Region:Middle East

Author(s):Rebecca

Product Code:KRAC3964

Pages:81

Published On:October 2025

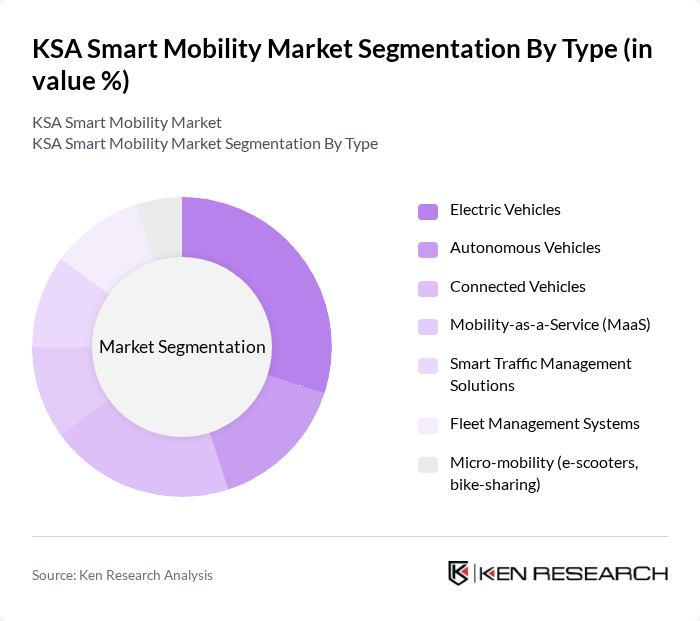

By Type:The KSA Smart Mobility Market can be segmented into various types, including Electric Vehicles, Autonomous Vehicles, Connected Vehicles, Mobility-as-a-Service (MaaS), Smart Traffic Management Solutions, Fleet Management Systems, and Micro-mobility (e-scooters, bike-sharing). Each of these segments plays a crucial role in shaping the future of transportation in the Kingdom, with electric and autonomous vehicles gaining traction due to government support and technological advancements, while shared mobility and smart traffic solutions are expanding in urban centers.

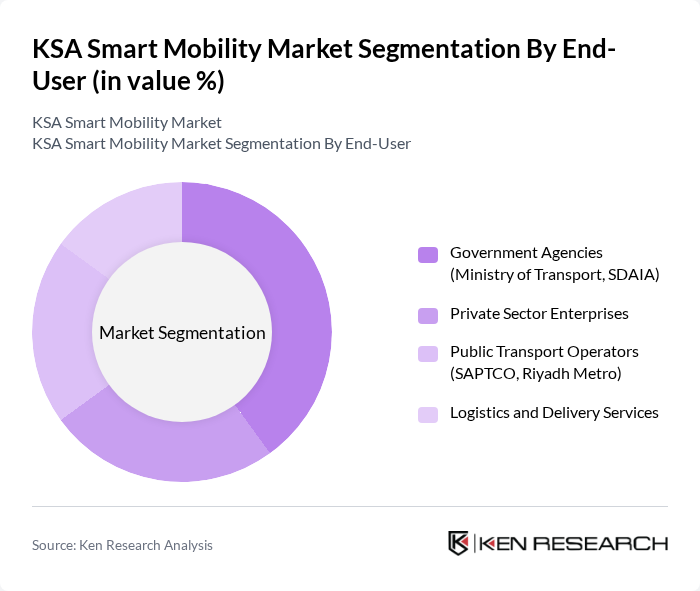

By End-User:The end-user segmentation of the KSA Smart Mobility Market includes Government Agencies (Ministry of Transport, SDAIA), Private Sector Enterprises, Public Transport Operators (SAPTCO, Riyadh Metro), and Logistics and Delivery Services. Each of these end-users has unique requirements and contributes to the overall growth of the market, with government agencies playing a leading role in policy implementation and infrastructure development, while private enterprises and logistics providers drive innovation and service expansion.

The KSA Smart Mobility Market is characterized by a dynamic mix of regional and international players. Leading participants such as Uber Technologies, Inc., Careem Networks FZ LLC, Tesla, Inc., Siemens AG, Alstom S.A., Huawei Technologies Co., Ltd., Ford Motor Company, General Motors Company, Nissan Motor Corporation, BMW AG, Volkswagen AG, BYD Company Limited, SAPTCO (Saudi Public Transport Company), Riyadh Metro Project (Arriyadh Development Authority), SDAIA (Saudi Data and Artificial Intelligence Authority) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA Smart Mobility Market is poised for significant transformation as urbanization accelerates and government initiatives gain momentum. In future, advancements in technology, particularly in AI and IoT, will enhance mobility solutions, making them more efficient and user-friendly. The integration of smart traffic management systems and the expansion of electric vehicle infrastructure will further support sustainable transportation. As public awareness grows, the market is expected to embrace innovative solutions that align with global sustainability goals, fostering a more connected and efficient urban environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Electric Vehicles Autonomous Vehicles Connected Vehicles Mobility-as-a-Service (MaaS) Smart Traffic Management Solutions Fleet Management Systems Micro-mobility (e-scooters, bike-sharing) |

| By End-User | Government Agencies (Ministry of Transport, SDAIA) Private Sector Enterprises Public Transport Operators (SAPTCO, Riyadh Metro) Logistics and Delivery Services |

| By Application | Urban Mobility Intercity Transportation Last-Mile Delivery Emergency Services |

| By Distribution Channel | Direct Sales Online Platforms Dealerships |

| By Investment Source | Government Funding Private Investments Public-Private Partnerships (PPP) |

| By Policy Support | Subsidies for Electric Vehicles Tax Incentives for Smart Mobility Solutions Grants for Research and Development |

| By User Demographics | Age Groups Income Levels Urban vs Rural Users |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Public Transportation Innovations | 100 | Transport Authority Officials, Urban Mobility Planners |

| Electric Vehicle Adoption | 75 | Automotive Industry Experts, EV Manufacturers |

| Smart Infrastructure Development | 60 | Civil Engineers, Infrastructure Project Managers |

| Mobility-as-a-Service (MaaS) Solutions | 55 | Technology Providers, Service Operators |

| Urban Mobility Trends | 50 | Urban Planners, Policy Analysts |

The KSA Smart Mobility Market is valued at approximately USD 6.7 billion, driven by government initiatives to diversify the economy, enhance urban infrastructure, and promote sustainable transportation solutions, including electric and autonomous vehicles.