Region:Middle East

Author(s):Shubham

Product Code:KRAA8833

Pages:84

Published On:November 2025

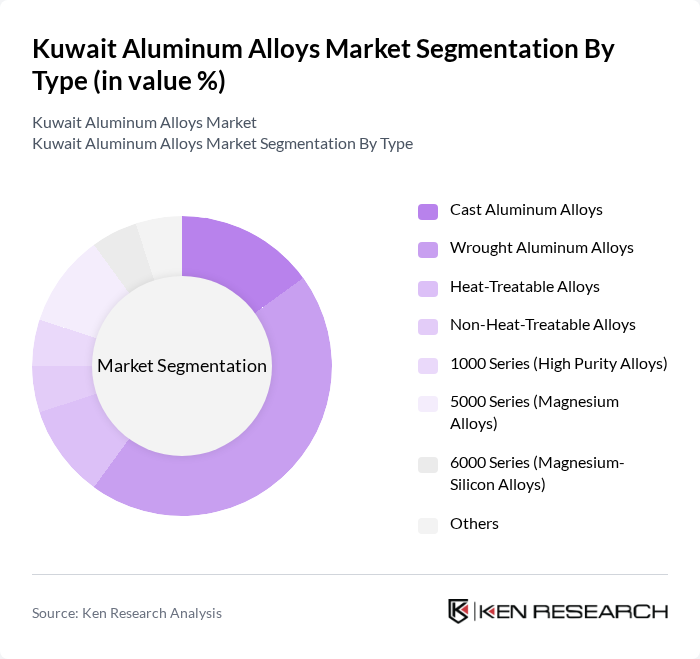

By Type:The aluminum alloys market is segmented into Cast Aluminum Alloys, Wrought Aluminum Alloys, Heat-Treatable Alloys, Non-Heat-Treatable Alloys, 1000 Series (High Purity Alloys), 5000 Series (Magnesium Alloys), 6000 Series (Magnesium-Silicon Alloys), and Others. Among these,Wrought Aluminum Alloysdominate the market due to their superior mechanical properties, formability, and versatility across automotive, aerospace, and construction applications. The demand for lightweight, high-strength materials continues to drive the preference for wrought alloys, which are essential for structural and safety-critical components .

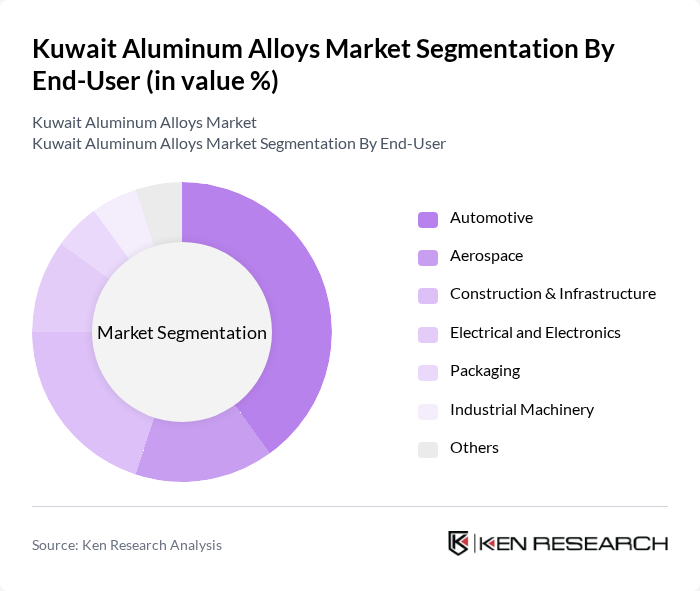

By End-User:The end-user segmentation of the aluminum alloys market includes Automotive, Aerospace, Construction & Infrastructure, Electrical and Electronics, Packaging, Industrial Machinery, and Others. TheAutomotive sectoris the leading end-user, driven by the industry's transition to lightweight materials for improved fuel efficiency, lower emissions, and the rising adoption of electric vehicles. Aluminum alloys are increasingly used in battery housings, structural frames, and body panels, while the construction sector utilizes these alloys for building facades, windows, and roofing due to their strength and corrosion resistance .

