Region:Middle East

Author(s):Dev

Product Code:KRAC4147

Pages:91

Published On:October 2025

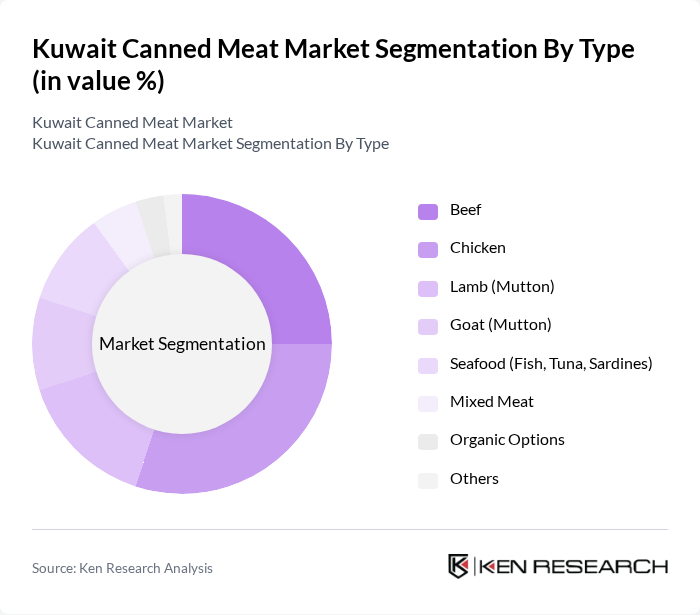

By Type:The canned meat market can be segmented into various types, including beef, chicken, lamb (mutton), goat (mutton), seafood (fish, tuna, sardines), mixed meat, organic options, and others. Poultry represents the largest segment in the market, reflecting consumer preference for chicken in ready-to-eat formats. Lamb (mutton) is emerging as the fastest-growing segment, driven by traditional dietary preferences and cultural consumption patterns. The demand for organic options is also rising as health-conscious consumers seek cleaner and more sustainable food choices.

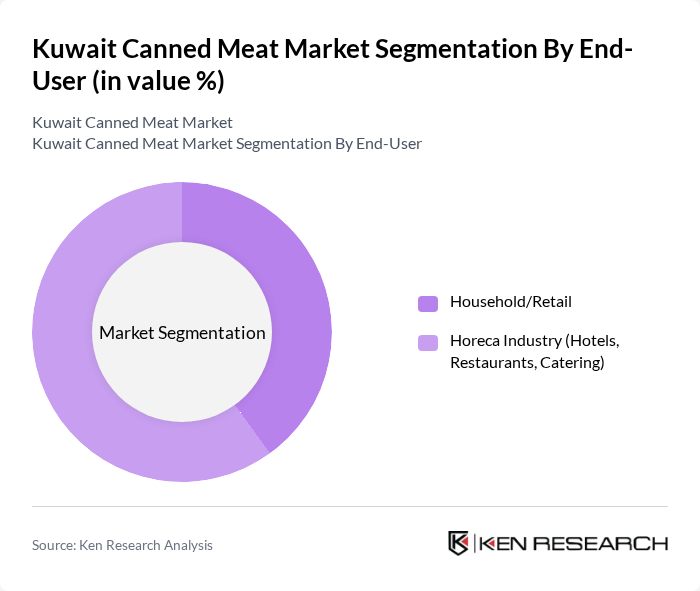

By End-User:The market can be segmented into household/retail and the Horeca industry (hotels, restaurants, catering). The Horeca sector is significant, commanding a substantial share of the market, driven by the increasing number of dining establishments and catering services that require bulk canned meat products. The household segment is also growing steadily as more consumers opt for convenient meal solutions for their families.

The Kuwait Canned Meat Market is characterized by a dynamic mix of regional and international players. Leading participants such as Americana Group, Almarai Food Company, JBS Foods, Danish Crown A/S, Conagra Brands, Inc., Tyson Foods, Inc., Hormel Foods Corporation, Al Kabeer Group, Al Watania Poultry, Al-Qatami Group, Al-Jazeera Foods, Al-Falah Group, Al-Sultan Group, Al-Mansour International, Al-Babtain Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the canned meat market in Kuwait appears promising, driven by evolving consumer preferences and market dynamics. The increasing inclination towards organic and natural products is expected to shape product offerings, with manufacturers likely to innovate in flavor and variety. Additionally, the growth of e-commerce platforms will facilitate wider distribution, allowing consumers to access a broader range of canned meat products conveniently. These trends indicate a vibrant market landscape poised for growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Beef Chicken Lamb (Mutton) Goat (Mutton) Seafood (Fish, Tuna, Sardines) Mixed Meat Organic Options Others |

| By End-User | Household/Retail Horeca Industry (Hotels, Restaurants, Catering) |

| By Sales Channel | Store-Based Retailing (Supermarkets, Hypermarkets, Convenience Stores) Non-Store-Based Retailing / Online Retailers |

| By Nature | Conventional Organic |

| By Packaging Type | Cans Pouches Tetra Packs |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Established Brands New Entrants Private Labels |

| By Nutritional Content | High Protein Low Sodium Gluten-Free Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Household Decision Makers, Food Enthusiasts |

| Distribution Channel Analysis | 80 | Logistics Coordinators, Supply Chain Managers |

| Health and Nutrition Perspectives | 60 | Nutritionists, Health Coaches |

| Market Trends and Innovations | 50 | Product Development Managers, Food Technologists |

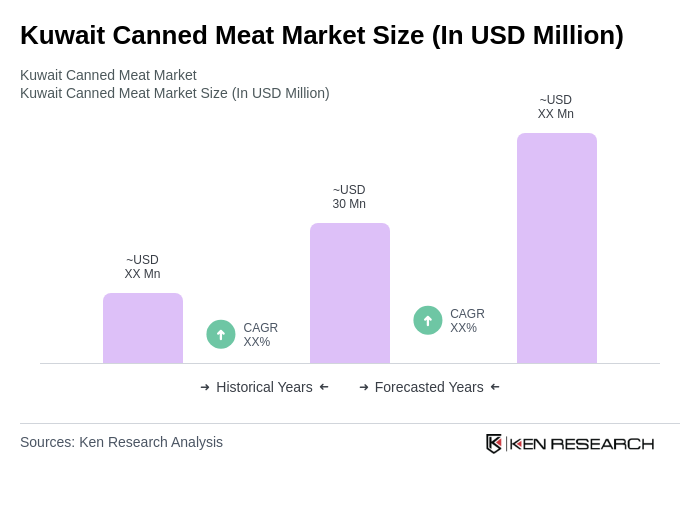

The Kuwait Canned Meat Market is valued at approximately USD 30 million, reflecting a growing demand for convenient food options, particularly among the expatriate population and due to the rise in online grocery shopping.