Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4876

Pages:88

Published On:December 2025

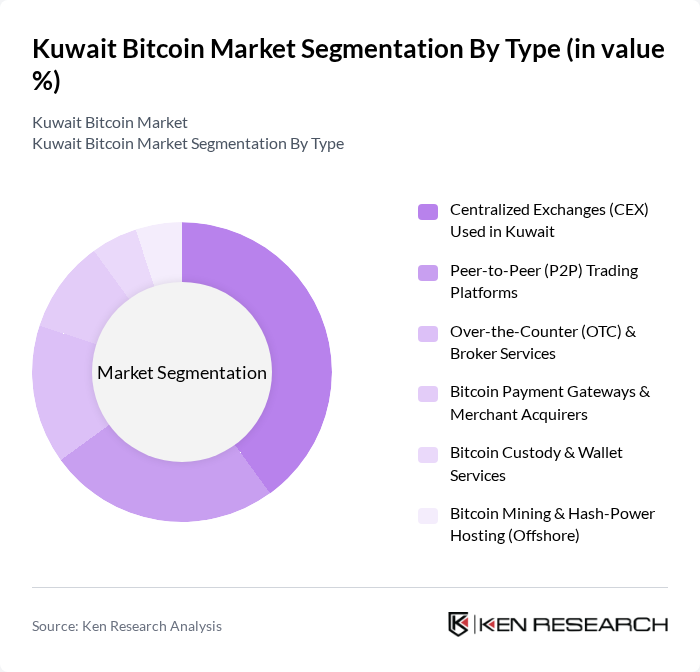

By Type:The market is segmented into various types, including Centralized Exchanges (CEX), Peer-to-Peer (P2P) Trading Platforms, Over-the-Counter (OTC) & Broker Services, Bitcoin Payment Gateways & Merchant Acquirers, Bitcoin Custody & Wallet Services, and Bitcoin Mining & Hash-Power Hosting (Offshore). Each of these segments plays a crucial role in shaping the overall market dynamics, with exchanges and remittance-linked services being particularly important use cases in Kuwait’s crypto adoption.

By End-User:The end-user segmentation includes Retail / Individual Traders & Investors, High-Net-Worth Individuals (HNWIs) & Family Offices, SMEs and Online Merchants Accepting Bitcoin, Financial Institutions & Fintechs (Indirect Exposure), Crypto / Web3 Startups and Trading Desks, and Expatriate Workers Using Bitcoin for Remittances. Each user group has distinct motivations and usage patterns that influence market trends, with retail investors and expatriates driving day-to-day transaction volumes and institutional and fintech players exploring Bitcoin mainly for diversification, remittance rails, and blockchain-based financial innovation.

The Kuwait Bitcoin Market is characterized by a dynamic mix of regional and international players. Leading participants such as Rain Financial Inc., BitOasis Technologies FZE, CoinMENA B.S.C. (Closed), Binance Holdings Ltd., Bybit Fintech Limited, KuCoin Global, Gate Technology Inc. (Gate.io), Kraken (Payward Inc.), Bitstamp Ltd., eToro Group Ltd., Crypto.com (Foris DAX Asia Pte. Ltd.), OKX (Aux Cayes Fintech Co. Ltd.), By Local P2P Platforms Facilitating Kuwait Trades (e.g., Paxful, Binance P2P), Global Bitcoin Custodians Serving GCC Clients (e.g., Coinbase Custody, BitGo), Regional Payment Apps Enabling Crypto Spending (e.g., Tap Payments, Stc Pay – where crypto-linked products are available) contribute to innovation, geographic expansion, and service delivery in this space, with Bybit, Binance, and Rain frequently cited among the most used platforms by Kuwaiti users.

