Region:Middle East

Author(s):Shubham

Product Code:KRAD3590

Pages:97

Published On:November 2025

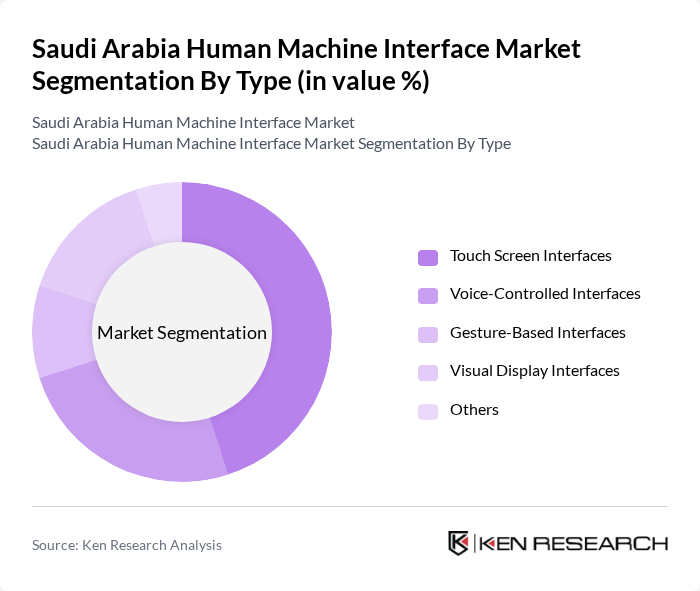

By Type:The market is segmented into Touch Screen Interfaces, Voice-Controlled Interfaces, Gesture-Based Interfaces, Visual Display Interfaces, and Others. Touch Screen Interfaces lead the market due to their intuitive operation, reliability, and widespread use in industrial automation, medical devices, and consumer electronics. The proliferation of smart manufacturing and digital control panels is accelerating the adoption of touch-based HMIs, while voice and gesture interfaces are gaining traction in automotive and healthcare settings for hands-free operation and accessibility .

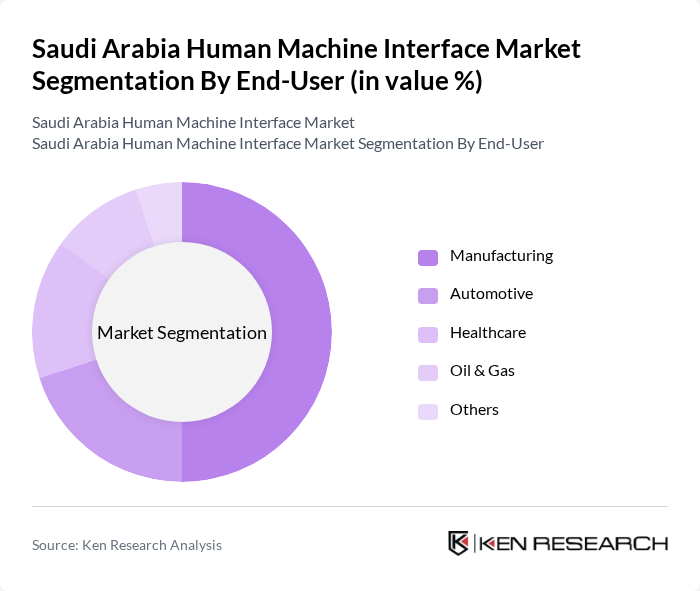

By End-User:End-user segmentation includes Manufacturing, Automotive, Healthcare, Oil & Gas, and Others. Manufacturing remains the dominant sector, driven by the rapid adoption of Industry 4.0, smart factories, and digital process automation. Automotive and healthcare sectors are expanding due to the integration of advanced HMI for safety, diagnostics, and user experience. The oil & gas sector leverages HMI for real-time monitoring and control in critical infrastructure .

The Saudi Arabia Human Machine Interface Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Rockwell Automation, Schneider Electric, Honeywell International Inc., Mitsubishi Electric Corporation, ABB Ltd., Yokogawa Electric Corporation, Omron Corporation, General Electric Company, Advantech Co., Ltd., National Instruments Corporation, B&R Industrial Automation, Beckhoff Automation GmbH, Delta Electronics, Inc., and EATON Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Human Machine Interface market appears promising, driven by ongoing technological advancements and government support. By future, the integration of artificial intelligence and machine learning into HMI systems is expected to enhance operational efficiency and user experience. Additionally, the growing emphasis on cybersecurity will lead to the development of more secure HMI solutions, ensuring data protection and compliance with regulations. These trends will likely foster a more robust market environment, encouraging further investments and innovations.

| Segment | Sub-Segments |

|---|---|

| By Type | Touch Screen Interfaces Voice-Controlled Interfaces Gesture-Based Interfaces Visual Display Interfaces Others |

| By End-User | Manufacturing Automotive Healthcare Oil & Gas Others |

| By Industry Vertical | Aerospace Food & Beverage Pharmaceuticals Utilities Others |

| By Technology | Embedded Technology Software-Based Technology Cloud-Based Technology Others |

| By Application | Process Control Machine Control Data Acquisition Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive HMI Solutions | 100 | Product Managers, Automotive Engineers |

| Healthcare HMI Applications | 60 | Healthcare IT Managers, Clinical Engineers |

| Industrial Automation Interfaces | 70 | Operations Managers, Automation Specialists |

| Consumer Electronics HMI | 50 | Product Development Managers, UX Designers |

| Smart Home Technology Interfaces | 40 | Home Automation Experts, Product Managers |

The Saudi Arabia Human Machine Interface Market is valued at approximately USD 120 million, reflecting a five-year historical analysis. This growth is driven by increased automation in various sectors, including manufacturing, oil & gas, and healthcare.