Region:Middle East

Author(s):Dev

Product Code:KRAD4425

Pages:92

Published On:December 2025

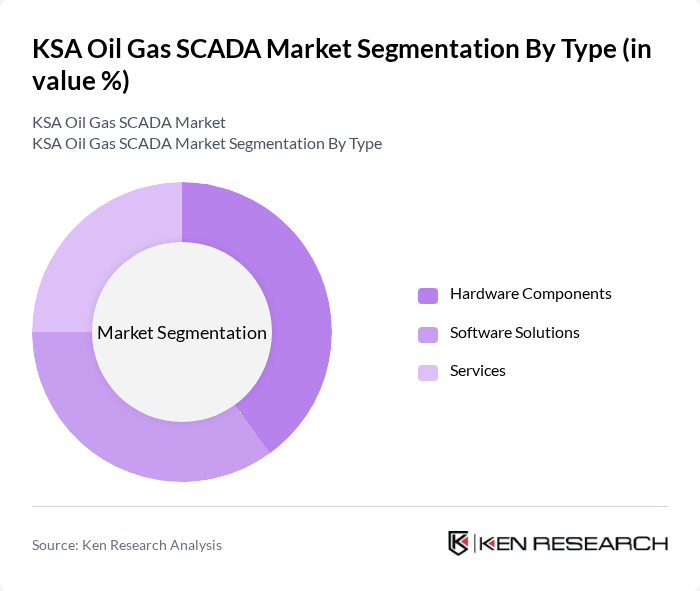

By Type:The segmentation by type includes Hardware Components, Software Solutions, and Services. Each of these subsegments plays a crucial role in the overall market dynamics, with hardware components being essential for the physical infrastructure, software solutions providing the necessary analytics and control capabilities, and services ensuring ongoing support and maintenance.

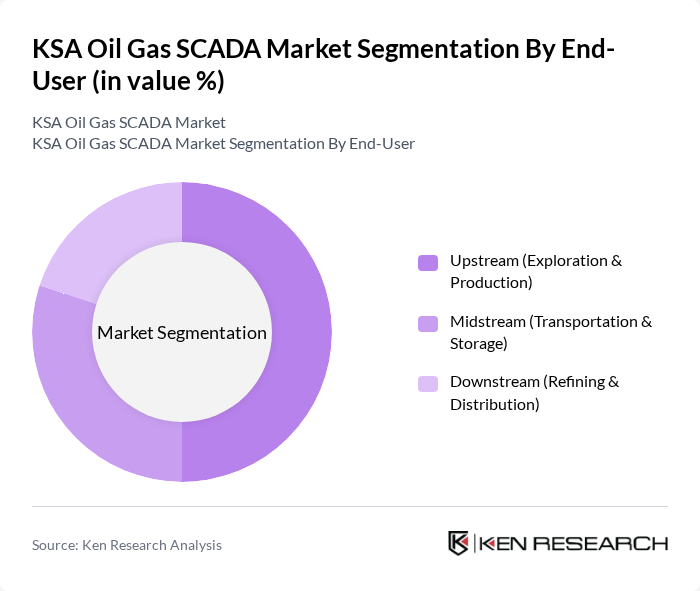

By End-User:The end-user segmentation includes Upstream (Exploration & Production), Midstream (Transportation & Storage), and Downstream (Refining & Distribution). Each segment has unique requirements and applications for SCADA systems, with upstream operations focusing on exploration and production efficiency, midstream on transportation logistics, and downstream on refining processes and distribution management.

The KSA Oil Gas SCADA Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, Schlumberger Limited, Honeywell International Inc., Siemens AG, ABB Ltd., Emerson Electric Co., Yokogawa Electric Corporation, Rockwell Automation Inc., Schneider Electric SE, General Electric Company, Kongsberg Gruppen ASA, Mitsubishi Electric Corporation, National Oilwell Varco Inc., Invensys plc, and Aker Solutions ASA contribute to innovation, geographic expansion, and service delivery in this space.

The KSA oil and gas SCADA market is poised for transformative growth, driven by technological advancements and regulatory support. As companies increasingly adopt cloud-based solutions and IoT technologies, operational efficiencies will improve significantly. Furthermore, the integration of AI for predictive maintenance will enhance system reliability. In future, the market is expected to witness a substantial shift towards sustainable practices, aligning with global environmental standards and enhancing competitiveness in the energy sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Hardware Components Software Solutions Services |

| By End-User | Upstream (Exploration & Production) Midstream (Transportation & Storage) Downstream (Refining & Distribution) |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Component | SCADA Software Remote Terminal Units (RTUs) Programmable Logic Controllers (PLCs) Communication Systems |

| By Application | Pipeline Monitoring Wellhead and Production Monitoring Process Automation & Control Leak Detection & Alarm Management |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production SCADA Systems | 45 | Production Managers, IT Directors |

| Midstream Pipeline Monitoring Solutions | 38 | Operations Supervisors, Safety Managers |

| Downstream Refinery Automation | 42 | Process Engineers, Maintenance Managers |

| SCADA Cybersecurity Measures | 35 | Cybersecurity Analysts, Compliance Officers |

| Integration of IoT in SCADA Systems | 40 | R&D Managers, Technology Strategists |

The KSA Oil Gas SCADA Market is valued at approximately USD 90 million, driven by the increasing demand for automation, real-time monitoring, and enhanced operational efficiency in the oil and gas sector.