The future of the Bitcoin market in Kuwait appears promising, driven by increasing digital currency adoption and government initiatives to support blockchain technology. As institutional investments continue to rise, the market is likely to see enhanced liquidity and innovation. However, addressing regulatory uncertainties and security concerns will be crucial for sustainable growth. The collaboration between the government and private sector is expected to foster a more robust ecosystem, paving the way for broader acceptance and integration of Bitcoin in everyday transactions.

| Segment | Sub-Segments |

|---|---|

| By Type | Centralized Exchanges (CEX) Used in Kuwait Peer-to-Peer (P2P) Trading Platforms Over-the-Counter (OTC) & Broker Services Bitcoin Payment Gateways & Merchant Acquirers Bitcoin Custody & Wallet Services Bitcoin Mining & Hash?Power Hosting (Offshore) |

| By End-User | Retail / Individual Traders & Investors High-Net-Worth Individuals (HNWIs) & Family Offices SMEs and Online Merchants Accepting Bitcoin Financial Institutions & Fintechs (Indirect Exposure) Crypto / Web3 Startups and Trading Desks Expatriate Workers Using Bitcoin for Remittances |

| By User Demographics | Age Groups (18-24, 25-34, 35-44, 45+) Income Levels (Low, Middle, High) Nationality (Kuwaiti Nationals vs Expatriates) Geographic Distribution (Kuwait City, Other Urban, Semi?Urban/Rural) |

| By Transaction Channel | Web-Based Trading Platforms Mobile Apps & Mobile Wallets P2P Escrow Platforms Cross-Border Payment / Remittance Channels |

| By Investment Ticket Size (Per User, Cumulative Holdings) | Micro Investments (Under US$500) Small Investments (US$500 – US$5,000) Medium Investments (US$5,000 – US$25,000) Large Investments (Over US$25,000) |

| By Use Case | Trading & Short-Term Speculation Long-Term Investment / Store of Value Cross-Border Payments & Remittances Payments for Goods & Services Hedging and Portfolio Diversification |

| By Regulatory / Jurisdictional Exposure | Platforms Regulated in GCC / MENA (e.g., Bahrain, UAE) Global Offshore Platforms Accessible from Kuwait Fully Compliant with FATF Travel Rule & AML Standards Unregulated / Informal Channels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Bitcoin Adoption | 90 | Retail Business Owners, Payment Processors |

| Investor Sentiment Analysis | 120 | Individual Investors, Financial Analysts |

| Regulatory Impact Assessment | 80 | Regulatory Officials, Compliance Officers |

| Technological Infrastructure Evaluation | 70 | IT Managers, Blockchain Developers |

| Market Trends and Forecasting | 60 | Market Researchers, Economic Analysts |

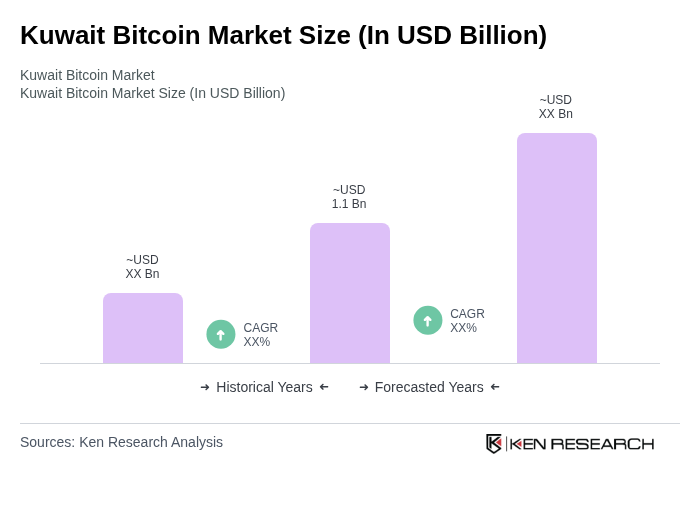

The Kuwait Bitcoin market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased user adoption, trading activities, and the expansion of regional crypto exchanges catering to Kuwaiti users.