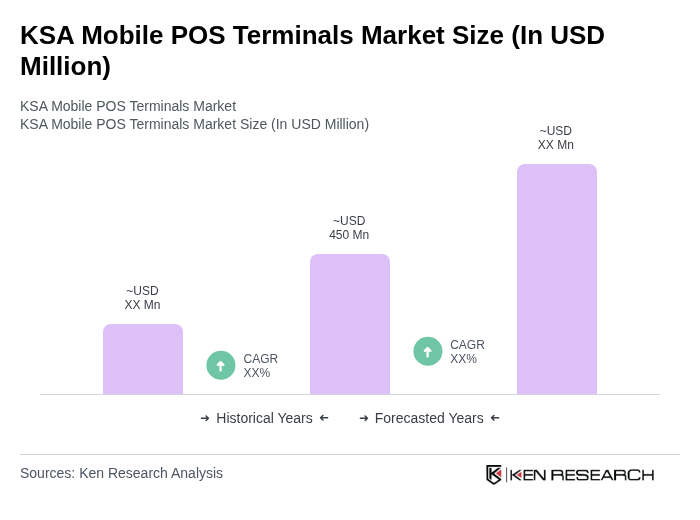

The KSA Mobile POS Terminals Market is valued at approximately USD 450 million, reflecting a significant growth trend driven by the increasing adoption of cashless payment solutions and the rise of e-commerce in the region.