Region:Middle East

Author(s):Rebecca

Product Code:KRAA9214

Pages:82

Published On:November 2025

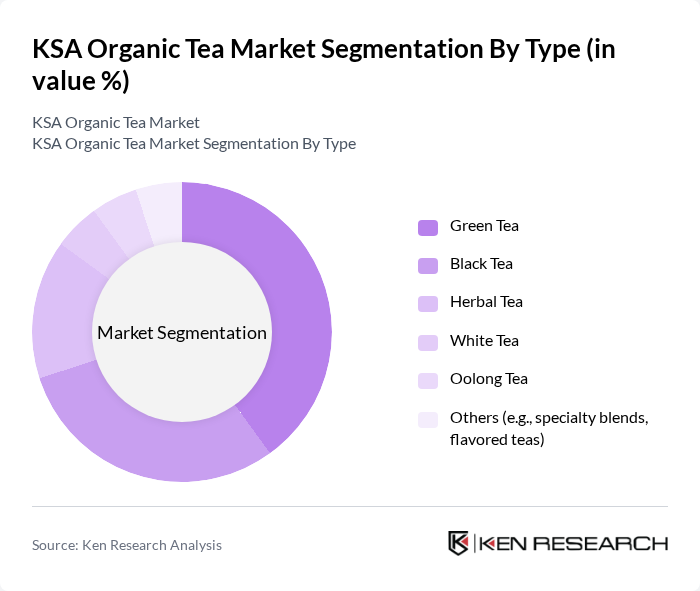

By Type:The market is segmented into various types of organic tea, including Green Tea, Black Tea, Herbal Tea, White Tea, Oolong Tea, and Others (e.g., specialty blends, flavored teas). Among these, Green Tea is the most popular due to its perceived health benefits, including weight management and antioxidant properties. Black Tea follows closely, favored for its robust flavor and versatility in blends. Herbal Tea is gaining traction, especially among health-conscious consumers seeking caffeine-free options. The Others category includes niche products that cater to specific consumer preferences, contributing to the overall diversity of the market.

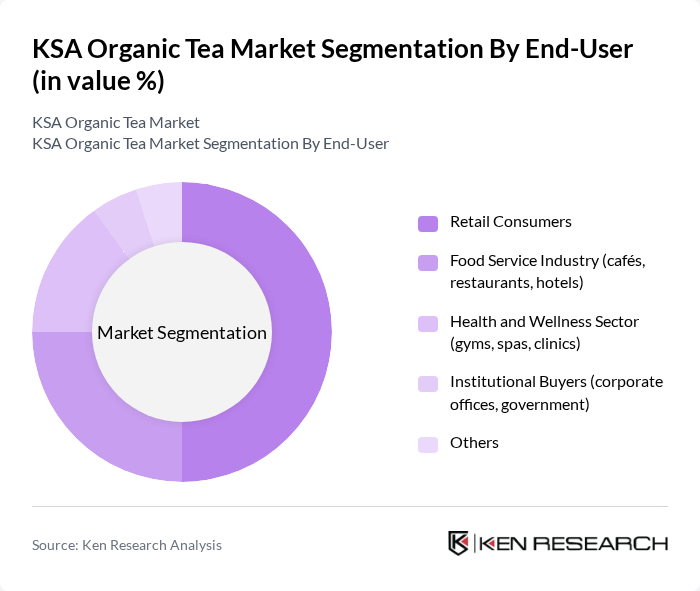

By End-User:The KSA Organic Tea Market is segmented by end-user into Retail Consumers, Food Service Industry (cafés, restaurants, hotels), Health and Wellness Sector (gyms, spas, clinics), Institutional Buyers (corporate offices, government), and Others. Retail Consumers dominate the market, driven by the increasing trend of health-conscious purchasing behavior. The Food Service Industry is also significant, as many establishments are incorporating organic tea into their menus to cater to health-oriented customers. The Health and Wellness Sector is emerging as a key player, with gyms and spas offering organic tea as part of their wellness programs.

The KSA Organic Tea Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Wazir Tea, Ahmad Tea, Twinings, Dilmah, Yogi Tea, Pukka Herbs, Organic India, Celestial Seasonings, Harney & Sons, Teavana, Numi Organic Tea, Rishi Tea, Stash Tea, Tazo Tea, The Republic of Tea, Equal Exchange, Tata Consumer Products, Unilever (Lipton Organic), Madura Tea Estates, Halssen & Lyon contribute to innovation, geographic expansion, and service delivery in this space.

The future outlook for the KSA organic tea market appears promising, driven by increasing health awareness and a shift towards natural products. As consumer preferences evolve, the market is likely to witness a surge in demand for innovative organic tea blends and herbal options. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing consumers to explore diverse offerings. This dynamic environment presents opportunities for brands to engage with health-conscious consumers and capitalize on the growing trend of sustainable living.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Tea Black Tea Herbal Tea White Tea Oolong Tea Others (e.g., specialty blends, flavored teas) |

| By End-User | Retail Consumers Food Service Industry (cafés, restaurants, hotels) Health and Wellness Sector (gyms, spas, clinics) Institutional Buyers (corporate offices, government) Others |

| By Packaging Type | Loose Leaf Tea Bags (standard, pyramid, sachets) Bottled Tea (RTD - Ready to Drink) Cartons, Paper Pouches, Cans Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience/Grocery Stores Online Retail (e-commerce, D2C) Specialty Tea Boutiques Food Service Industry Others |

| By Region | Northern and Central Region Western Region Eastern Region Southern Region |

| By Price Range | Premium Mid-Range Budget Others |

| By Consumer Demographics | Age Group Gender Income Level Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Organic Tea | 120 | Health-conscious Consumers, Organic Product Buyers |

| Retail Distribution Channels for Organic Tea | 60 | Retail Managers, Category Buyers |

| Production Insights from Organic Tea Farmers | 40 | Tea Farmers, Agricultural Consultants |

| Market Trends from Health and Wellness Experts | 50 | Nutritionists, Wellness Coaches |

| Sales Strategies from Organic Tea Brands | 45 | Marketing Managers, Brand Strategists |

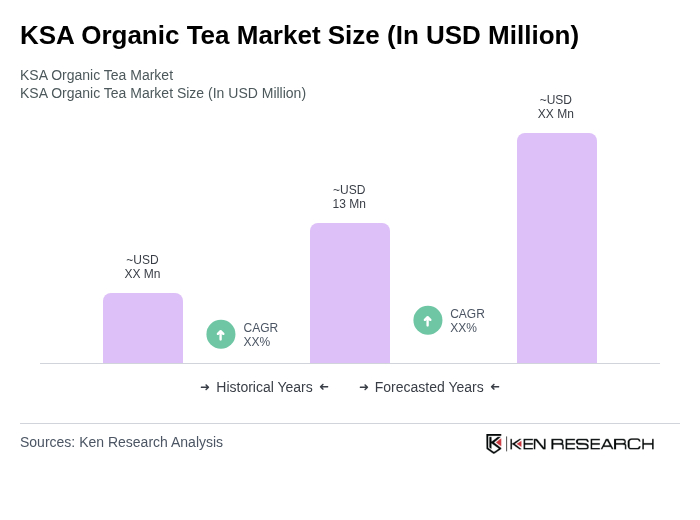

The KSA Organic Tea Market is valued at approximately USD 13 million, reflecting a significant growth trend driven by increasing health consciousness and a rising demand for organic products among consumers in Saudi Arabia.