Region:Global

Author(s):Geetanshi

Product Code:KRAC8189

Pages:93

Published On:November 2025

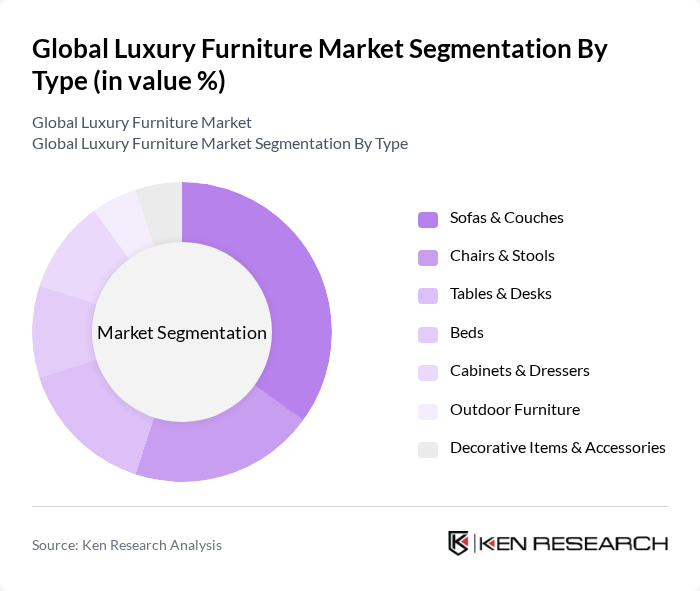

By Type:The luxury furniture market is segmented into various types, including sofas & couches, chairs & stools, tables & desks, beds, cabinets & dressers, outdoor furniture, and decorative items & accessories. Among these, sofas & couches dominate the market due to their essential role in living spaces and the increasing consumer preference for stylish and comfortable seating options. The trend towards open-plan living has further fueled the demand for versatile and aesthetically pleasing sofas. The growing focus on modular and space-saving designs is also shaping product development, especially in urban environments .

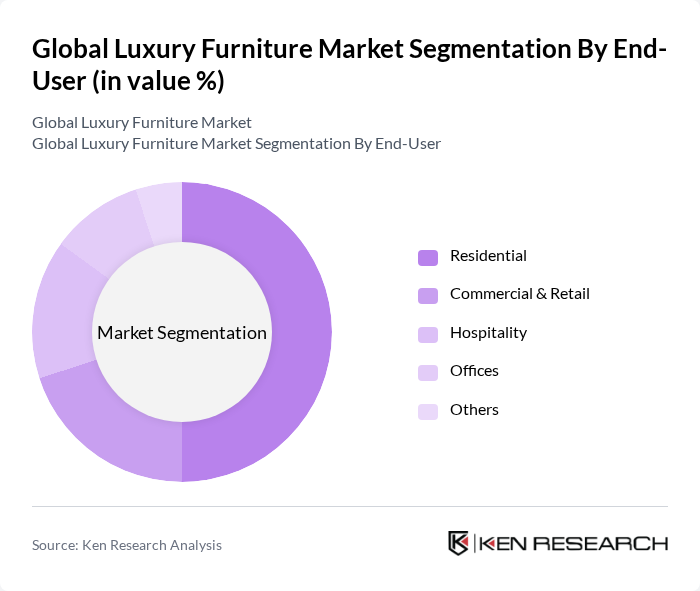

By End-User:The luxury furniture market is segmented by end-user into residential, commercial & retail, hospitality, offices, and others. The residential segment holds the largest share, driven by the increasing trend of home renovations and the desire for high-end furnishings among homeowners. The rise in disposable income and the growing influence of interior design trends have led consumers to invest more in luxury furniture for their living spaces. The commercial and hospitality sectors are also experiencing growth, supported by luxury real estate developments and upscale hotel projects .

The Global Luxury Furniture Market is characterized by a dynamic mix of regional and international players. Leading participants such as Roche Bobois, RH (Restoration Hardware), Knoll, B&B Italia, Poltrona Frau, Minotti, Cassina, Ligne Roset, Fendi Casa, Armani/Casa, Baker Furniture, Theodore Alexander, Henredon, Christopher Guy, Duresta, Molteni & C, Flexform, Eichholtz, Bentley Home, Boca do Lobo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury furniture market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to gain a competitive edge. Additionally, the integration of smart technology in furniture design is expected to enhance functionality and appeal. With the rise of e-commerce, luxury furniture brands can reach a broader audience, facilitating growth and innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Sofas & Couches Chairs & Stools Tables & Desks Beds Cabinets & Dressers Outdoor Furniture (Patio, Rooftop, Beachfront, etc.) Decorative Items & Accessories |

| By End-User | Residential Commercial & Retail Hospitality (Hotels, Restaurants, Resorts) Offices Others |

| By Material | Wood Metal Glass Upholstery (Leather, Fabric, etc.) Plastic & Other Materials |

| By Style | Contemporary/Modern Traditional/Classic Rustic Industrial Minimalist Others |

| By Distribution Channel | Online Retail/E-commerce Offline Retail (Department Stores, Independent Retailers, Showrooms) Direct Sales Factory Outlets Others |

| By Price Range | Premium Mid-Range Luxury Entry-Level Luxury Others |

| By Region | North America (U.S., Canada, Mexico) Europe (U.K., Germany, France, Italy, Spain, Rest of Europe) Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific) Latin America (Brazil, Argentina, Rest of Latin America) Middle East & Africa (UAE, Saudi Arabia, South Africa, Rest of MEA) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Furniture Retailers | 120 | Store Managers, Sales Directors |

| Interior Designers | 100 | Lead Designers, Project Managers |

| Manufacturers of Luxury Furniture | 80 | Production Managers, Quality Control Officers |

| High-End Consumers | 120 | Affluent Homeowners, Luxury Lifestyle Influencers |

| Distributors and Wholesalers | 70 | Distribution Managers, Supply Chain Analysts |

The Global Luxury Furniture Market is valued at approximately USD 24 billion, reflecting a significant growth trend driven by increasing disposable incomes and a rising preference for high-quality, aesthetically pleasing furniture among consumers.