Region:Middle East

Author(s):Dev

Product Code:KRAD7732

Pages:90

Published On:December 2025

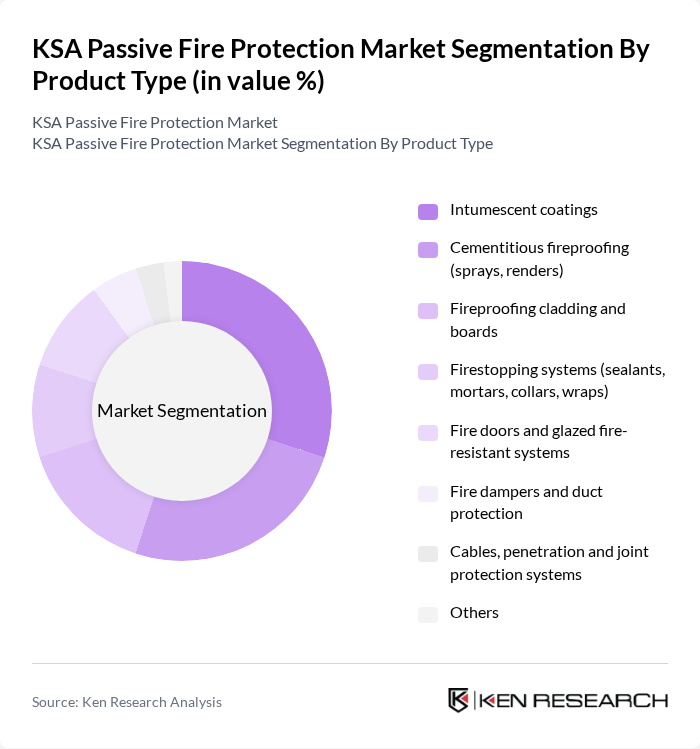

By Product Type:The product type segmentation includes various subsegments that cater to different fire protection needs. The dominant subsegment in this category is intumescent coatings, which are widely used for their effectiveness in protecting structural steel from fire and expected to register the fastest growth. Cementitious fireproofing is also significant due to its application in various construction projects and status as the largest revenue-generating segment. Firestopping systems are gaining traction as they are essential for maintaining the integrity of fire-rated walls and floors. The demand for fire doors and glazed fire-resistant systems is also on the rise, driven by safety regulations and building codes.

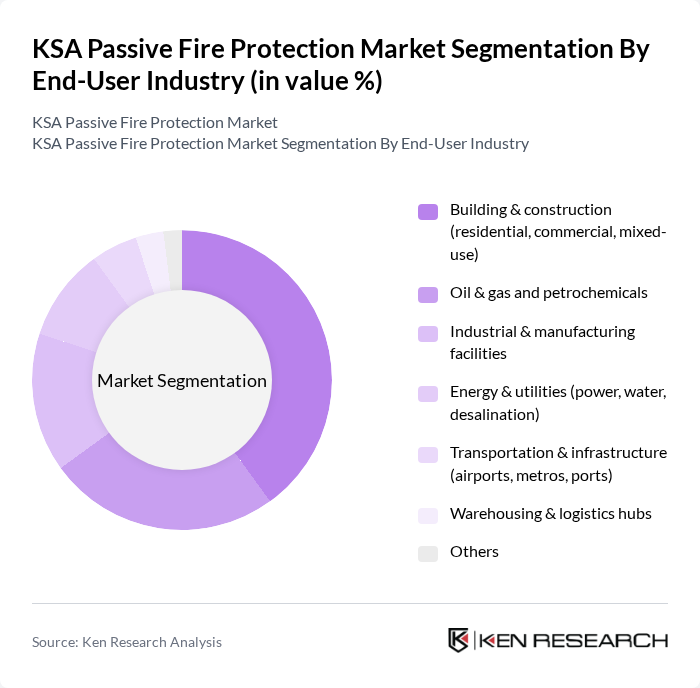

By End-User Industry:The end-user industry segmentation highlights the various sectors utilizing passive fire protection solutions. The building and construction sector is the largest consumer, driven by ongoing residential and commercial projects. The oil and gas industry also significantly contributes to the market due to stringent safety requirements in facilities. Industrial and manufacturing facilities are increasingly adopting fire protection measures to comply with safety regulations. The energy and utilities sector is also a key player, particularly in power generation and water desalination projects.

The KSA Passive Fire Protection Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hilti Group, 3M Company, RPM International Inc. (including Carboline), Jotun Saudi Arabia, Sherwin-Williams (Saudi Arabia), Hempel Saudi Arabia, Sika Saudi Arabia, Promat (Etex Group), Saint-Gobain (including Gyproc Saudi Arabia), ROCKWOOL Saudi Arabia, NAFFCO KSA, Firestop Middle East (KSA operations), Riyadh Fireproofing & Insulation Co. (RFIC), Al-Babtain Power & Telecom (fire-rated cable management and enclosures), Bin Ghurair Trading & Contracting (fire doors and passive systems) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA passive fire protection market is poised for significant growth, driven by ongoing construction projects and heightened regulatory scrutiny. As the government continues to invest in infrastructure and urban development, the demand for advanced fire safety solutions will increase. Additionally, the integration of smart technologies in building designs will enhance fire safety measures, creating a more robust market environment. Stakeholders are expected to focus on innovative materials and training programs to address current challenges and capitalize on emerging opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Intumescent coatings Cementitious fireproofing (sprays, renders) Fireproofing cladding and boards Firestopping systems (sealants, mortars, collars, wraps) Fire doors and glazed fire-resistant systems Fire dampers and duct protection Cables, penetration and joint protection systems Others |

| By End-User Industry | Building & construction (residential, commercial, mixed-use) Oil & gas and petrochemicals Industrial & manufacturing facilities Energy & utilities (power, water, desalination) Transportation & infrastructure (airports, metros, ports) Warehousing & logistics hubs Others |

| By Application | Structural steel protection Compartmentation (walls, floors, ceilings) Opening and penetration protection Ducts, pipes and cable tray protection New construction Retrofitting & refurbishment Maintenance & repair Others |

| By Material Class | Cementitious and gypsum-based materials Intumescent and epoxy-based coatings Mineral wool, stone wool and fiber-based systems Calcium silicate and other inorganic boards Polymer and composite-based materials Others |

| By Distribution Channel | Direct project sales (to contractors and EPCs) Authorized distributors and dealers Specialized applicators and installers Online and e-procurement platforms Others |

| By Region | Central Region (Riyadh & surrounding) Eastern Region (Dammam, Dhahran, Jubail) Western Region (Jeddah, Makkah, Madinah, Red Sea projects) Southern Region Northern Region |

| By Regulatory & Certification Compliance | Compliance with Saudi Building Code (SBC) Civil Defense approvals International fire standards (UL, FM, EN) Green building and sustainability certifications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Projects | 60 | Project Managers, Safety Compliance Officers |

| Residential Fire Safety Installations | 50 | Home Builders, Architects |

| Industrial Facility Fire Protection | 40 | Facility Managers, Safety Engineers |

| Government Infrastructure Projects | 40 | Public Works Officials, Safety Inspectors |

| Fire Safety Equipment Suppliers | 50 | Sales Managers, Product Development Leads |

The KSA Passive Fire Protection Market is valued at approximately USD 45 million, driven by increasing construction activities, stringent fire safety regulations, and heightened awareness of fire safety standards across various industries, particularly in high-rise buildings and industrial facilities.