Region:Middle East

Author(s):Shubham

Product Code:KRAC4277

Pages:85

Published On:October 2025

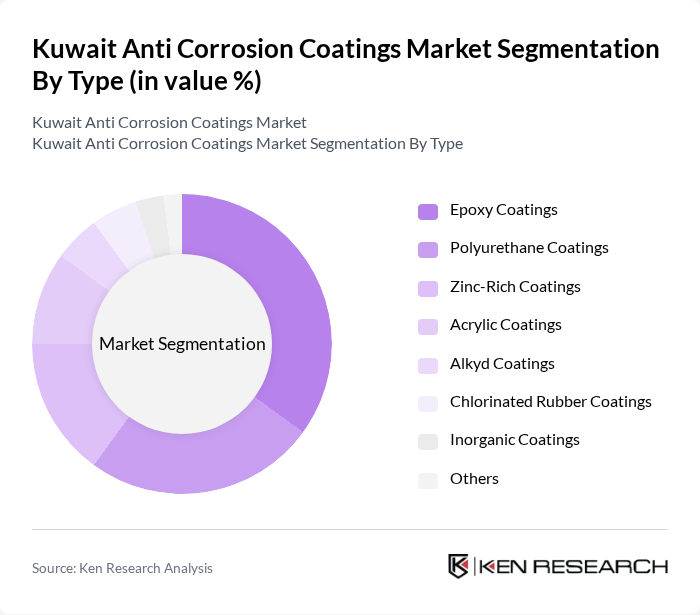

By Type:The market is segmented into various types of coatings, each serving specific applications and industries. The primary types include Epoxy Coatings, Polyurethane Coatings, Zinc-Rich Coatings, Acrylic Coatings, Alkyd Coatings, Chlorinated Rubber Coatings, Inorganic Coatings, and Others. Among these, Epoxy Coatings are leading due to their excellent adhesion and resistance to chemicals and moisture, making them ideal for industrial applications.

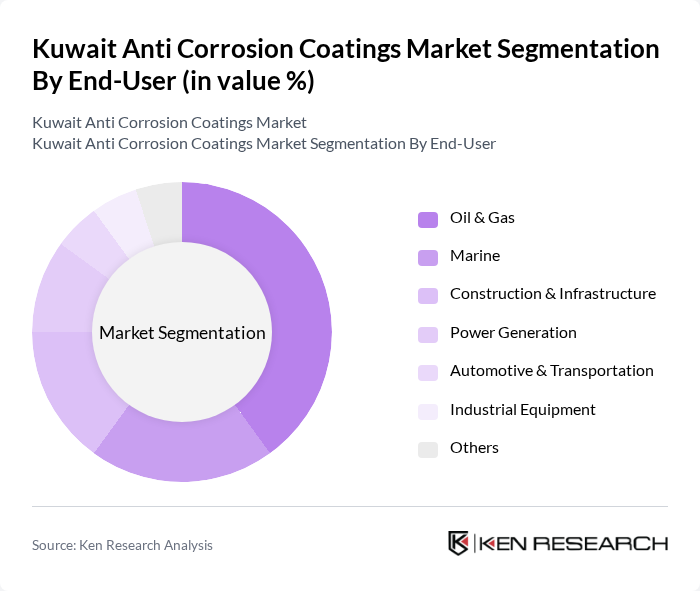

By End-User:The end-user segmentation includes Oil & Gas, Marine, Construction & Infrastructure, Power Generation, Automotive & Transportation, Industrial Equipment, and Others. The Oil & Gas sector is the largest consumer of anti-corrosion coatings due to the harsh environmental conditions and the need for protective measures against corrosion in pipelines and storage tanks.

The Kuwait Anti Corrosion Coatings Market is characterized by a dynamic mix of regional and international players. Leading participants such as PPG Industries, Inc., AkzoNobel N.V., The Sherwin-Williams Company, BASF SE, RPM International Inc., Hempel A/S, Jotun A/S, Kansai Paint Co., Ltd., Nippon Paint Holdings Co., Ltd., National Paints Factories Co. Ltd., Axalta Coating Systems Ltd., Berger Paints India Limited, Asian Paints Limited, Al Ghanim Specialities Co. (Kuwait), Gulf Paints (Kuwait) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait anti-corrosion coatings market appears promising, driven by ongoing infrastructure projects and a strong focus on sustainability. As the government continues to invest in modernization, the demand for advanced coating solutions will likely increase. Additionally, the shift towards eco-friendly products will create opportunities for manufacturers to innovate and capture new market segments. Companies that embrace digital technologies and smart coatings will be well-positioned to thrive in this evolving landscape, ensuring long-term growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy Coatings Polyurethane Coatings Zinc-Rich Coatings Acrylic Coatings Alkyd Coatings Chlorinated Rubber Coatings Inorganic Coatings Others |

| By End-User | Oil & Gas Marine Construction & Infrastructure Power Generation Automotive & Transportation Industrial Equipment Others |

| By Application | Protective Coatings Decorative Coatings Marine Coatings Industrial Coatings Pipeline Coatings Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Stores Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Eastern Kuwait Western Kuwait Others |

| By Regulatory Compliance | ISO Standards Local Environmental Regulations International Safety Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Coating Applications | 100 | Project Managers, Site Engineers |

| Oil & Gas Industry Coating Requirements | 80 | Procurement Managers, Operations Supervisors |

| Marine Coating Solutions | 50 | Marine Engineers, Fleet Managers |

| Industrial Coating Innovations | 60 | R&D Managers, Product Development Leads |

| Regulatory Compliance in Coatings | 40 | Compliance Officers, Environmental Managers |

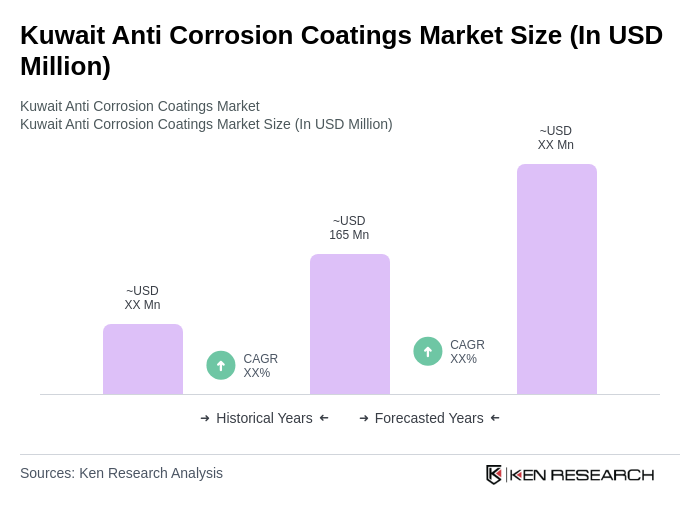

The Kuwait Anti Corrosion Coatings Market is valued at approximately USD 165 million, driven by the increasing demand for protective coatings across various industries, particularly oil and gas, construction, and marine sectors.