Region:Asia

Author(s):Shubham

Product Code:KRAA8719

Pages:92

Published On:November 2025

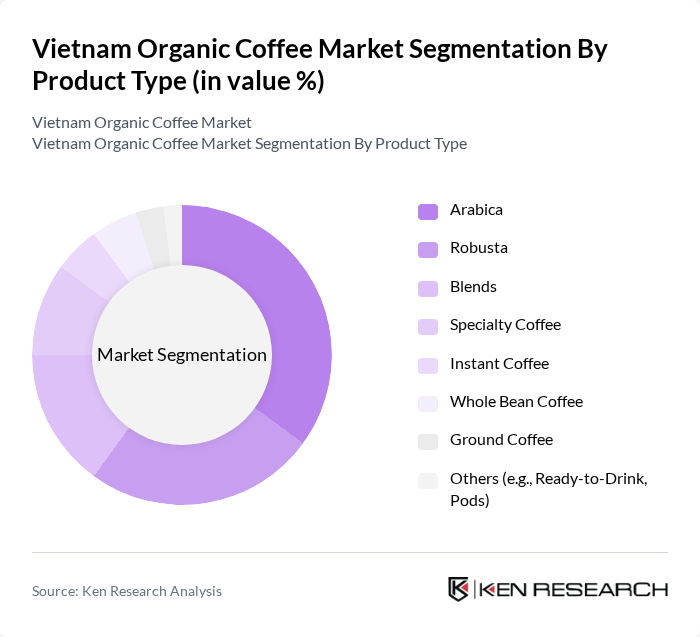

By Product Type:The product type segmentation includes various forms of organic coffee, catering to diverse consumer preferences. The subsegments are Arabica, Robusta, Blends, Specialty Coffee, Instant Coffee, Whole Bean Coffee, Ground Coffee, and Others (e.g., Ready-to-Drink, Pods). Arabica coffee is increasingly popular due to its superior flavor profile and growing demand among specialty coffee consumers. The premiumization trend is driving growth in specialty and blended coffee products, as consumers seek unique, high-quality experiences and are willing to pay more for traceable, sustainably sourced coffee .

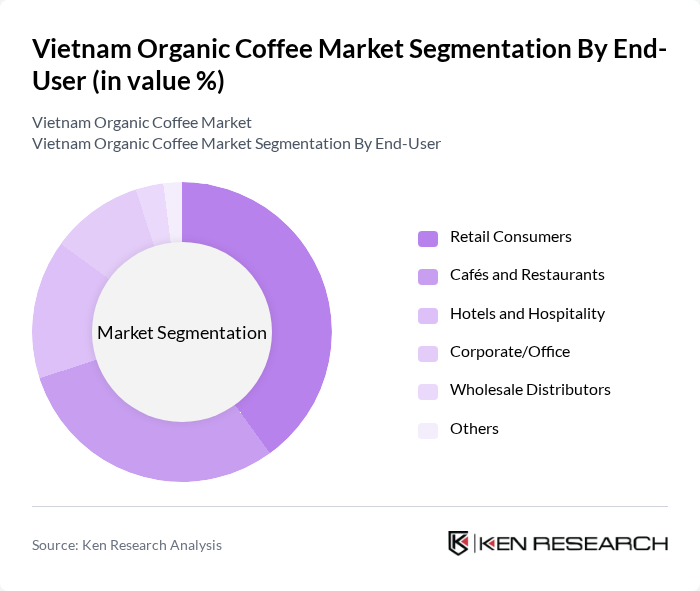

By End-User:The end-user segmentation encompasses various consumer categories, including Retail Consumers, Cafés and Restaurants, Hotels and Hospitality, Corporate/Office, Wholesale Distributors, and Others. Retail consumers are the largest segment, driven by the increasing trend of home brewing, the influence of specialty coffee culture, and the rising popularity of organic products. Cafés and restaurants are significant buyers, seeking to differentiate their offerings with high-quality, traceable organic coffee. The corporate sector is gradually adopting organic coffee for office consumption, reflecting a broader trend toward wellness and sustainability in workplace environments .

The Vietnam Organic Coffee Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trung Nguyên Legend, Highlands Coffee, Vinacafe Biên Hòa, Mê Trang Coffee, Phúc Long Coffee & Tea, G7 Coffee (Trung Nguyên Group), The Coffee House, Katinat Saigon Kafe, La Viet Coffee, Oriberry Coffee, An Phú Organic Coffee, Bosgaurus Coffee Roasters, Dalat Farm Coffee, Eatu Farm (Dak Lak), Organik ?à L?t contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Vietnam organic coffee market appears promising, driven by increasing health consciousness and a growing preference for sustainable products. As the government continues to support organic farming initiatives, the market is expected to witness significant growth. Additionally, the rise of e-commerce platforms will facilitate access to organic coffee, enhancing consumer reach. With the development of specialty coffee segments, the market is poised for innovation, catering to diverse consumer preferences and expanding its footprint in both domestic and international markets.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Arabica Robusta Blends Specialty Coffee Instant Coffee Whole Bean Coffee Ground Coffee Others (e.g., Ready-to-Drink, Pods) |

| By End-User | Retail Consumers Cafés and Restaurants Hotels and Hospitality Corporate/Office Wholesale Distributors Others |

| By Packaging Type | Bags Pods Cans Boxes/Cartons Others |

| By Distribution Channel | Online Retail/E-commerce Supermarkets/Hypermarkets Convenience Stores Specialty Stores Cafés/Coffee Shops Others (Direct-to-Consumer, HORECA) |

| By Region | Northern Vietnam Central Vietnam Southern Vietnam Others |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences Urban vs Rural Others |

| By Organic Certification Type | USDA Organic EU Organic JAS (Japanese Agricultural Standard) Local Vietnamese Certifications (e.g., VietGAP, TCVN) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Organic Coffee Farmers | 60 | Farm Owners, Cooperative Leaders |

| Retailers of Organic Coffee | 50 | Store Managers, Product Buyers |

| Consumers of Organic Coffee | 100 | Health-Conscious Shoppers, Coffee Enthusiasts |

| Exporters of Organic Coffee | 40 | Export Managers, Trade Specialists |

| Industry Experts and Analysts | 40 | Agricultural Economists, Market Analysts |

The Vietnam Organic Coffee Market is valued at approximately USD 510 million, reflecting a significant growth trend driven by increasing consumer demand for organic and specialty products, health consciousness, and the expansion of café culture in urban areas.