Region:Middle East

Author(s):Dev

Product Code:KRAD0410

Pages:100

Published On:August 2025

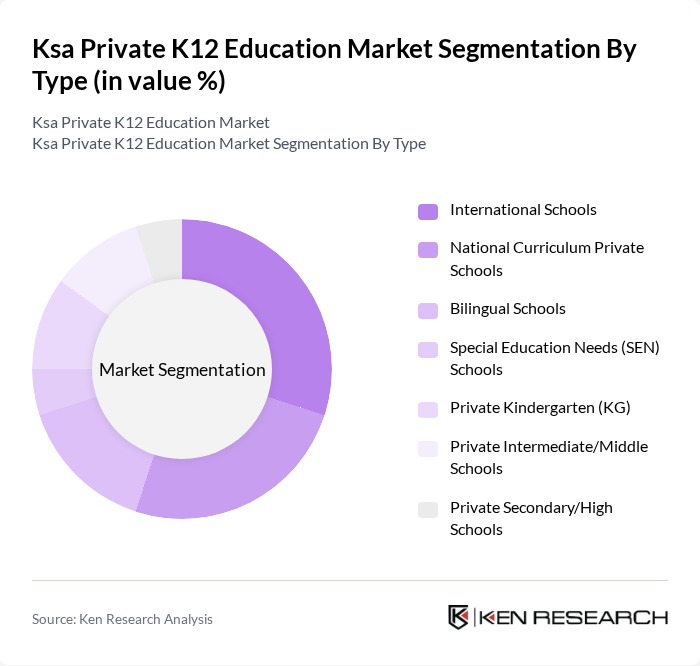

By Type:The Ksa Private K12 Education Market can be segmented into various types, including International Schools, National Curriculum Private Schools, Bilingual Schools, Special Education Needs (SEN) Schools, Private Kindergarten (KG), Private Intermediate/Middle Schools, and Private Secondary/High Schools. Each of these segments caters to different educational needs and preferences of families. Operators increasingly offer multiple curricula (e.g., American, British, IB) and bilingual models to serve both Saudi and expatriate families, aligned with Vision 2030’s emphasis on internationalization and quality enhancement.

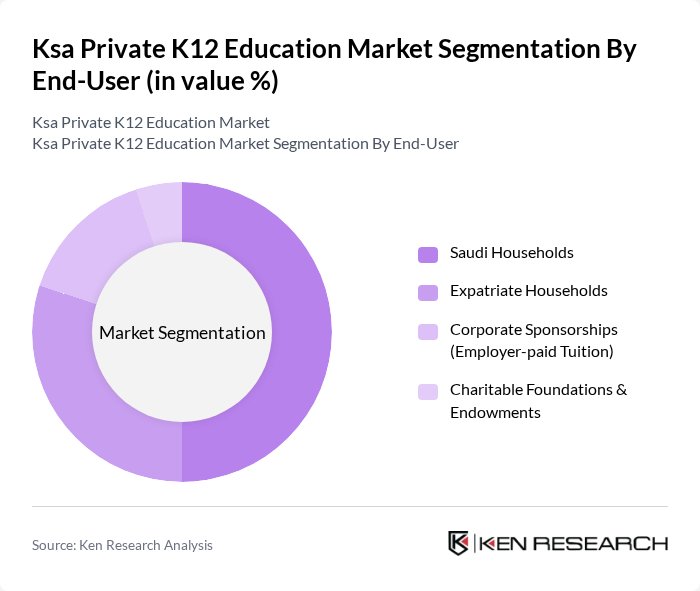

By End-User:The end-users of the Ksa Private K12 Education Market include Saudi Households, Expatriate Households, Corporate Sponsorships (Employer-paid Tuition), and Charitable Foundations & Endowments. Each of these segments reflects the diverse demographic and economic landscape of the Kingdom.

The Ksa Private K12 Education Market is characterized by a dynamic mix of regional and international players. Leading participants such as ATAA Educational Company (???? ???? ?????????), Maarif for Education & Training (????? ???????), National Company for Learning & Education – NCLE (?????? ??????? ???????), Kingdom Schools (????? ???????), Al Rowad International Schools (????? ??????), British International School of Jeddah – BISJ, American International School of Riyadh – AISR, International Schools Group – ISG (Dhahran, Dammam, Jubail), The International Schools of Choueifat – SABIS (Riyadh, Jeddah, Al Khobar), GEMS Education (Saudi Arabia operations), Aldenham Education Group – Aldenham Prep Riyadh, Downe House Riyadh, Lycée Français International de Riyad (AEFE network), International Indian School, Riyadh (IISR), Philippine International School in Riyadh (PISR) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA private K12 education market is poised for significant transformation, driven by ongoing government reforms and technological advancements. As the demand for quality education continues to rise, private institutions will likely adapt by enhancing their curricula and adopting innovative teaching methods. The focus on personalized learning and STEM education will shape future offerings, while partnerships with international institutions may further enrich the educational landscape, ensuring that KSA remains competitive in the global education arena.

| Segment | Sub-Segments |

|---|---|

| By Type | International Schools National Curriculum Private Schools Bilingual Schools Special Education Needs (SEN) Schools Private Kindergarten (KG) Private Intermediate/Middle Schools Private Secondary/High Schools |

| By End-User | Saudi Households Expatriate Households Corporate Sponsorships (Employer-paid Tuition) Charitable Foundations & Endowments |

| By Region | Riyadh (Central Region) Eastern Province (Dammam–Khobar–Dhahran) Makkah Region (Jeddah–Makkah–Taif) Madinah & Western Region (incl. Yanbu) Asir & Southern Region Northern Region |

| By Curriculum | Saudi National (Arabic) International Baccalaureate (IB) British (IGCSE/A-Levels) American (Common Core/Advanced Placement) Indian (CBSE/ICSE) Other International (e.g., French, Pakistani, Philippine) |

| By School Size | Small Schools (?500 students) Medium Schools (501–1,500 students) Large Schools (>1,500 students) |

| By Funding Source | Tuition & Fees Private Investors/Owners Corporate & Employer Contributions Philanthropy/Endowments |

| By Policy Support | Investment Licensing (MEWA/MISA and MoE approvals) Saudization & Teacher Accreditation Compliance PPPs and Land Lease Incentives Quality Assurance & Inspection Ratings (NCAAA/MoE) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private School Administrators | 90 | Principals, School Directors |

| Parents of K12 Students | 140 | Parents, Guardians |

| Educators in Private Schools | 80 | Teachers, Curriculum Coordinators |

| Education Policy Experts | 50 | Policy Analysts, Education Consultants |

| Private Education Investors | 40 | Investors, Financial Analysts |

The KSA Private K12 Education Market is valued at approximately USD 20 billion, reflecting significant growth driven by increasing demand for quality education, a rising expatriate population, and government initiatives aimed at enhancing educational standards.