Region:Middle East

Author(s):Geetanshi

Product Code:KRAE1216

Pages:82

Published On:December 2025

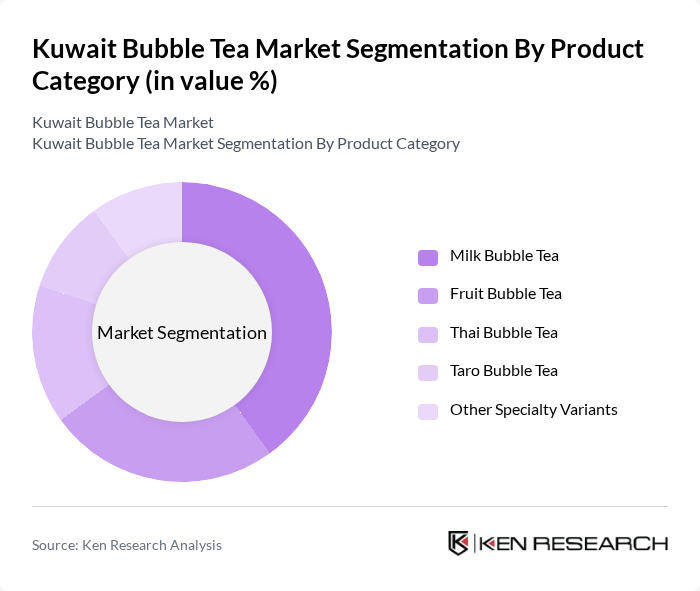

By Product Category:The product category segmentation of the bubble tea market includes various types of bubble tea offerings that cater to different consumer tastes and preferences. The subsegments include Milk Bubble Tea, Fruit Bubble Tea, Thai Bubble Tea, Taro Bubble Tea, and Other Specialty Variants. Each of these subsegments has its unique appeal, with Milk Bubble Tea being particularly popular due to its creamy texture and rich flavors.

The Milk Bubble Tea subsegment leads the market, driven by its creamy texture and the ability to customize flavors. Consumers are increasingly drawn to the rich and indulgent experience it offers, making it a favorite among both locals and expatriates. The trend of adding unique toppings and flavors has further solidified its position as the dominant choice in the bubble tea market.

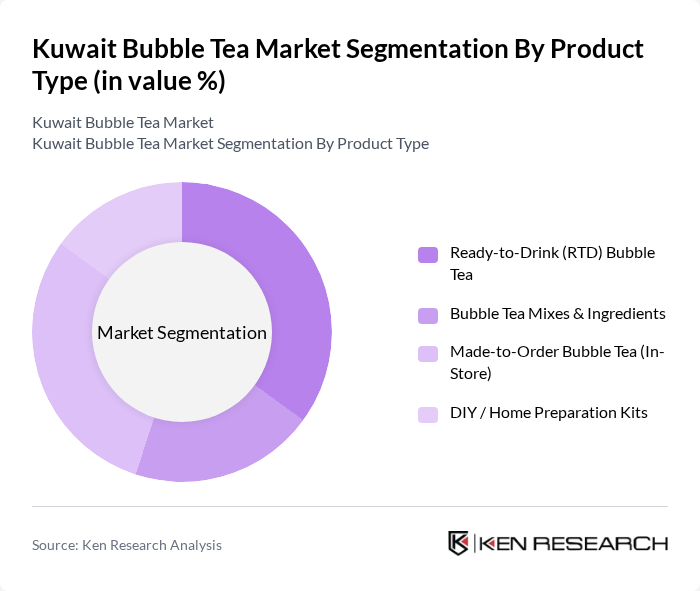

By Product Type:The product type segmentation includes various formats of bubble tea available in the market. This includes Ready-to-Drink (RTD) Bubble Tea, Bubble Tea Mixes & Ingredients, Made-to-Order Bubble Tea (In-Store), and DIY / Home Preparation Kits. Each type caters to different consumer needs, with RTD options gaining traction due to their convenience.

