Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1038

Pages:94

Published On:October 2025

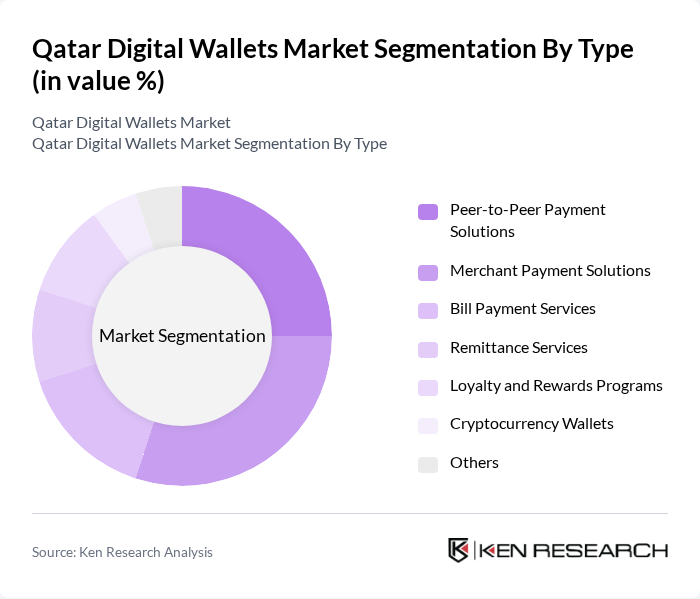

By Type:The digital wallets market can be segmented into various types, including Peer-to-Peer Payment Solutions, Merchant Payment Solutions, Bill Payment Services, Remittance Services, Loyalty and Rewards Programs, Cryptocurrency Wallets, and Others. Each of these sub-segments caters to different consumer needs and preferences, contributing to the overall growth of the market. Peer-to-peer and merchant payment solutions are experiencing the fastest growth, driven by interoperability, ease of use, and increasing merchant acceptance. Remittance services are also expanding rapidly, supported by Qatar’s large expatriate population and real-time corridors .

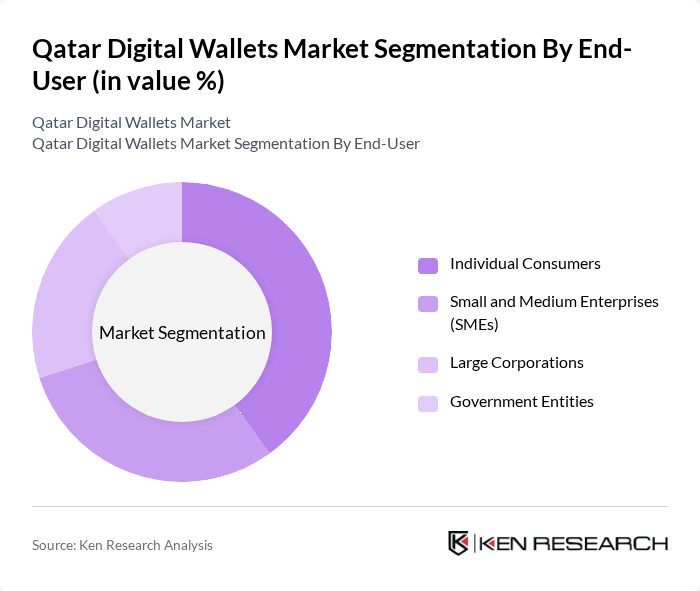

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has unique requirements and usage patterns, influencing the overall dynamics of the digital wallets market. Individual consumers drive the majority of transaction volume, while SMEs and large corporations are increasingly adopting digital wallets for business payments, payroll, and supplier transactions .

The Qatar Digital Wallets Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank (QNB), Doha Bank, Commercial Bank of Qatar, QPay International, Ooredoo Money, Vodafone Qatar, Dwallet Services, PayPal, Apple Pay, Samsung Pay, Google Pay, Al Rayan Bank, Qatar Islamic Bank (QIB), Masraf Al Rayan, 7sab contribute to innovation, geographic expansion, and service delivery in this space .

The future of the digital wallet market in Qatar appears promising, driven by technological advancements and evolving consumer preferences. As the adoption of decentralized finance (DeFi) solutions gains traction, digital wallets are likely to integrate more innovative features, enhancing user experience. Additionally, the increasing focus on biometric authentication will bolster security measures, further encouraging consumer trust. With ongoing government support and a growing e-commerce landscape, the digital wallet market is poised for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Peer-to-Peer Payment Solutions Merchant Payment Solutions Bill Payment Services Remittance Services Loyalty and Rewards Programs Cryptocurrency Wallets Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Application | Retail Payments Online Shopping Utility Payments Travel and Transportation Remittances Others |

| By Distribution Channel | Mobile Applications Web Platforms Third-Party Integrators |

| By User Demographics | Age Groups Income Levels Geographic Distribution |

| By Payment Method | Credit/Debit Card Integration Bank Transfers Cash-in/Cash-out Services |

| By Security Features | Biometric Authentication Two-Factor Authentication Encryption Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Digital Wallet Usage | 120 | Regular Users, Occasional Users, Non-Users |

| Merchant Adoption of Digital Wallets | 60 | Small Business Owners, Retail Managers |

| Corporate Digital Payment Solutions | 50 | Finance Managers, IT Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Regulatory Analysts |

| Fintech Industry Insights | 45 | Industry Experts, Financial Analysts |

The Qatar Digital Wallets Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital payment solutions, e-commerce growth, and a preference for contactless transactions among consumers.