Region:Middle East

Author(s):Shubham

Product Code:KRAD0923

Pages:99

Published On:November 2025

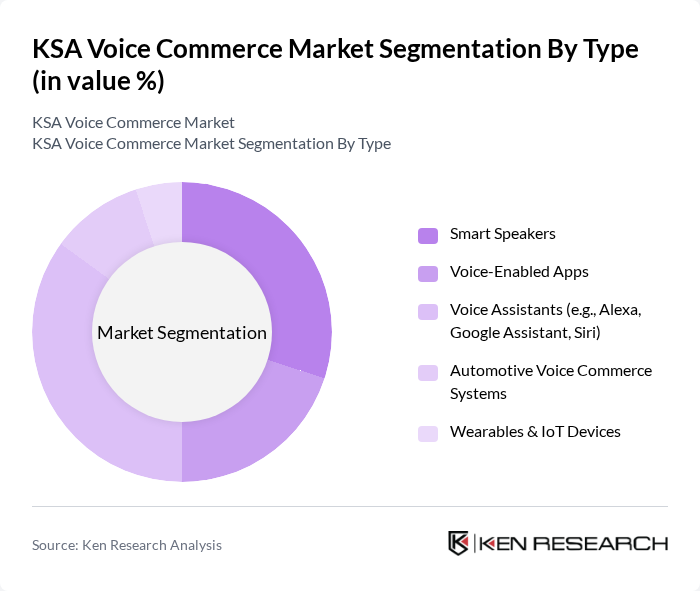

By Type:The KSA Voice Commerce Market is segmented into Smart Speakers, Voice-Enabled Apps, Voice Assistants, Automotive Voice Commerce Systems, and Wearables & IoT Devices. Among these, Voice Assistants are at the forefront due to their integration with smartphones and smart home devices, enabling seamless, hands-free interactions for shopping and payments. Smart Speakers also maintain a strong presence, driven by their multifunctionality and increasing household penetration.

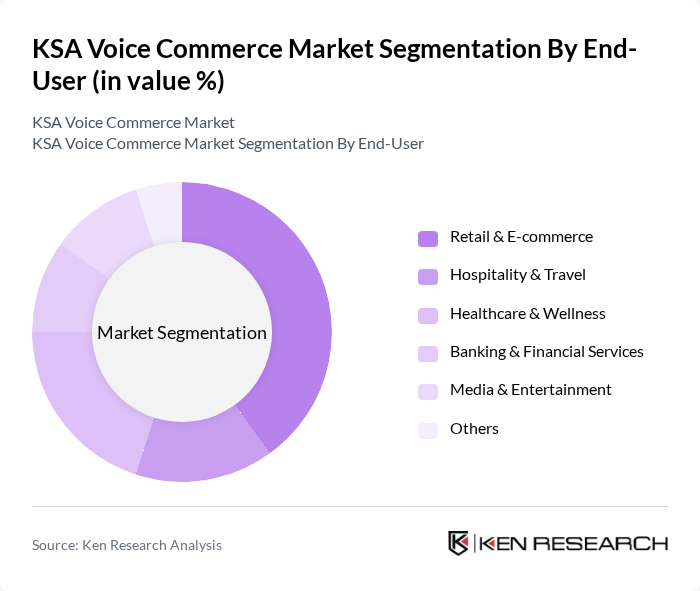

By End-User:The market is also segmented by end-users, including Retail & E-commerce, Hospitality & Travel, Healthcare & Wellness, Banking & Financial Services, Media & Entertainment, and Others. Retail & E-commerce leads due to the surge in online shopping and the convenience of voice-activated purchasing, while Healthcare & Wellness is rapidly adopting voice solutions for patient engagement and telehealth services.

The KSA Voice Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon (Amazon.sa, Alexa), Google (Google Assistant, Google Pay KSA), Apple (Siri, Apple Pay KSA), Microsoft (Cortana, Azure Cognitive Services), Noon (Noon.com, Noon Voice Shopping), STC (Saudi Telecom Company, STC Pay, AI Voice Solutions), Huawei (HiVoice, AppGallery KSA), IBM (Watson Assistant, KSA Deployments), Nuance Communications (Microsoft, Healthcare Voice Solutions), Baidu (DuerOS, Arabic Language Initiatives), Sestek (Conversational AI, KSA Deployments), Unifonic (KSA-based Conversational Commerce), Oracle (Oracle Digital Assistant, KSA Cloud), Cisco (Webex Voice, KSA Enterprise Solutions), Facebook (Meta, WhatsApp Voice Commerce) contribute to innovation, geographic expansion, and service delivery in this space.

The KSA voice commerce market is poised for significant growth, driven by technological advancements and changing consumer behaviors. As artificial intelligence and machine learning technologies evolve, they will enhance voice recognition accuracy and user experience. Additionally, the integration of voice commerce with social media platforms is expected to create new avenues for engagement and sales. Businesses that prioritize personalized customer experiences will likely gain a competitive edge, positioning themselves favorably in this rapidly evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Speakers Voice-Enabled Apps Voice Assistants (e.g., Alexa, Google Assistant, Siri) Automotive Voice Commerce Systems Wearables & IoT Devices |

| By End-User | Retail & E-commerce Hospitality & Travel Healthcare & Wellness Banking & Financial Services Media & Entertainment Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Technology | Natural Language Processing (NLP) Machine Learning & AI Cloud-Based Voice Platforms Edge Computing Solutions Others |

| By Application | Customer Service & Support Sales and Marketing Order Management & Fulfillment Payments & Transactions Others |

| By Investment Source | Private Investments Government Funding Venture Capital Corporate Investments Others |

| By Policy Support | Incentives for Digital Transformation Grants for Technology Development Tax Benefits for Startups Regulatory Sandboxes for Voice Commerce Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Voice Commerce Adoption | 80 | Retail Managers, E-commerce Directors |

| Consumer Preferences in Voice Shopping | 120 | General Consumers, Tech-savvy Shoppers |

| Voice Technology Providers | 60 | Product Managers, Business Development Executives |

| Hospitality Sector Voice Commerce Usage | 40 | Hotel Managers, Customer Experience Officers |

| Banking and Financial Services Voice Transactions | 40 | Banking Executives, Digital Transformation Leads |

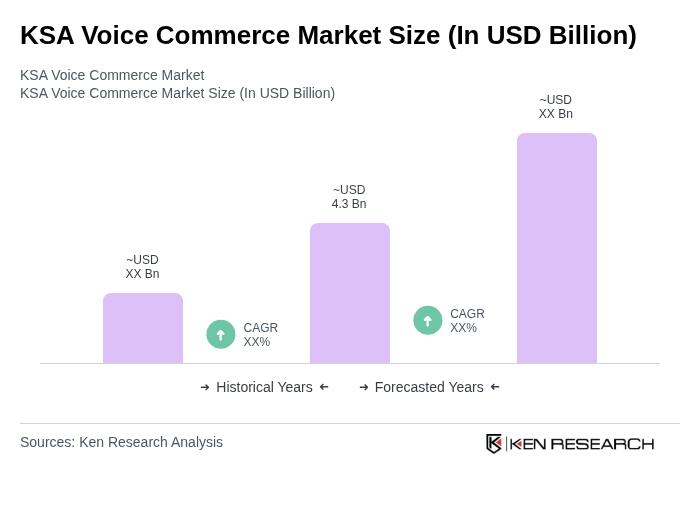

The KSA Voice Commerce Market is valued at approximately USD 4.3 billion, driven by the rapid adoption of smart devices, robust internet connectivity, and a growing consumer preference for hands-free technology in digital transactions.