Region:Middle East

Author(s):Rebecca

Product Code:KRAC4021

Pages:91

Published On:October 2025

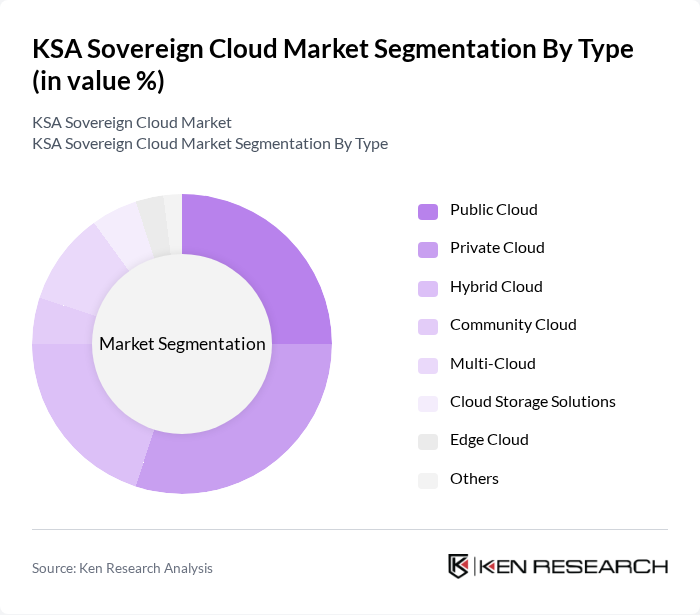

By Type:The market is segmented into various types of cloud services, including Public Cloud, Private Cloud, Hybrid Cloud, Community Cloud, Multi-Cloud, Cloud Storage Solutions, Edge Cloud, and Others. Each type serves different business needs and preferences, with organizations increasingly opting for hybrid and multi-cloud solutions to enhance flexibility and security. The growing emphasis on hybrid and multi-cloud environments is driven by the need for operational resilience, regulatory compliance, and workload optimization across sectors .

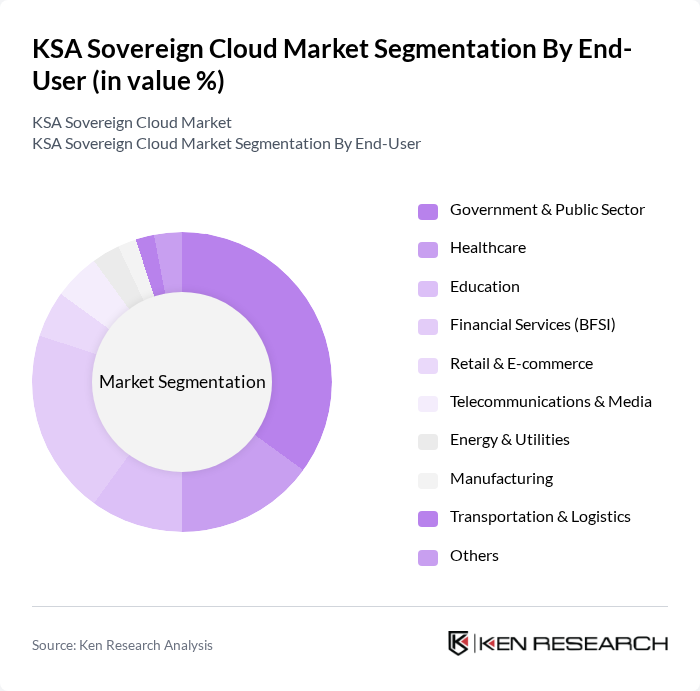

By End-User:The end-user segmentation includes Government & Public Sector, Healthcare, Education, Financial Services (BFSI), Retail & E-commerce, Telecommunications & Media, Energy & Utilities, Manufacturing, Transportation & Logistics, and Others. The government and BFSI sectors are leading the adoption of sovereign cloud solutions due to stringent data compliance requirements and the need for secure data management. Large enterprises, particularly in government and financial services, are the most prominent users, driven by regulatory mandates and the need for robust data protection .

The KSA Sovereign Cloud Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Cloud, Mobily, Zain KSA, Oracle, Microsoft Azure, Amazon Web Services (AWS), IBM Cloud, Google Cloud, SAP, Huawei Cloud, Alibaba Cloud, DigitalOcean, Rackspace Technology, OVHcloud, T-Systems, Cloud4C, Nutanix, Bespin Global contribute to innovation, geographic expansion, and service delivery in this space.

The KSA sovereign cloud market is poised for significant growth, driven by government initiatives and increasing demand for localized data solutions. As organizations prioritize data sovereignty and compliance, the adoption of hybrid cloud models is expected to rise. Furthermore, advancements in AI and machine learning will enhance cloud capabilities, enabling businesses to leverage data more effectively. The focus on cybersecurity will also shape the market, as investments in secure cloud infrastructures become paramount for organizations navigating regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Community Cloud Multi-Cloud Cloud Storage Solutions Edge Cloud Others |

| By End-User | Government & Public Sector Healthcare Education Financial Services (BFSI) Retail & E-commerce Telecommunications & Media Energy & Utilities Manufacturing Transportation & Logistics Others |

| By Application | Data Backup and Recovery Disaster Recovery Big Data Analytics Application Development and Testing Cloud Hosting AI & Machine Learning Workloads IoT & Edge Applications Others |

| By Deployment Model | On-Premises Off-Premises Managed Services Hosted Private Cloud Others |

| By Industry Vertical | Government and Public Sector BFSI (Banking, Financial Services, and Insurance) Manufacturing Energy and Utilities Transportation and Logistics Healthcare & Life Sciences Retail & E-commerce Telecommunications & Media Others |

| By Service Type | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Cloud Security Services Data Residency & Compliance Services Others |

| By Pricing Model | Pay-as-you-go Subscription-based Reserved Instances Consumption-based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 100 | IT Managers, CTOs, CIOs |

| SME Cloud Utilization | 80 | Business Owners, IT Consultants |

| Government Cloud Initiatives | 60 | Public Sector IT Directors, Policy Makers |

| Healthcare Cloud Solutions | 50 | Healthcare IT Managers, Compliance Officers |

| Financial Services Cloud Strategies | 40 | Risk Managers, IT Security Officers |

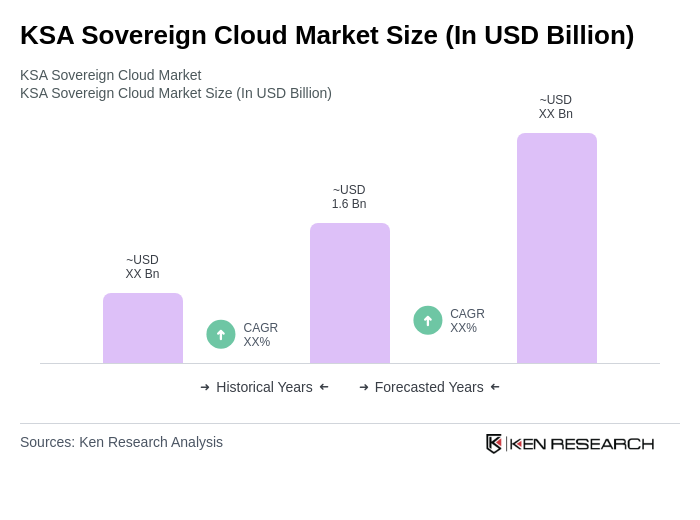

The KSA Sovereign Cloud Market is valued at approximately USD 1.6 billion, reflecting significant growth driven by increasing demand for data sovereignty, enhanced security measures, and digital transformation initiatives across various sectors in the Kingdom.