The Made-to-Order Bubble Tea (In-Store) subsegment is currently leading the market, as consumers prefer freshly prepared beverages that can be customized to their liking. This trend is particularly strong among younger demographics who enjoy the experience of personalizing their drinks while socializing in cafés.

The Kuwait Bubble Tea Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gong Cha, Chatime, Yi Fang Taiwan Fruit Tea, Sharetea, Tiger Sugar, The Alley, Bubbles & Co. Kuwait, Keventers Kuwait, Bubbleology, Tea Club Kuwait, Booba Nation Kuwait, Gong Cha – Alshaya Group Franchise, Local Independent Bubble Tea Cafés (Representative Profiles), Major Online Delivery Aggregators (Talabat, Deliveroo, Carriage – as Bubble Tea Channels), RTD & Retail Bubble Tea Brands Present in Kuwait (Selected Profiles) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bubble tea market in Kuwait appears promising, driven by evolving consumer preferences and innovative product offerings. As health-conscious trends gain momentum, brands are likely to introduce more organic and low-calorie options to cater to a broader audience. Additionally, the integration of technology in ordering and delivery services will enhance customer convenience, potentially increasing market penetration and customer loyalty in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Milk Bubble Tea Fruit Bubble Tea Thai Bubble Tea Taro Bubble Tea Other Specialty Variants |

| By Product Type | Ready-to-Drink (RTD) Bubble Tea Bubble Tea Mixes & Ingredients Made-to-Order Bubble Tea (In-Store) DIY / Home Preparation Kits |

| By Key Tea Type | Black Tea Based Green Tea Based Oolong Tea Based Others (Herbal, Mixed Tea Bases) |

| By Flavor | Fruit Flavour Brown Sugar / Caramel Coffee & Cocoa Flavours Traditional Tea Flavours Others |

| By Milk Type Used | Animal-Based Milk Plant-Based Milk (Almond, Soy, Oat, Coconut, etc.) |

| By Distribution Channel | Store-Based Retailers (Cafés, Bubble Tea Shops, QSRs) Non-Store Retailers (E-commerce, Delivery Apps) Supermarkets & Hypermarkets Convenience Stores & Kiosks |

| By Consumer Demographics | Age Group (Teens, Young Adults, Adults) Income Level (Middle-Income, Upper-Middle, High-Income) Expat vs Local Population Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Bubble Tea | 120 | Young Adults (18-30 years), Beverage Enthusiasts |

| Retail Outlet Insights | 60 | Shop Owners, Franchise Managers |

| Market Trends and Growth Drivers | 50 | Industry Analysts, Market Researchers |

| Health and Wellness Impact on Beverage Choices | 40 | Health-Conscious Consumers, Nutritionists |

| Brand Loyalty and Marketing Effectiveness | 70 | Marketing Professionals, Brand Managers |

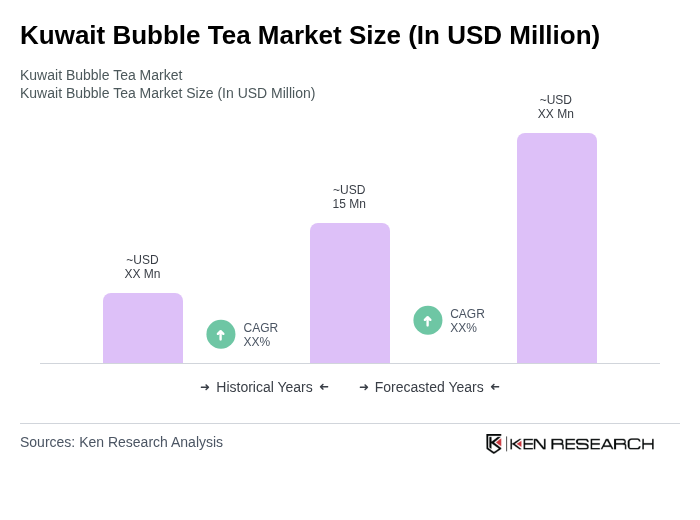

The Kuwait Bubble Tea Market is valued at approximately USD 15 million, reflecting a growing trend driven by the beverage's popularity among youth and the café culture in urban areas.