The Kuwait Aluminum Alloys Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Extrusions, Kuwait Aluminium Company (Kuwait Aluminium Extrusion Co. - KAEC), Alcoa Corporation, Emirates Global Aluminium (EGA), Qatar Aluminium Limited (Qatalum), Norsk Hydro ASA, RUSAL, Constellium SE, Novelis Inc., Hindalco Industries Limited, UACJ Corporation, Kobe Steel, Ltd., Bahrain Aluminium (Aluminium Bahrain B.S.C. - Alba), Technal Middle East (Hydro Group), Al Ghanim Industries (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The Kuwait aluminum alloys market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the construction and automotive sectors continue to expand, the demand for high-quality aluminum alloys will likely increase. Additionally, the focus on lightweight materials in electric vehicles and aerospace applications will create new opportunities. Companies that invest in innovative production methods and sustainable practices will be better positioned to capitalize on these trends, ensuring long-term growth and competitiveness in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Cast Aluminum Alloys Wrought Aluminum Alloys Heat-Treatable Alloys Non-Heat-Treatable Alloys Series (High Purity Alloys) Series (Magnesium Alloys) Series (Magnesium-Silicon Alloys) Others |

| By End-User | Automotive Aerospace Construction & Infrastructure Electrical and Electronics Packaging Industrial Machinery Others |

| By Application | Structural Components Engine & Powertrain Components Electrical Conductors & Busbars Packaging Materials (Cans, Foils) Building Facades & Windows Others |

| By Form | Sheets and Plates Bars and Rods Foils Extrusions & Profiles Ingots Others |

| By Region | Central Kuwait Southern Kuwait Northern Kuwait Eastern Kuwait |

| By Production Method | Casting Rolling Extrusion Forging High Pressure Die Casting Others |

| By Recycling Rate | High Recycling Rate Moderate Recycling Rate Low Recycling Rate Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Aluminum Alloys | 100 | Procurement Managers, Product Engineers |

| Construction Sector Aluminum Applications | 80 | Project Managers, Architects |

| Consumer Goods Aluminum Products | 70 | Product Development Managers, Marketing Directors |

| Industrial Aluminum Alloys | 90 | Operations Managers, Supply Chain Analysts |

| Aluminum Recycling Initiatives | 60 | Sustainability Managers, Environmental Compliance Officers |

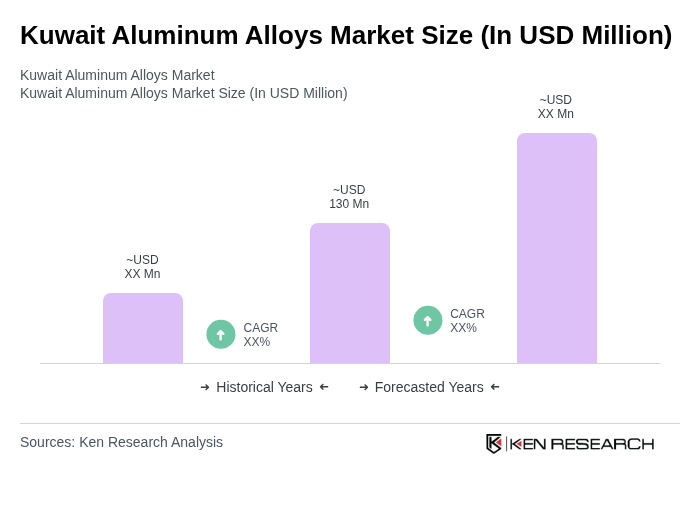

The Kuwait Aluminum Alloys Market is valued at approximately USD 130 million, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by demand in automotive, construction, and transportation sectors.