Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4018

Pages:99

Published On:December 2025

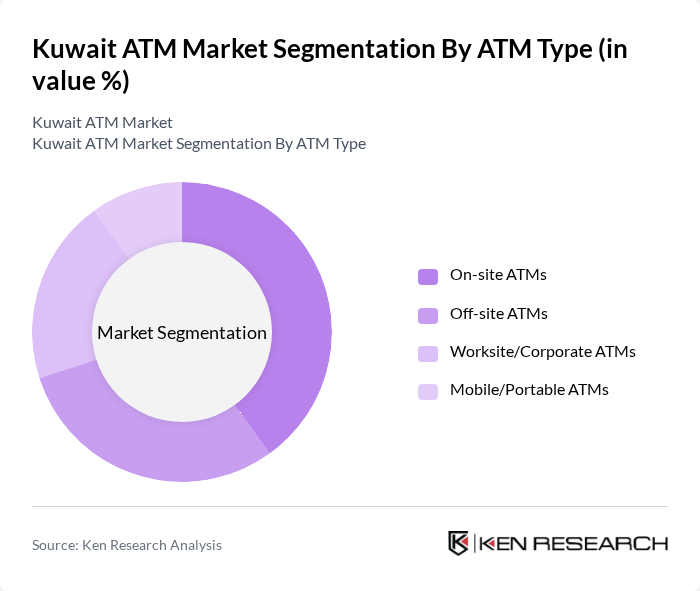

By ATM Type:The ATM market can be segmented into various types, including On-site ATMs, Off-site ATMs, Worksite/Corporate ATMs, and Mobile/Portable ATMs. Each type serves different consumer needs and locations, contributing to the overall market dynamics.

The On-site ATMs segment dominates the market due to their strategic placement within bank branches, providing customers with easy access to cash and banking services. The convenience of having ATMs located at bank premises encourages frequent usage, making them a preferred choice for consumers. Off-site ATMs also play a significant role, particularly in retail locations, but On-site ATMs remain the most utilized due to their reliability and security.

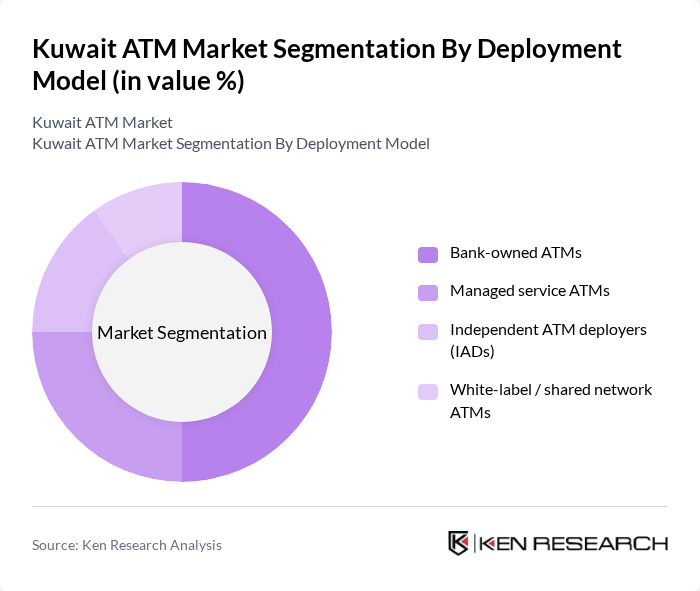

By Deployment Model:The deployment model of ATMs can be categorized into Bank-owned ATMs, Managed service ATMs, Independent ATM deployers (IADs), and White-label/shared network ATMs. Each model has its unique operational framework and market presence.

Bank-owned ATMs lead the market due to the established trust and brand recognition associated with financial institutions. These ATMs are often preferred by consumers for their reliability and security. Managed service ATMs are gaining traction as banks look to outsource operations, while IADs and white-label ATMs cater to niche markets, but they do not match the extensive reach of bank-owned ATMs.

The Kuwait ATM market is characterized by a dynamic mix of regional and international players. Leading participants such as National Bank of Kuwait (NBK), Kuwait Finance House (KFH), Gulf Bank, Burgan Bank, Boubyan Bank, Al Ahli Bank of Kuwait (ABK), Kuwait International Bank (KIB), Warba Bank, Ahli United Bank – Kuwait operations, Qatar National Bank – Kuwait branch, Bank of Bahrain and Kuwait – Kuwait branch, Arab Bank – Kuwait branch, HSBC Bank Middle East – Kuwait, Standard Chartered Bank – Kuwait, Commercial Bank of Kuwait (CBK) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the ATM market in Kuwait appears promising, driven by ongoing technological advancements and a shift towards cashless transactions. As banks continue to innovate and enhance customer experiences, the integration of AI and contactless features will likely become standard. Additionally, the government's push for financial inclusion will encourage the establishment of ATMs in underserved areas, further expanding access to banking services. This evolving landscape presents a unique opportunity for growth and development in the ATM sector.

| Segment | Sub-Segments |

|---|---|

| By ATM Type | On-site ATMs Off-site ATMs Worksite/Corporate ATMs Mobile/Portable ATMs |

| By Deployment Model | Bank-owned ATMs Managed service ATMs Independent ATM deployers (IADs) White-label / shared network ATMs |

| By Location | Bank branches Off-site retail locations Transport hubs and fuel stations Government and public sector sites |

| By Functionality | Cash-dispensing ATMs Cash-recycling ATMs Deposit-accepting ATMs Multifunction banking kiosks |

| By Technology | Conventional card-based ATMs EMV and NFC-enabled ATMs Biometric/cardless ATMs Remote monitoring and smart ATMs |

| By Transaction Type | Cash withdrawals Balance inquiries and mini-statements Deposits, transfers and bill payments Foreign exchange and remittance services |

| By End-User Sector | Retail and commercial banks Islamic banks Non-bank financial institutions Large retailers and service merchants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Banking Sector ATM Operations | 100 | ATM Managers, Operations Heads |

| Consumer Usage Patterns | 120 | Bank Customers, Retail Users |

| Financial Technology Insights | 80 | Fintech Experts, Technology Consultants |

| Regulatory Impact Assessment | 60 | Regulatory Officials, Compliance Officers |

| Market Trends and Forecasting | 70 | Market Analysts, Economic Researchers |

The Kuwait ATM market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the increasing adoption of digital banking services and cashless transactions, alongside the expansion of banking infrastructure across the country.